What Next?

Seven straight weeks of red for the S&P 500. Nine straight weeks of red for Bitcoin, so far. Luna and UST, collectively worth over $50 billion a month ago, are now worth next to nothing.

Growth equities ran up the last two years due in large part to $4 trillion of additional liquidity and near 0 interest rates. Crypto was the largest benefactor. This economic stimulus is now reversing and all risk assets have reacted negatively.

Two important questions: when will risk assets bottom and when they do, which ones will the market favor? The first question has to do with broad risk sentiment which is stemming largely from fiscal and monetary fears… don’t fight the Fed. The second question requires filtering the sectors and names that only outperformed due to the loose-money policies of 2020-2021.

Don’t Fight the Fed

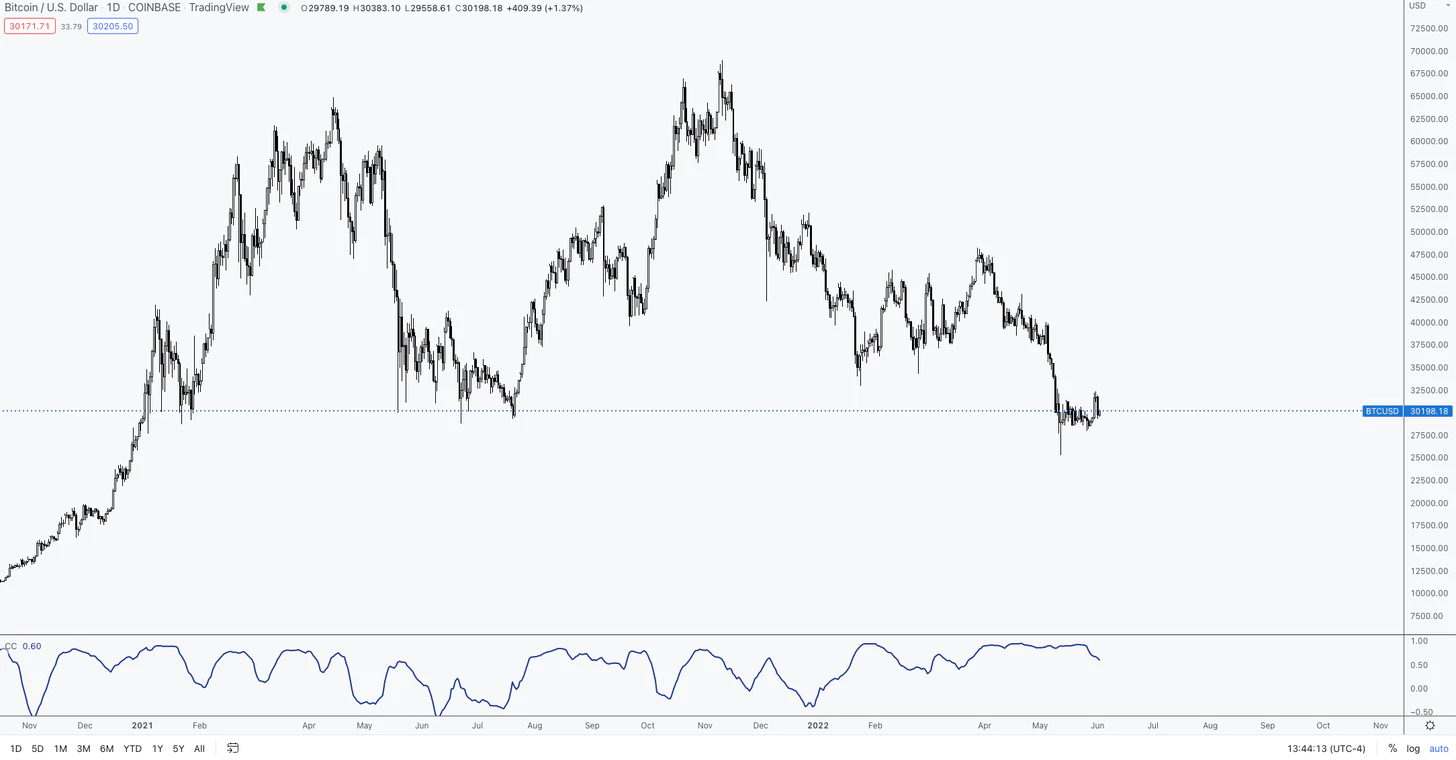

After 7 straight down weeks, only the fourth time on record, equities posted their best performance since November 2020. Crypto previously held a tight correlation with equities but didn’t enjoy the same rebound. Bitcoin was mostly flat while altcoins continued their downward trend — ETH was down approximately 12% in the same week the Nasdaq was up over 6%.

This aggressive rally in equities is fairly typical of bear markets and as we head into the June FOMC meeting, this price action is unlikely to foretell a more dovish tone from Powell.

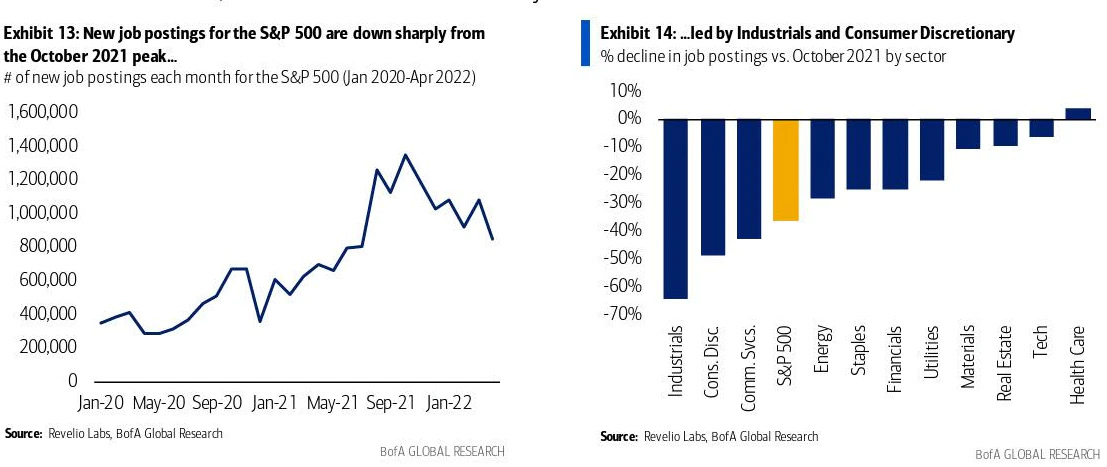

However, as we’ve written in prior newsletters, economic data and public market performance have a delayed and inversely correlated relationship. This is explained by how economic data feeds into the market’s expectations of Fed actions. With this in mind, the economic data has started to sound the alarms of a recession. GDP growth has been negative for a second month, home sales are down 16% month over month, and stories of layoffs are frequent. Fed officials have begun to soften their tones.

We’re unlikely to experience a V-shaped bottom reminiscent of March 2020 when trillions of dollars were injected into the market. As we’ve written in prior commentaries, value is beginning to surface, but the trend is still down.

Crypto’s Revival

There are likely some second-order effects from the Luna/UST blowup that have hampered the crypto market in the last two weeks. If this is the case, we may see some lagged mean reversion to mimic that of equities once the forced selling subsides.

While we’ve seen correlation markedly drop, it’s overly optimistic to assume the relationship has broken. It’s more likely that correlation stays rather high. This could be a worry if the bounce in equities proves to simply be a bear market rally. If equities retrace, you might expect crypto to follow.

The good news is that Bitcoin dominance, a proxy for risk sentiment and capital flows, has been rising rapidly. This is an early sign of capitulation as market participants retreat to what is perceived to be a safer and more stable asset. As the cycle goes, money flows into Bitcoin, then to other majors, and then to smaller cap assets as risk appetite increases. Watch for continued outperformance from Bitcoin.

Throughout all of this volatility, the amount of Bitcoin that hasn’t been moved in over a year is at an all-time high. Holders appear unphased.

DeFi

Given that most of DeFi value comes from the trading of other DeFi assets, the sector is exceptionally reflexive. As the value of ETH and all assets decline and as trading volume subsides, DeFi metrics fall as well. Fundamentals follow price. Once majors such as ETH and BTC recover, DeFi will follow, but it will take time.

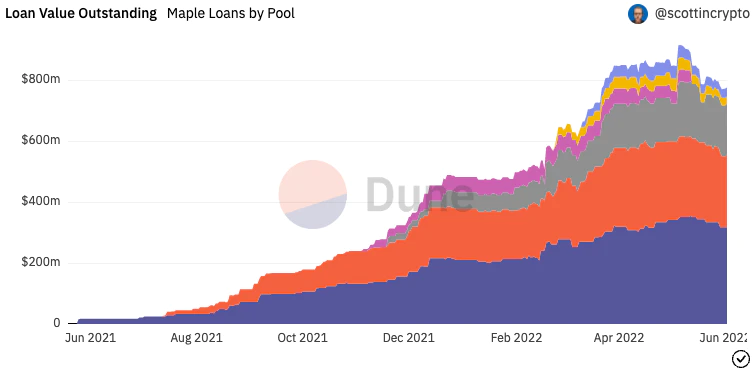

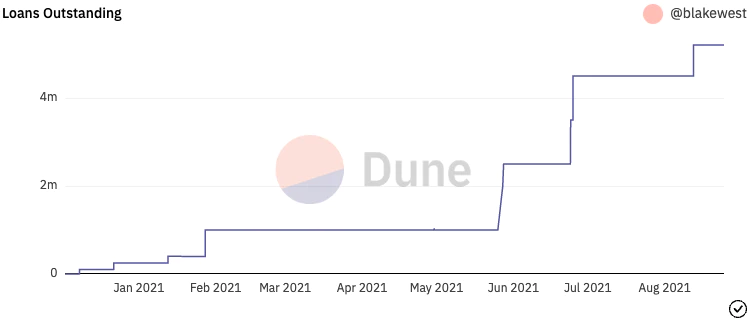

An exception might be DeFi products that serve exogenous communities. Two projects that come to mind are Maple and Goldfinch, which provide undercollateralized loans to credit-worthy businesses. Maple, which lends to crypto-businesses, has experienced rapid growth but a dropoff in the last month, likely as a result of a broad deleveraging. Goldfinch lends to less crypto-centric businesses and is less reflexive as a result. It has experienced slow but consistent growth.

NFTs

The NFT space is financial in nature and as a result, similarly reflexive to DeFi. But there’s an opportunity to become less a speculative arena and more the focal point of digital commerce. Music NFTs and gaming are two areas that are showing early signs of adoption and could see user growth independent of speculation.

Conclusion

The performance of financial assets is largely a function of flows. Money was added to the system and it’s now being removed. But depressed prices provide opportunity. Bitcoin is no less powerful as a global, fixed-supply, apolitical money. Ethereum is no less revolutionary as a platform for permissionless, unstoppable applications. DeFi is no less disruptive as a 24/7, automated financial system. As the media begins to report impending global doom and dance on the graves of crypto participants, we can find comfort in the fact that the industry is just getting started. Once the dust settles, there will be no better area to invest.30 Day Correlation: SPX & BitcoinBitcoin DominanceBitcoin’s Price (blue) vs % of Bitcoin Supply Held for Over a Year (green)MapleGoldfinch