Musical Chairs

Our mean reversion metrics suggest caution after last weekend’s rally. Funding has been very noisy and a poor signal of late. Skew is neutral. BTC Basis and Open Interest gave a short-term sell signal yesterday.

Crypto market cycles test patience. There are two axes of misery. The first is the decline in price that puts market participants in a tenuous situation if not outright liquidated. The other is an extended period of low volatility that leaves traders uninterested. It’s our opinion that we’ve already experienced the worst price declines and we are now more than halfway through the low volatility environment that leads people to give up on the space.

Past cycles are a good guide to navigating this environment. Bottoms have historically occurred around five hundred days before a price expansion. Note, that we only have two historical samples, so it’s important to not treat this as gospel but there are some common denominators. These cycles have aligned with the expansion in global M2; with tightening financial conditions it’s likely we see substantial easing in 2024. The other historical factor is the Bitcoin Halving which we have talked about in depth in prior letters. Following the logarithmic regression, we would expect the Bitcoin expansion to top out around $150k in mid-2025. That would indicate a $3 trillion market cap for Bitcoin, which seems reasonable given global adoption trends and the much-talked-about spot ETFs on the horizon.

The Halving is important because it reduces the amount of capital required to increase the price of Bitcoin. The Puell multiple demonstrates this well – after the halving the indicator will indicate a strong buy signal as Bitcoin will become twice as sensitive to upward movements given half the amount of daily supply production.

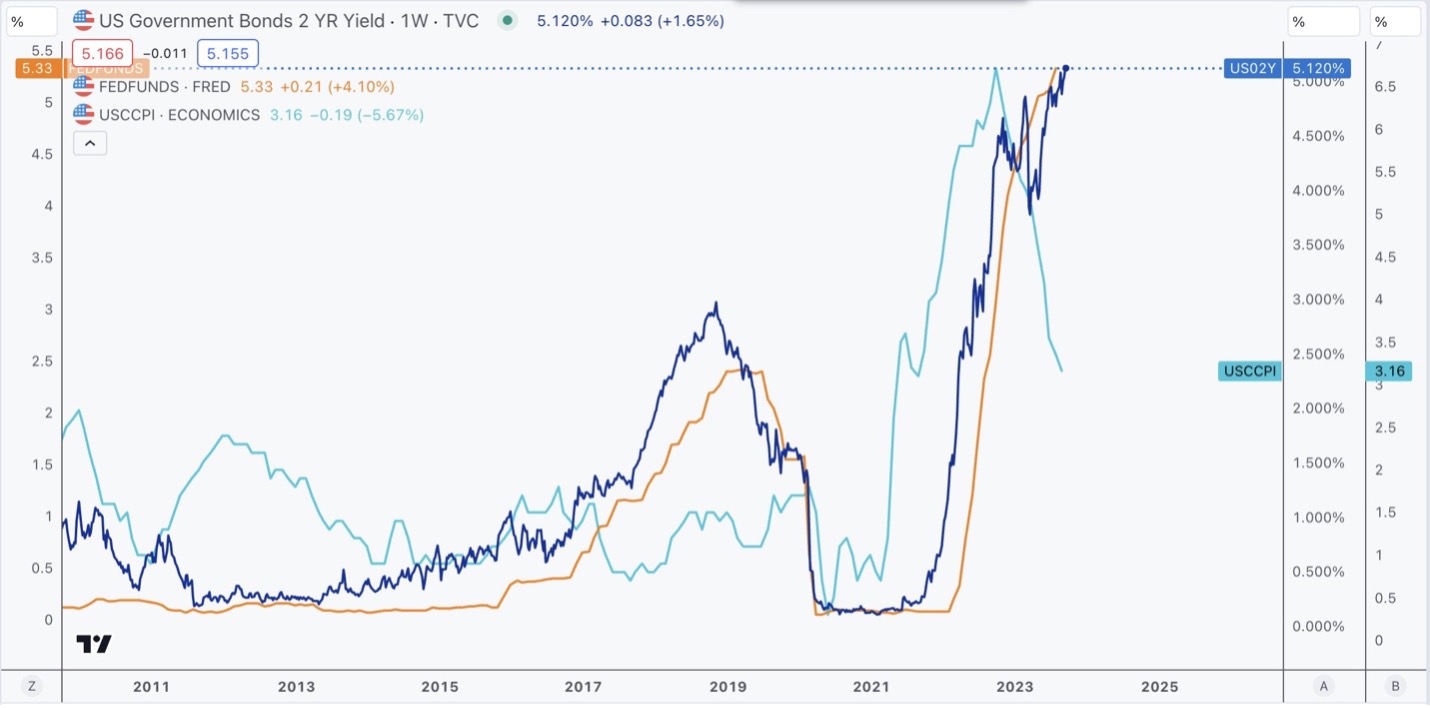

Why do we expect an easier environment in 2024? One factor is rapidly declining inflation. The below chart shows the relationship between the CPI, the 2YR yield, and the Fed Funds Rate. Inflation leads by about sixteen months. So, while we expect rates to rise in the short-term, we’re nearing the end.

The ETF decision will be a key event to watch for with Blackrock leading the charge. Gensler’s SEC appears resistant but if anyone can force the issue it’s Blackrock. As of right now, all spot ETFs that were scheduled for October have been delayed. The next deadlines to watch are January 10th-15th.

The Altcoin Rotation

The Halving and the imminent ETFs are likely to contribute to Bitcoin’s outperformance in the next six months, but it would be a mistake to ignore emergent narratives and leading altcoins.

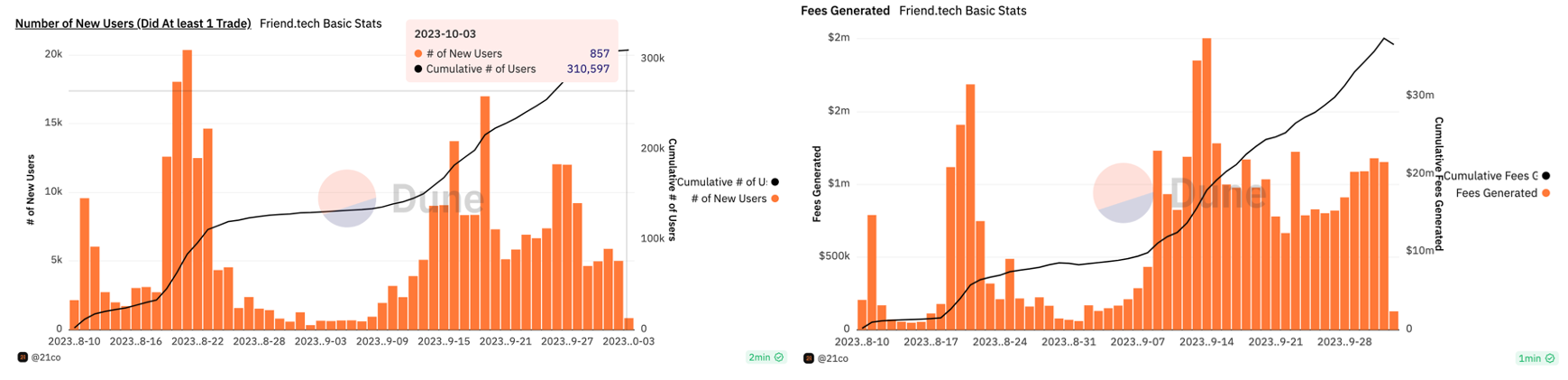

The most recent narrative is crypto consumer products. Despite a lackluster market over the summer, Friend.tech has continued to grow its userbase, its trading volume, and its TVL. In just two months, the business has generated $30 million in fees. The stats are skewed due to people farming a potential airdrop but they’re impressive, nonetheless.

There aren’t many ways to directly invest in the Friend.tech narrative at the moment. You can either try to farm the airdrop, but it’s a crowded move. You could invest in an emergent competitor that has a token but it’s likely that you’ll be investing in a laggard with a poor network effect. Or you could invest in new applications and tooling built on top of Friend.tech. I think the last approach is the best one. In fact, I could see the Friend.tech social graph becoming an onchain primitive. Instead of trying to rebuild a creator<>fan relationship, a consumer app could grant certain access based on the Keys a person holds.

The Friend.tech app is limited in a lot of ways, but it’s also unlocked a creator<>fan relationship like no other crypto app has so far. It feels a bit like early DeFi, meaning we’ll likely see a lot of copycats. Only the ones with a lasting product will survive. Speculation is a great bootstrapping mechanism but when the speculation dies down, there needs to be something to keep everyone coming back.

We’ve talked a lot about Solana over the past year. The user experience is better than any other chain, the fees are negligible, transactions are near instant, and it’s trading at 5% of the market cap of Ethereum. The upcoming launch of the Firedancer client (tooling for node validators) will deliver enormous performance gains to an already performant network and will make Solana one of the only ecosystems other than Ethereum with multiple clients. In the Firedancer demo, Solana achieved 600k transactions per second.

In addition to the network-level performance and upgrades, applications and companies are taking notice of Solana. Visa added support for Solana and released an in-depth report of the network’s capabilities. Maker, which was one of the earliest, and still one of the largest projects on Ethereum, announced its plan to build on Solana. The network TVL is steadily growing as liquid staking becomes popular and multiple projects implement rewards programs.

Solana is also my bet for leading consumer interest in crypto. The chain is easier for consumers to use, and because it scales, is easier for developers to build on.

In summary, we’re nearing the end of the accumulation. We have three months to identify the assets and themes we want to target for the next two years. The longer this accumulation draws on the more optimistic we become.

Cheers,

Plaintext Capital