Thoughts on the Executive Order

Yesterday, the President signed an Executive Order (EO) titled “Ensuring Responsible Development of Digital Assets’’. For those interested in the official fact sheet, it is a short and easy read.

This EO is peculiar as it does not mandate the enforcement of rules but rather, asks several government agencies to study digital assets to present guidance that will “support innovation while mitigating the risks for consumers, businesses…”.

The language is encouraging, describing crypto as strategically critical for the nation, and repeatedly emphasizing a desire to ensure “U.S. competitiveness and leadership in, and leveraging of digital asset technologies”. Jerry Brito, executive director of leading crypto think-tank Coincenter says:

While strange on the surface, this EO is much needed because a dizzying amount of regulatory ambiguity remains. One obvious example requiring clarity is tokenomics. Developers are currently being forced to either forego equity-like economic benefits for tokens or to sever all ties with the US to elude the wrath of the SEC. This uncertainty is undoubtedly hurting the potential of crypto.

Regulating crypto is tricky. Networks are constantly evolving and seldom fit neatly into pre-existing regulatory molds. Attempts to push regulation have sometimes resulted in nonsensical or unenforceable rules (see Infrastructure Bill). While several agencies like the CFTC or SEC do regulate certain corners of the ecosystem, uncharted territory abounds.

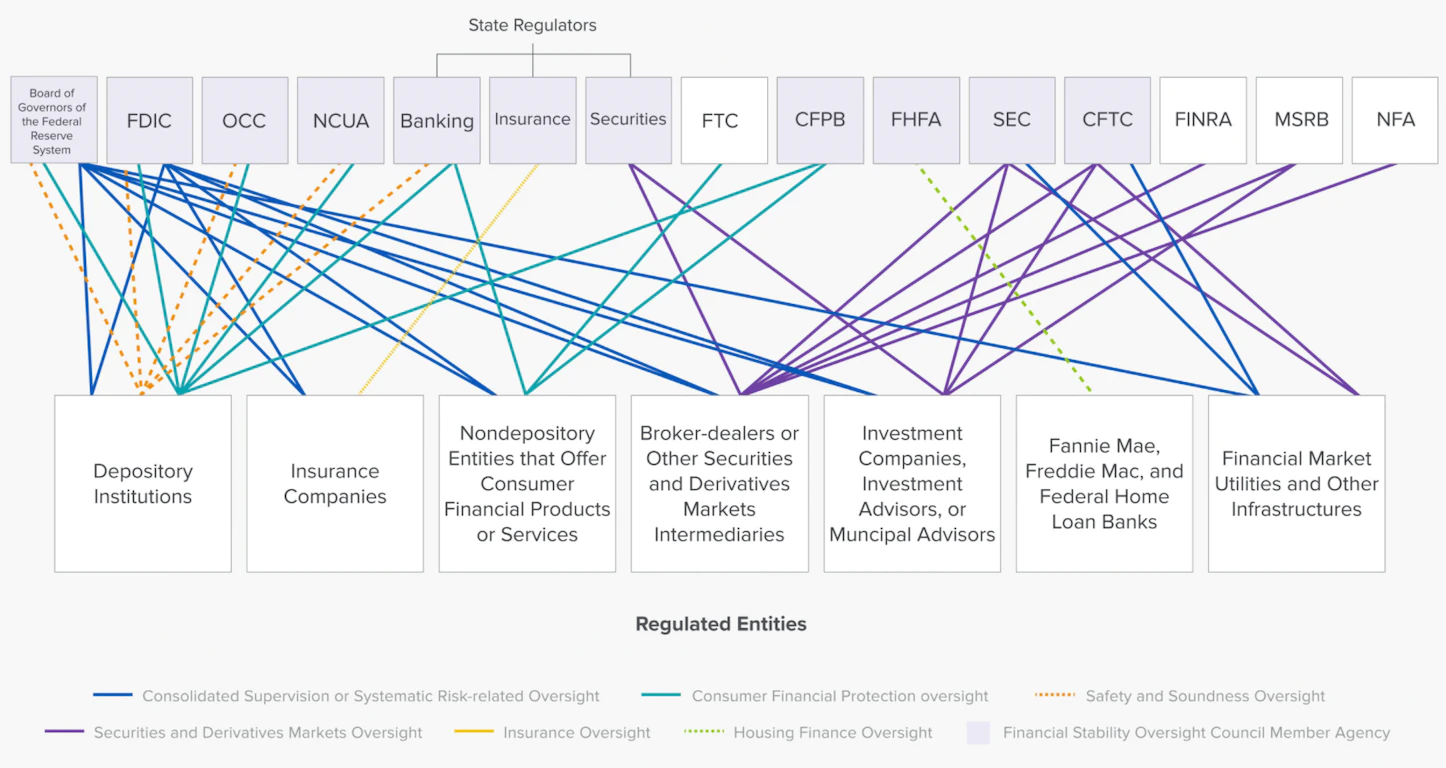

Many of the problems we ascribe to crypto simply reflect issues in society and regulation is no different. Borrowing from A16Z, the chart below portrays the fragmented and intertwined nature of financial regulation today.

It should come as no surprise that it has been so difficult to push regulation in a space so complex and covered by so many regulators. We view this EO as a necessary “nudge” for agencies to design holistic guidelines that can unleash the full potential of crypto.

A generational investment opportunity cannot exist without uncertainty. Regulation could be the largest remaining hurdle for institutional and many retail investors. Whatever the precise outcome, regulatory clarity is likely to herald a new wave of investors, and with them renewed tail-winds for digital assets.

Fran