Onchain Summer

Mean Reversion Metrics

Every month we will share the below collection of short-term mean reversion metrics we use to identify turning points. All of these are based on various derivatives data and normalized according to our backtesting.

-

Skew looks at the relative implied volatility of puts and calls with similar deltas and expirations. It’s a way to gauge if the market is crowded in either direction.

-

Funding demonstrates the relationship between the spot market and perpetual futures. High funding indicates that aggressive buying is happening in the perpetual futures relative to the spot market.

-

Aggressive change in futures open interest offers confluence to the above.

-

Periods of high volatility are often followed by periods of low volatility and vice versa.

August Wrap

-

BASE experienced a surge in traction after launching in early August. It’s pushing 100k daily active users, nearly eclipsing Optimism. Base is a logical entry point for newcomers given the 100 million Coinbase users.

-

Friend.tech launched a social app that allows users to bet on the potential of other users by buying shares. Owning shares of a content creator gives that user access to the creator’s content. The app mixes aspects of Twitter and OnlyFans, injects speculation into the core of the application, and gives content creators significant revenue based on the amount of trading they are associated with. The speculative nature of the app seems to rub people the wrong way but it’s clear some version of Friend.tech will have its breakout moment in the coming years. Friend.tech has also prioritized easy onboarding which has historically been a big hangup for crypto applications.

-

Summer 2023 will be remembered as “Onchain Summer”, where volumes and performance of on-exchange assets were abysmal, but a mini bull market carried on in newly launched memecoins and gambling apps.

-

In a highly anticipated decision, Grayscale won its suit against the SEC for wrongfully denying its spot ETF application. It was a huge win and another embarrassment for the SEC. Despite the positive ruling, all Bitcoin ETF decisions slated for September 2nd were delayed until October. There will be eight bitcoin ETFs up for decision between October 8th and October 19th.

Onchain Summer

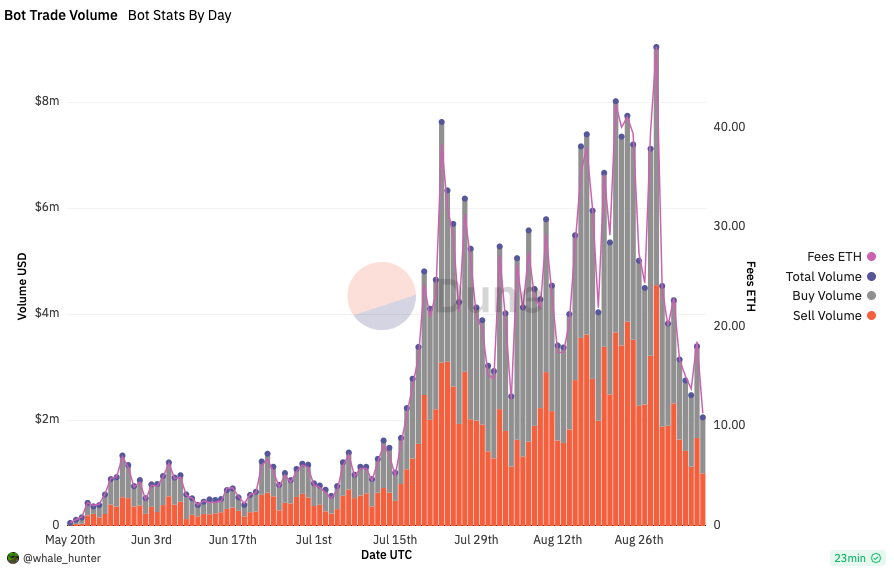

This summer demonstrated a chasm in the crypto market. Large assets listed on exchanges performed poorly but a collection of onchain assets returned hundreds or thousands of percent. For the most part, professional investors missed out on these returns while retail investors and “degens” cleaned up. Projects like Rollbit and Unibot were generating significant revenue but were dismissed early on due, in part, to their speculative nature. Speculation is often treated as a dirty word, but it’s impossible to deny that it’s a strong use case in the crypto ecosystem. The below shows the impressive growth in volume for Unibot, a trading bot built through Telegram.

Eight Months Until Halving

We are eight months out from the halving and just had a major result with the Grayscale vs SEC win. The people following this most closely estimate that there is a 75% chance of a spot ETF approval by the end of the year. As we’ve mentioned before, this would be a major catalyst.

Apart from the ETF news, the market continues to show signs of apathy. Volumes and volatility are low. Absent aggressive monetary or fiscal stimulus, bottoms take time to develop. Using the last cycle as a reference, Bitcoin was trading at $7,000 six months before the halving and at $3,000 three months before the halving. We remain optimistic, slowly adding to long-term fundamental positions.

Cheers,

Plaintext Capital