Light at the end of the tunnel

The crypto market has been in a sustained downtrend for the last three months, seemingly acting as a canary in the coal mine for global risk assets. Only recently have inflation worries caught up to major equities indices triggering a -12% move in the SPX, peak to trough.

Bitcoin and Ethereum retraced over 50%, Solana retraced nearly 70%, and other altcoins 90%+. While we’re confident that the crypto market is in its infancy, momentum often supersedes fundamentals in the short term, and it’s important to have a risk management strategy.

In the crypto markets, pundits are now calling for a multi-year bear market. In traditional markets, some are calling for the end of a “superbubble”. This post by Jeremy Grantham has been referenced repeatedly. These doomsday calls have grown louder as market prices have declined which indicates among other signals, that the downtrend is becoming exhausted. The worst may be behind us.

In our year-end commentary, we noted the signs of excess of 2021. We are still in a downward trending market, and it should be respected as such. But now is the time to be patient and await exceptional opportunities.

The market’s attention and capital are scarce, and there are some signs of saturation. In an asset class that is likely to create tens or hundreds of trillions of wealth over the next decade, make sure you don’t sacrifice the long term in favor of the short term.

Bitcoin’s range

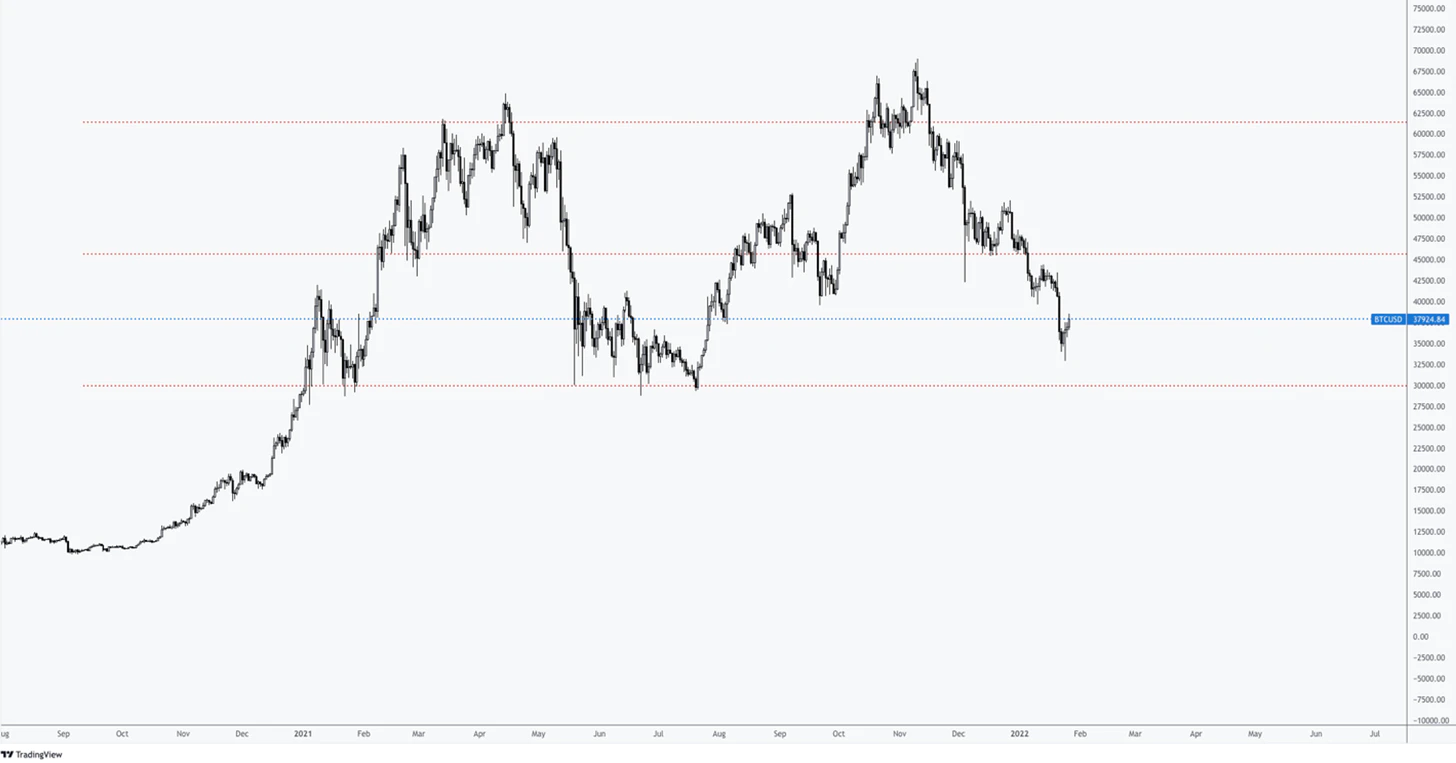

It’s important to realize that Bitcoin has been in the same range for over a year now. Multiple sectors in crypto have undergone mini market cycles, all while Bitcoin appears to be undergoing an extended period of accumulation. Typically, the longer the accumulation, the larger the breakout.

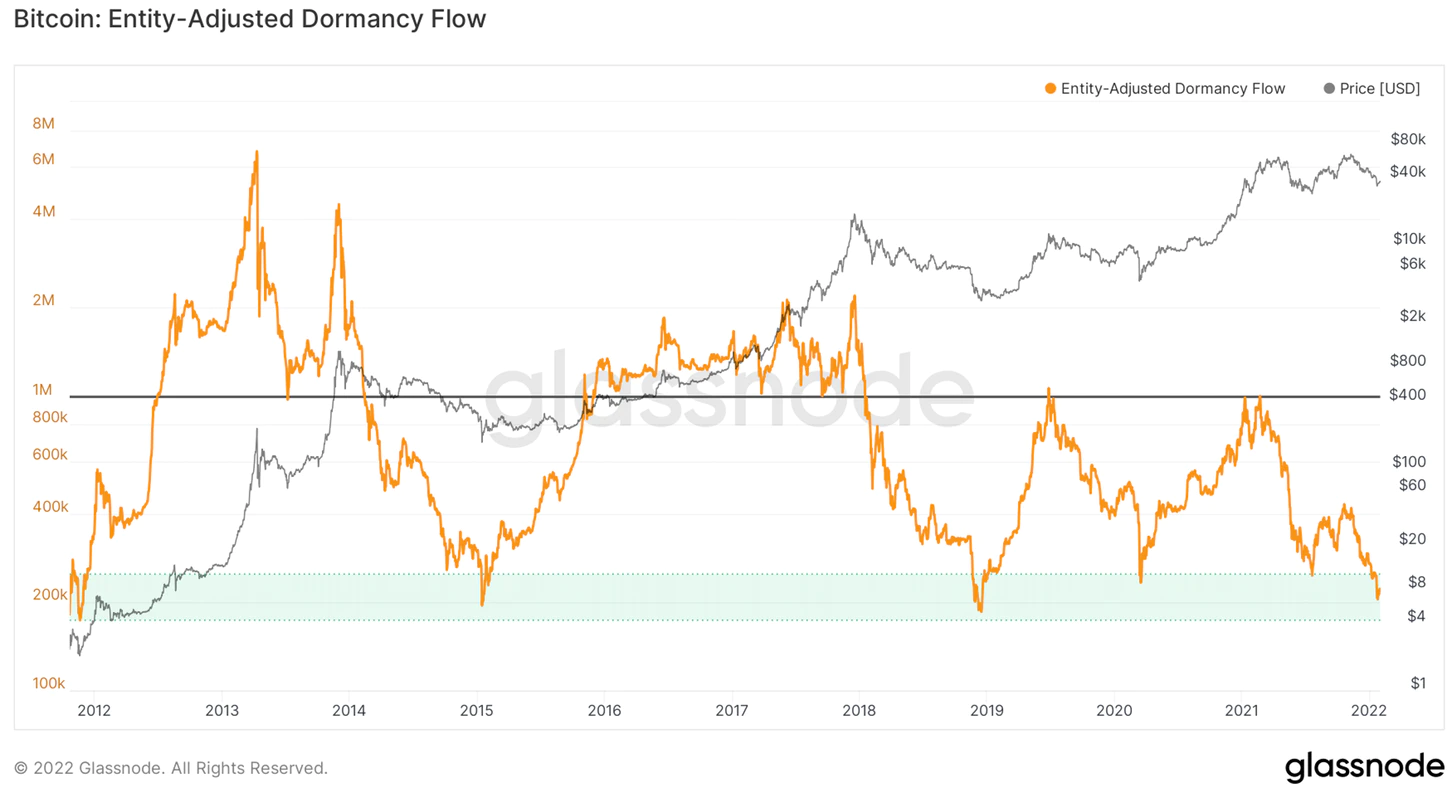

On-chain readings have limited efficacy for short-term direction but can be useful for understanding the larger market regime. Dormancy flow measures market capitalization relative to the average age of Bitcoins moved on-chain. Dormancy flow has been able to illustrate areas where Bitcoin holders have capitulated, repeatedly marking bottoms.

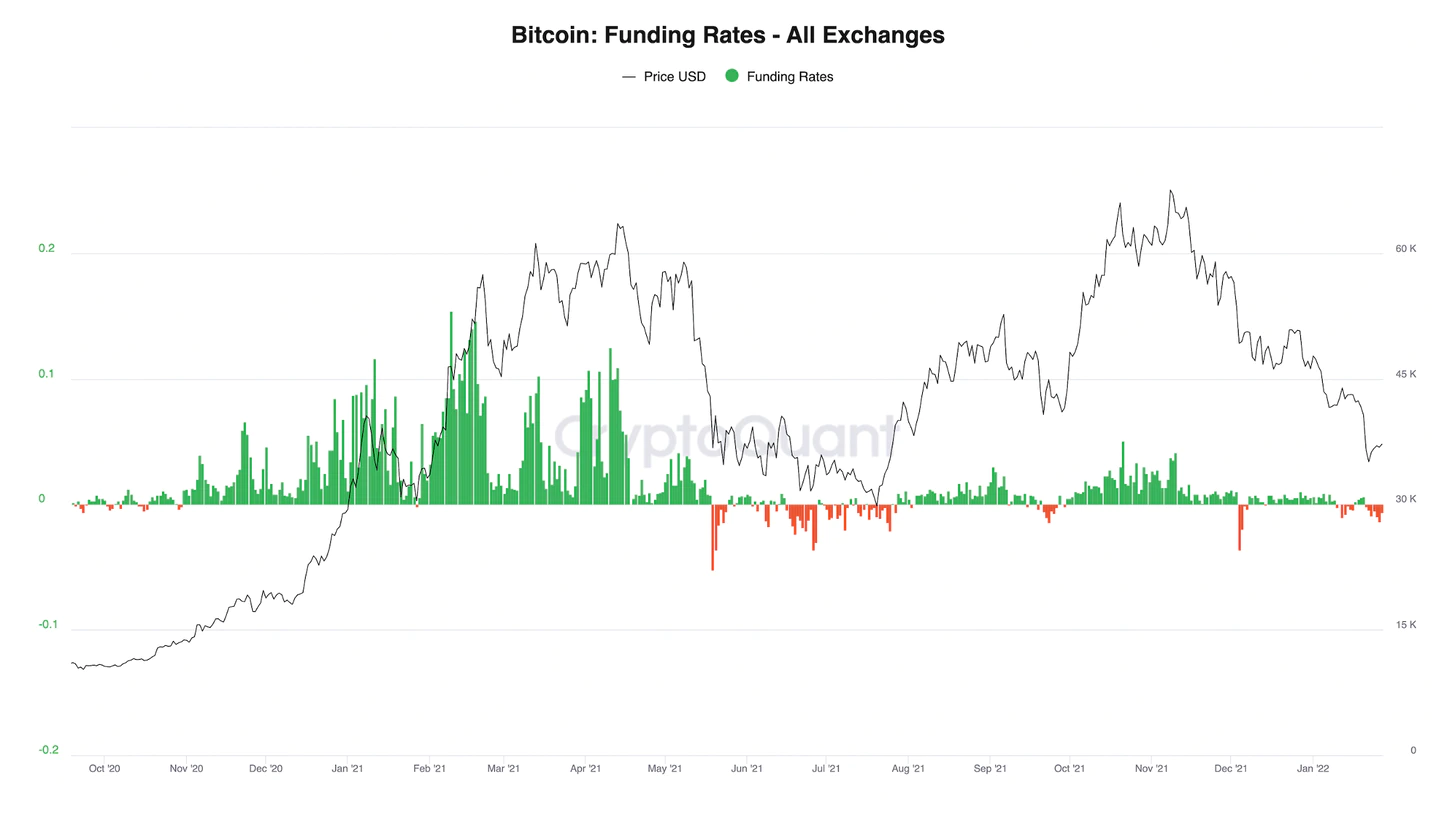

We’ve discussed in prior letters how funding rates show which side of the trade is more crowded. It’s more effective at extreme readings, but it can provide a possible indication of trend exhaustion. This is especially true with negative funding rates (indicating high short interest) because the market typically is long-biased. Below we see that negative funding has been the dominant paradigm for the last two weeks.

The Fed’s Confidence Game

The most important factor in global risk assets is the Fed. Following the market shock of March 2020, the Fed cut rates to zero, announced a commitment to backstop Treasuries and mortgage-backed securities, and even bought junk bonds. Since March 2020, the Fed’s balance sheet doubled from $4 trillion to over $8.8 trillion. The market became assured that the Fed would maintain market stability.

With the assurances from the Fed, risk assets rallied for the following year and a half. But signs of excess materialized, and in the fall inflation reached 7%, the highest reading since 1982. Whatever the causes, inflation is a problem for the current administration and the Fed. Unsurprisingly, the Fed followed with a more hawkish stance, indicating a reduction in its balance sheet and the potential for rate hikes. As a forward-looking machine, the market has reacted negatively. There is an existential worry that the Fed will not backstop the market as it has in the past, but we don’t believe this is true.

The Fed is playing a game of confidence. It’s crucial that it maintains legitimacy — when the consensus believes the Fed is an “unhinged money printer”, it must demonstrate conservatism. But ultimately it is bound by the enormous global debt overhang. $60 trillion of this debt is dollar-denominated, meaning that as the dollar strengthens and rates rise, the debt becomes harder to service. This increases the risk of default and a deflationary spiral that would cripple the global economy — it would be catastrophic. Powell is aware of historical precedents: Paul Volcker aggressively raised rates in the 80s leading to recession and Alan Greenspan raised rates to mark the end of the dot com bubble. Powell does not intend to be the poster child for a global recession.

Historically, when governments have debt that is difficult to service, they debase the denominator of that debt — in this case, the US dollar. It’s likely that the US will continue to follow this path. Inflation is far more palatable than deflation because it happens more slowly, can be disguised, and it’s harder to pinpoint the culprit. But deflation happens quickly and painfully, and it is easy to identify a scapegoat.

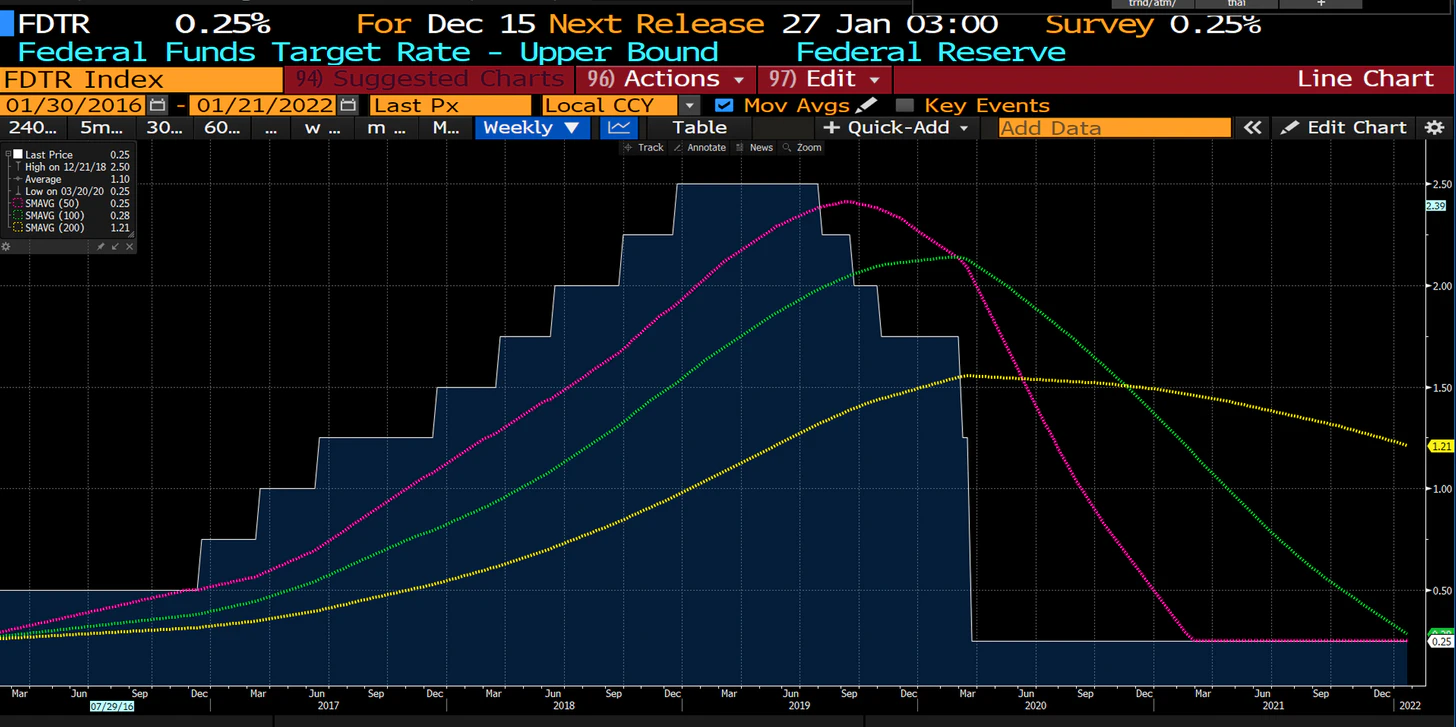

Finally, it’s likely that monetary policy expectations are worse than the reality. The below chart shows eight rate hikes from September 2016 to June 2019 that coincided with a nearly 40% rally in the S&P500.

Short-term volatility aside, chances of catastrophe appear limited for now. Further, Powell continues to repeat his most important phrase:

“*We are listening to the market.” *

If the market signals catastrophe, the Fed will be standing ready.

Crypto developments

Despite depressed prices across the board, let’s not miss the forest for the trees.

DeFi’s performance is inherently tied to prices of assets in the ecosystem — the value of reserves decreases when asset prices fall and cashflows decrease alongside. But the sector continues to mature and pass stress tests. Decentralized exchanges, Uniswap and Curve, facilitated $15 billion and $2 billion of weekly volume, respectively. Structured products grew their asset reserves by over 80% month-over-month. Undercollateralized lending platforms like Maple are providing over $500 million of loans to institutions. It’s clear that a parallel, 24/7, global, permissionless financial ecosystem is maturing.

Non-financial sectors like decentralized infrastructure are more likely to be countercyclical because their success is less dependent on the price of other assets in the ecosystem. Livepeer, a video transcoding service, recently shared that it processed 30 million minutes of video in Q4 2021, bolstered by partnerships with Korkuma, PlayDJ, and Vimm. Arweave continues to set new usage records with now 45 TB stored. Helium now has over 530k hotspots around the world, up nearly 20% in the last 30 days.

Market segments that have been seemingly unaffected by declining prices are digital content and NFTs. OpenSea did its highest monthly volume in January, $5.3 billion, even amid competition from LooksRare. Music publishing protocols like Nina, Catalog, and Sound have seen growing interest. Hopefully, this is a sign that new participants are entering web 3.0 not for financial speculation but for creative expression. We maintain that the direct artist-fan connection that is enabled by NFTs will catalyze a creative renaissance.

Summary

Declining prices can have an incredible influence on an investor’s perception of value. By all measures, the crypto market is still in a downtrend and for that reason, caution is warranted. But rather than abandon hope, the coming months may yield unique opportunities in the public markets. Investors now have had the benefit of evaluating products, teams, communities, and growth metrics of the best projects in the space. In some cases, valuations are approaching private market levels but with public market liquidity — a fantastic duo. This has been an aggressive reversal, but we ultimately expect it to be transitory.

Best,

Phil Bonello