The Big Picture

March was littered with doomsday headlines while also making the case for crypto crystal clear. The geopolitical climate is increasingly unstable but crypto can act as a stabilizing technology. And from an investment perspective, the trade is extremely positively skewed.

Nation-states are adopting Bitcoin, DeFi is battle-tested and ready to accommodate institutions, NFTs are onboarding millions of consumers, and banks are scrambling to enter the mix. The next few years will trigger mainstream frenzy — we’ll reach peak financialization and in doing so attract the builders that will lead the next decade of innovation. It’s a chaotic and exciting prospect.

The Bitcoin Trade

Sentiment: Bitcoin is too volatile and risky to be a global currency. In an environment of rate hikes and tapering, it will underperform.

Reality: Growth has repeatedly outperformed in the last decade even amid aggressive rate hikes. Bitcoin is demonstrating product-market fit and is being aggressively accumulated by long-term holders.

An apolitical, global, censorship-resistant store of value is increasingly palatable considering the Ruble lost 50% of its value in three weeks while Russia was effectively cut off from the global financial system. This is only weeks after financial surveillance and sanctions were imposed in Canada to combat the trucker protests.

Bitcoin and Ether are ways to protect one’s financial freedoms and prevent seizure. If you are a nation-state, there’s a strong argument for holding crypto “just in case.” Just in case you are on the wrong end of sanctions. Just in case your reserves are seized. And just in case these assets continue to appreciate as they have over the past decade.

Meanwhile, long-dated Bitcoin upside has rarely been cheaper.

Source: Laevitas

DeFi

Sentiment: DeFi is uninteresting relative to NFTs and has vastly underperformed L1s over the past year.

Reality: DeFi is the substrate of the crypto economy and assets that were once considered blue chips are now trading at 80% discounts. These projects have P/S ratios similar to mature businesses despite being early in their life cycles. The average P/S ratio for software businesses is over 16. Many of the most-used exchanges and lending protocols have a P/S under 10 with less than two years of track record.

Finance is an estimated 20-25% of global GDP. DeFi, the most mature sector in crypto represents about 1-2% of the aggregate $1.8 trillion crypto market capitalization. This gap is ripe to close.

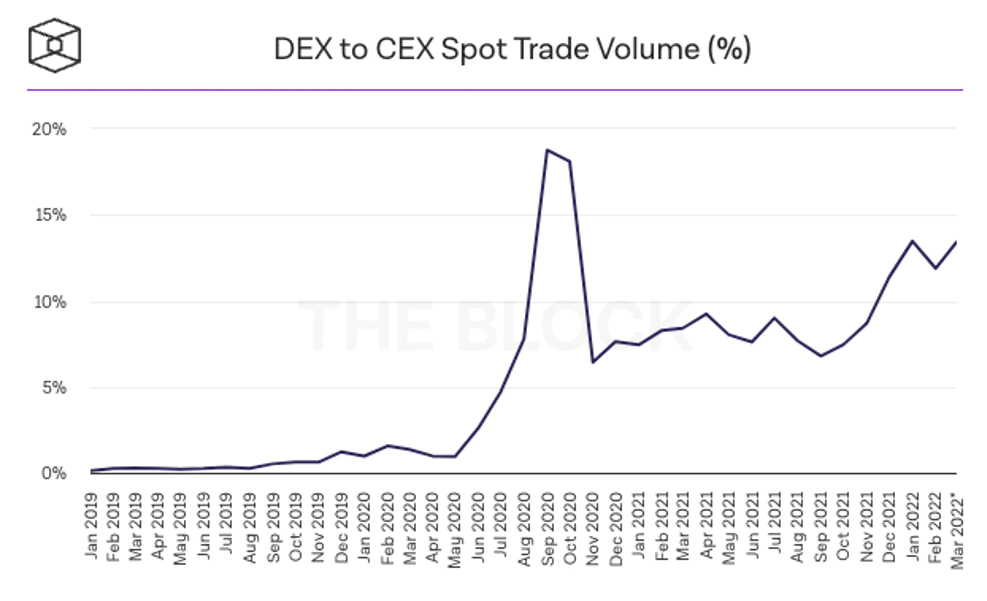

Volumes across centralized exchanges in crypto are about 20% of their peak of May 2021 and decentralized exchanges continue to gain market share relative to their centralized counterparts. As volume floods back into the crypto market, expect the decentralized finance economy to boom.

Source: The Block

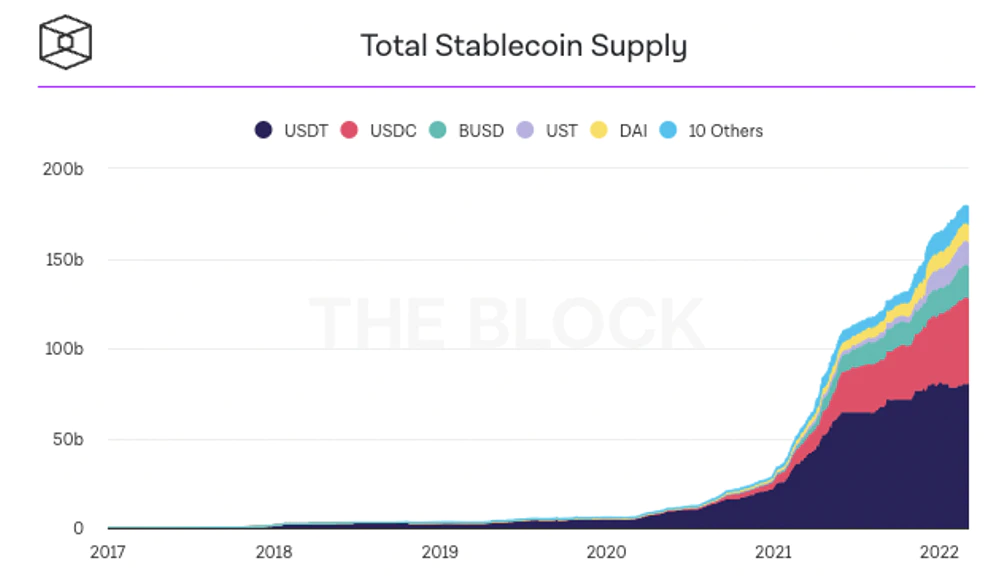

Meanwhile, stablecoin interest has skyrocketed. These stablecoins are often lent to generate yield or used to facilitate liquidity in DeFi. But when momentum is favorable, this dry powder might chase in-demand assets.

Source: The Block

Undercollateralized Lending

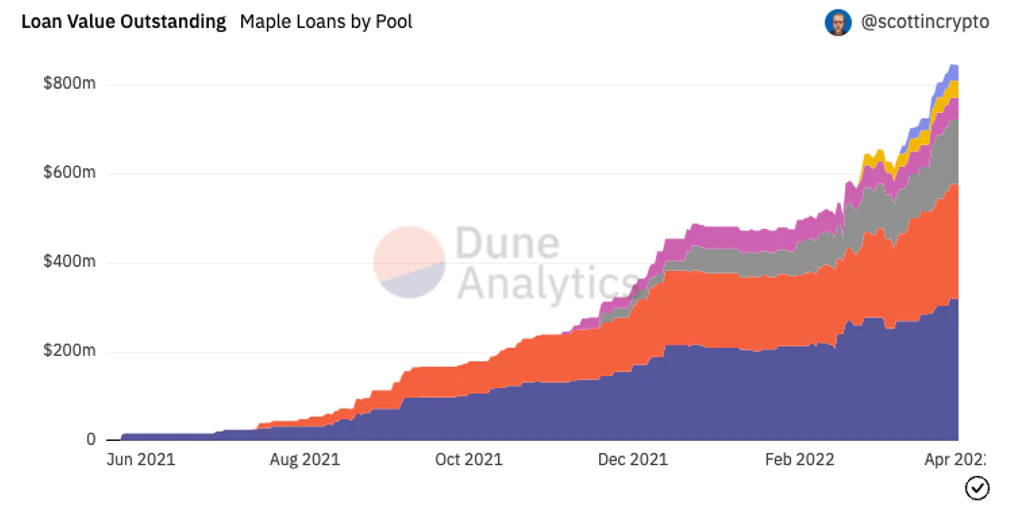

On-chain lending in crypto is usually over-collateralized because it’s difficult to apply recourse if a borrower defaults. By using off-chain delegates, projects can offer under-collateralized lending and the process more capital efficient and lucrative. As a result, this attracts more capital and increases the GDP of DeFi. This sector is taking off in a big way. As shown below, Maple is leading the charge despite a risk-off market in the last 5 months.

Source: Dune Analytics

Storage

Sentiment: AWS is too big to fail. The service is cheap and reliable. There’s little reason to use a decentralized alternative.

Reality: Centralized service providers are targets for censorship and represent single points of failure. Decentralized alternatives offer censorship resistance, anti-fragility, and redundancy that centralized services can’t. Digital storage is growing exponentially, and decentralized networks will be able to provide a cheaper, more reliable experience.

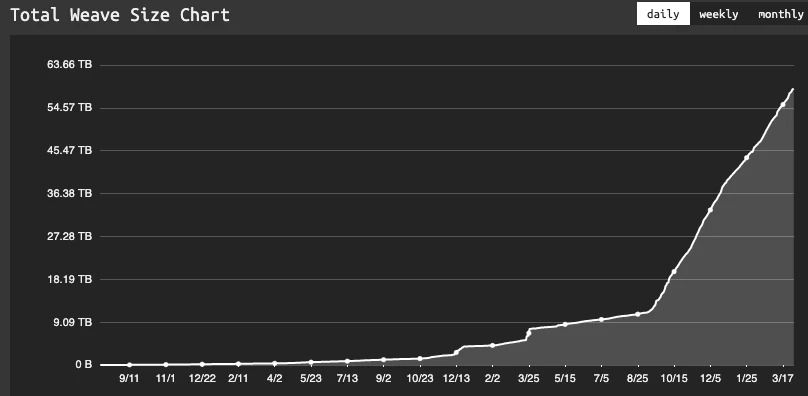

Permanent storage, which is the gold standard for NFTs, is not possible through a centralized approach. NFTs are a permanent digital signature but the digital media is often stored on an impermanent AWS instance - if the bills aren’t paid, the media is lost. Arweave offers a solution to this with permanent data storage and adoption is skyrocketing.

Source: ViewBlock

Digital Monetization

Sentiment: JPEGs selling for millions of dollars exemplified NFT mania and the bubble has popped.

Reality: We’re in the early stages of content monetization.

NFTs are onboarding millions of consumers who otherwise are uninterested in things like decentralized finance. Visual art took off in 2021 and music is finding its footing in 2022.

Projects like Nina, Catalog, and Sound are providing tools for musicians to seamlessly publish, monetize, and distribute their music. There are 443 million global paid streaming accounts and that represents only 11% of smartphone users. And although streaming has been popular among consumers, it has disenfranchised artists. The market is ripe for disruption, and NFTs put the power back into the artists’ hands.

Institutionalization

Sentiment: Regulators will crack down and institutions are scared to play in a murky regulatory environment.

Reality: Institutions are piling into the space as their clients clamor for access. Regulatory uncertainty is fading and trillions of capital is entering the ecosystem.

JP Morgan, Citi, Goldman Sachs, Citi, Citadel, Point72, Temasek, Black Rock… at this point the question is what institution, is not getting involved. Last week, Goldman changed the front page of their website to the below image. Make no mistake, these players have a lot of learning to do but their distribution is wide and will be integral to adoption over the next few years.