The Halving: Supply and Demand

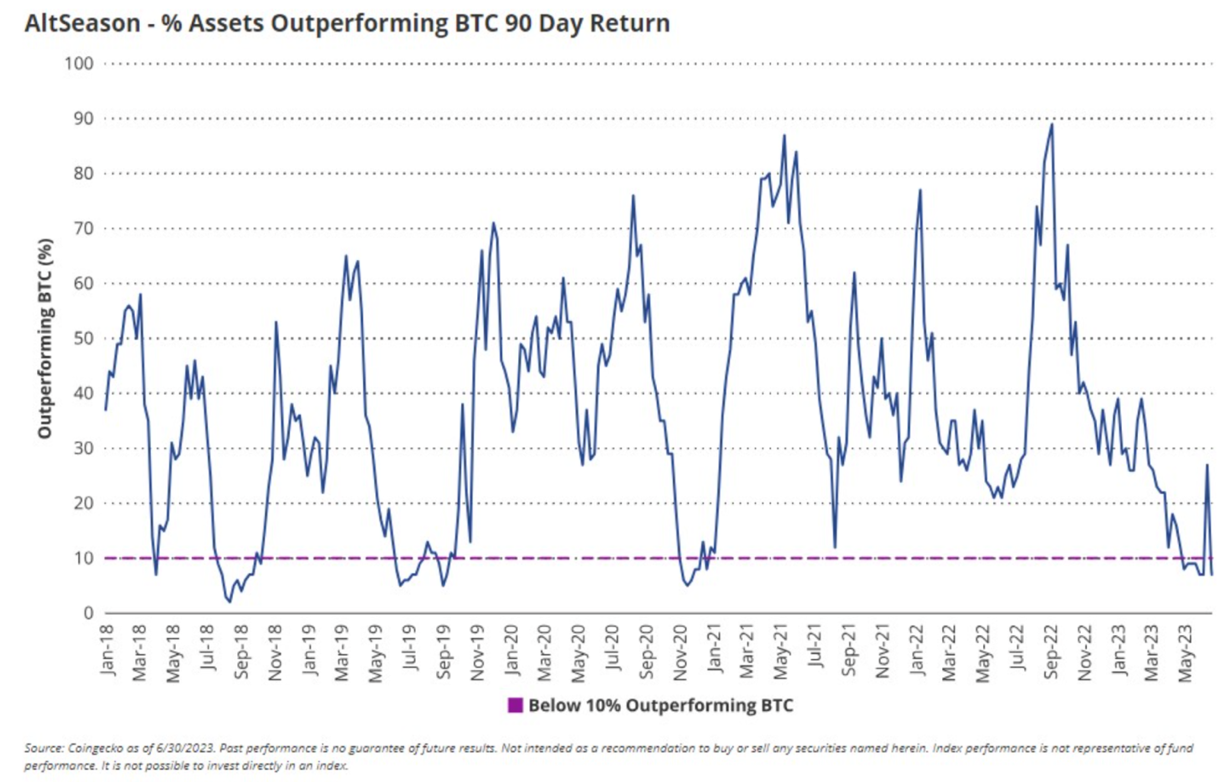

After the announcement of Blackrock’s Bitcoin spot ETF application, Bitcoin seemed poised to outperform. But as often happens, the market got ahead of itself with no new flows entering the ecosystem quite yet. Instead, Ripple benefitted from a positive ruling according to US District Judge Torres. This led altcoins to outperform given the reduced risk that they could be ruled securities. As the chart below demonstrates, an altcoin vs Bitcoin rally was due. Rarely is there such an extended period of Bitcoin outperformance without some period of catch-up by the rest of the market.

Source: Vaneck

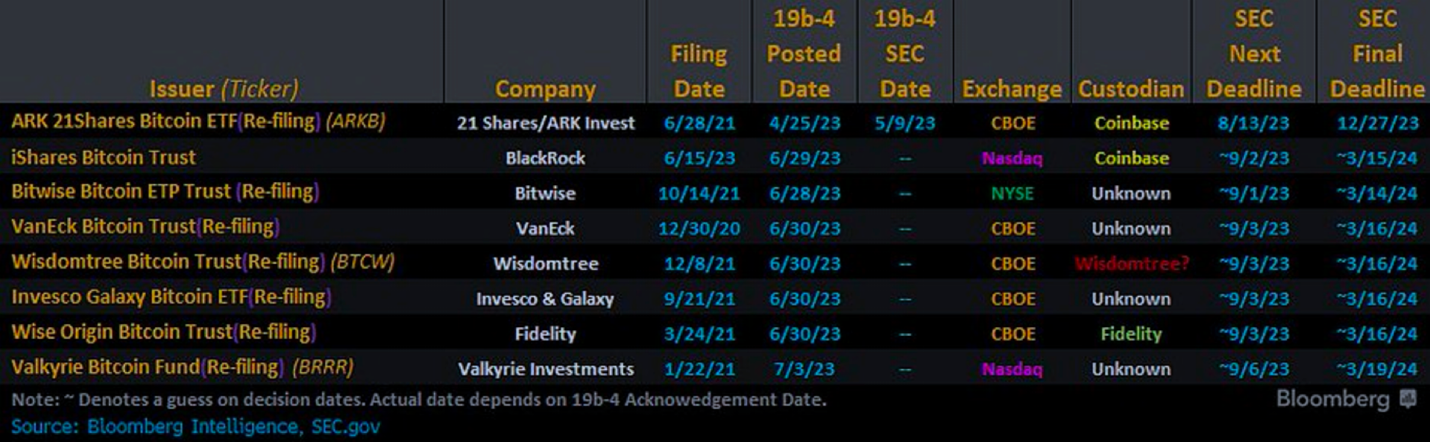

Upcoming ETF news

The market is anticipating some positive information regarding a Bitcoin spot ETF. Sometime between now and mid-September, Grayscale should be receiving a response to oral arguments surrounding their suit against the SEC. If the response is positive, it would indicate that there might be a good chance of an imminent ETF approval. If negative, we can be sure a spot ETF won’t be approved anytime soon.

Ark’s ETF is the first of many pending applications and is slated to be approved, denied, or delayed by August 13th. If there is no news regarding Grayscale’s suit by then, Ark’s ETF is very likely to be delayed. This may have a short-term negative effect on the market so it’s worth paying attention to.

Cycle commentary

We expect that a spot ETF will be approved in the coming months and likely by early September. The impact of a spot ETF can’t be overstated. It will decrease the cost to buy and hold Bitcoin by an order of magnitude, it will open the $100 trillion advisory network, and it will drastically reduce the reputation risk of investing in Bitcoin.

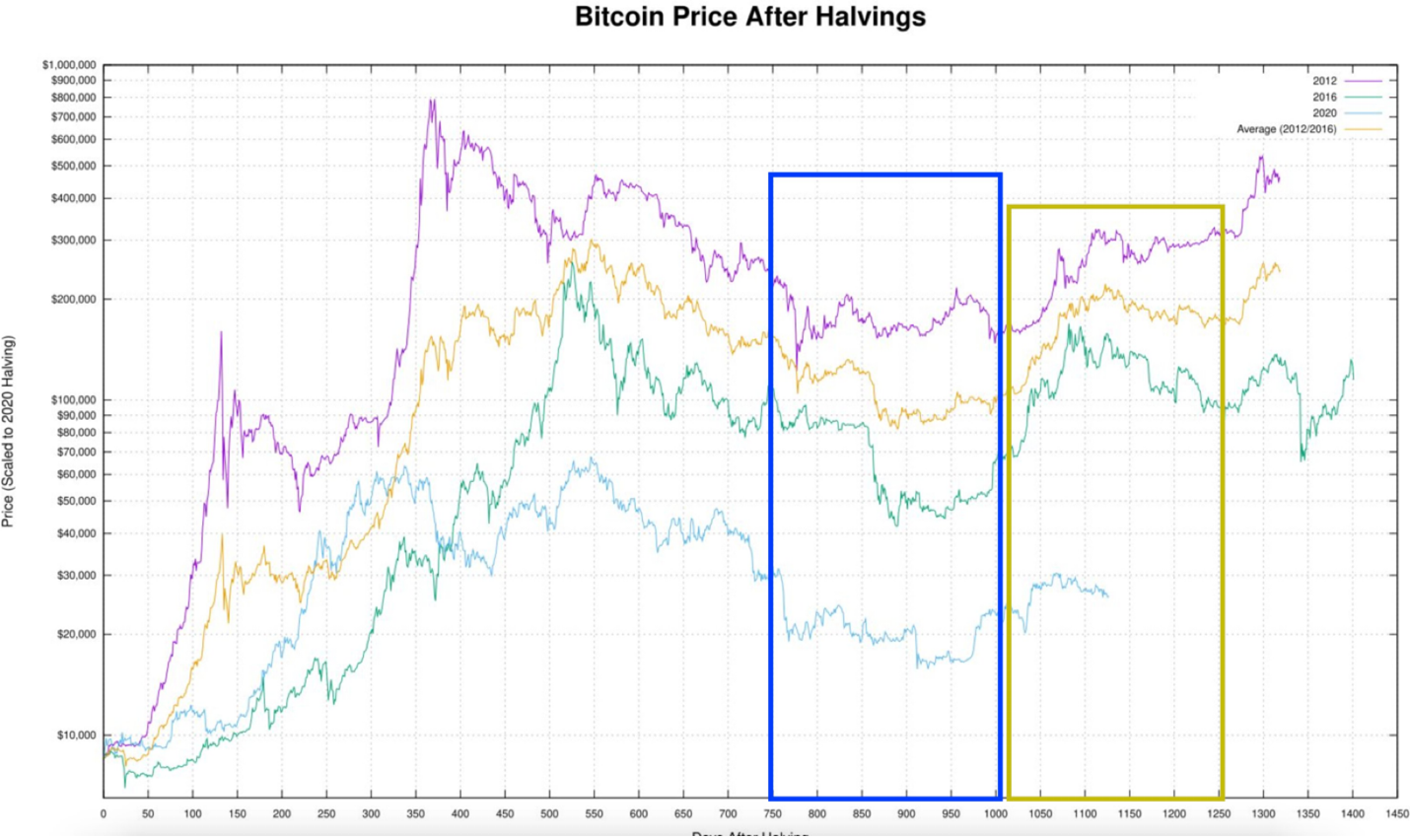

If approved, the ETF would come at the perfect time. Bitcoin is at the tail end of a 2-year bear market where excess leverage has been wiped from the market and stronger buyers have entered. The Bitcoin halving is estimated to occur on April 26, 2024, and will have a significant impact on the supply and demand balance. Daily issuance will drop from 900 BTC to 450 BTC and investment advisors will, for the first time, have access to a viable Bitcoin investment product. It’s hard to draw up a better scenario.

But is the halving priced in? While investors know that it’s coming, there are structural issues preventing an efficient market. It’s difficult to secure long-term financing to purchase Bitcoin, miners don’t hedge out their future product, and there simply isn’t enough capital earmarked for crypto to price in such a significant event. This is why despite knowledge of the supply change, the price of Bitcoin has historically gone up after the halving. Miners are the market’s natural sellers and after the halving, they have half as much to sell.

Source: N/A

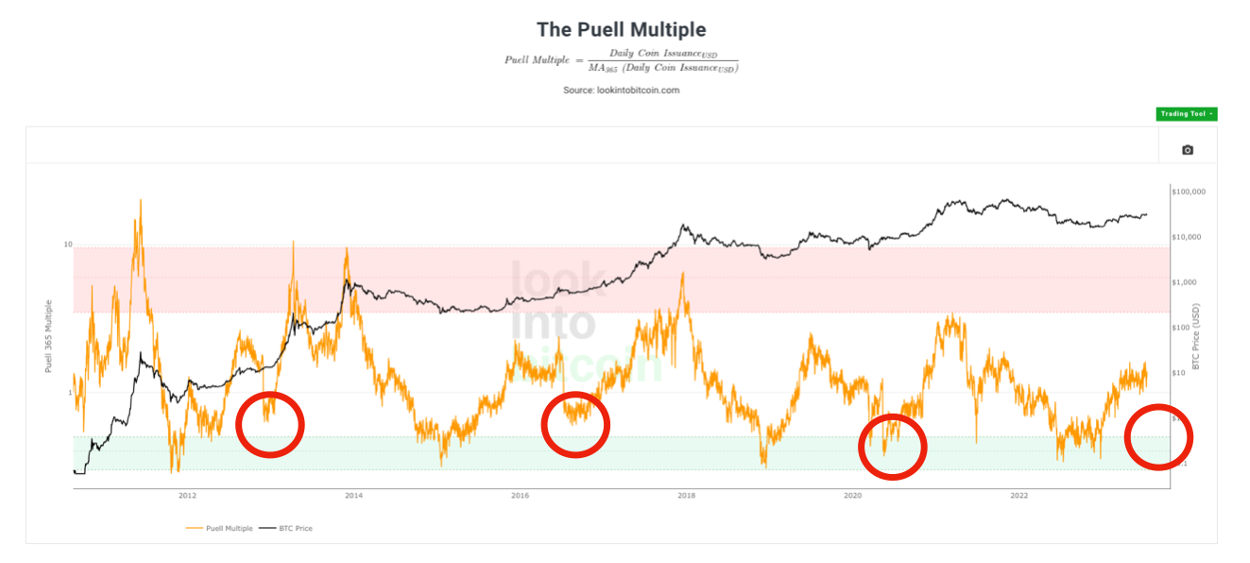

The Puell Multiple illustrates the marginal demand necessary to support price. It shows the ratio between the current daily issuance and the 1-year trailing mean of issuance. When the Puell multiple is low, it means that less demand is needed to support the price. The red circles represent each having, and the subsequent effect on the Puell multiple. Less demand is needed to support the price, so given constant demand, the price should increase.

Additionally, the available supply is extremely tight according to the below chart. 70% of the total Bitcoin supply has not moved in over a year. If market participants haven’t sold during the last year of a brutal bear market, they are unlikely to sell until they see higher prices.

Outlook

After rallying nearly 100% to start the year, it’s not surprising that Bitcoin is consolidating while major decisions await. The Grayscale ruling and ETF decisions will be pivotal events heading into 2024. If an ETF is approved, it would be a major demand catalyst running in parallel to the halving’s supply shock. Our outlook remains the same; identify asymmetric opportunities that will outperform over the next two years.

Cheers,

Plaintext Capital