Inflation, Solana, and the Future of AI Music on Web 3

Macro

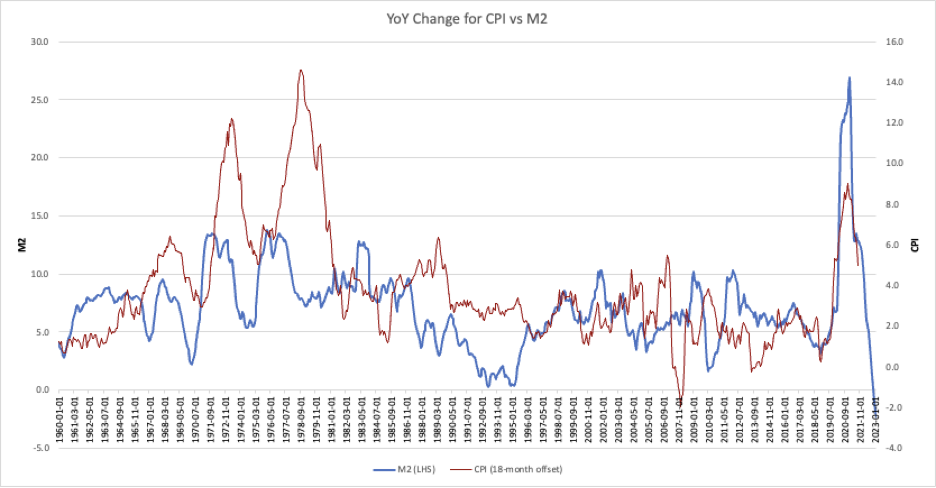

Inflation continues to come down which gives the Fed breathing room should the economy deteriorate. The chart below shows the relationship between M2 and CPI with an eighteen-month offset.

The Fed is unlikely to pivot before deterioration because taking the foot off the gas early with inflation still elevated could damage the Fed’s credibility. Because the Fed is unlikely to pivot before a deterioration, liquidity will remain tight with trillions stuffed into money market funds and the reverse repo program; rates are too attractive for that capital to flow elsewhere. Additionally, the Treasury General Account has been drawn down since September which has been a net positive for liquidity, but with the account nearly empty this drawdown is set to reverse.

Dollar dominance has weakened over the last six months as China, Russia and other countries have looked to reduce dependence on the bully that is the USD. The DXY started its downtrend in September after a nearly two-year bull market. A weakening dollar is bullish for dollar-denominated assets. Adding fuel to the fire, Stanley Druckenmiller said his sole high-conviction trade right now is “short the US dollar.” However, in the short term given the liquidity factors previously mentioned, DXY might see a jump and risk assets a slump. We think patience will be rewarded.

Bitcoin

On the crypto front, Bitcoin has a few potential supply overhangs including Mt. Gox distribution and scheduled selling from the US government. There is also a small possibility surrounding the dissolution of GBTC which would result in billions of dollars of Bitcoin being unlocked from the trust and potentially finding their way to the market. Despite these overhangs, Bitcoin dominance remains at the highest levels of the past two years as altcoins have continued to lose value relative to Bitcoin. As mentioned previously, Bitcoin dominance is generally expected to increase in bear markets as the lower beta, value play.

Solana

April was an exciting month for Solana with the launch of the Solana Saga mobile phone. The Saga is the first vertically integrated mobile stack designed for crypto, and in this case, Solana. The Apple and Google App stores have historically been hard for crypto businesses to work with, so the Solana team took the matter into their own hands. With the Solana Mobile Stack, developers can more easily build a mobile-first experience for Solana apps. With Solana’s fees and speed, these applications might be able to deliver a Web2-like user experience.

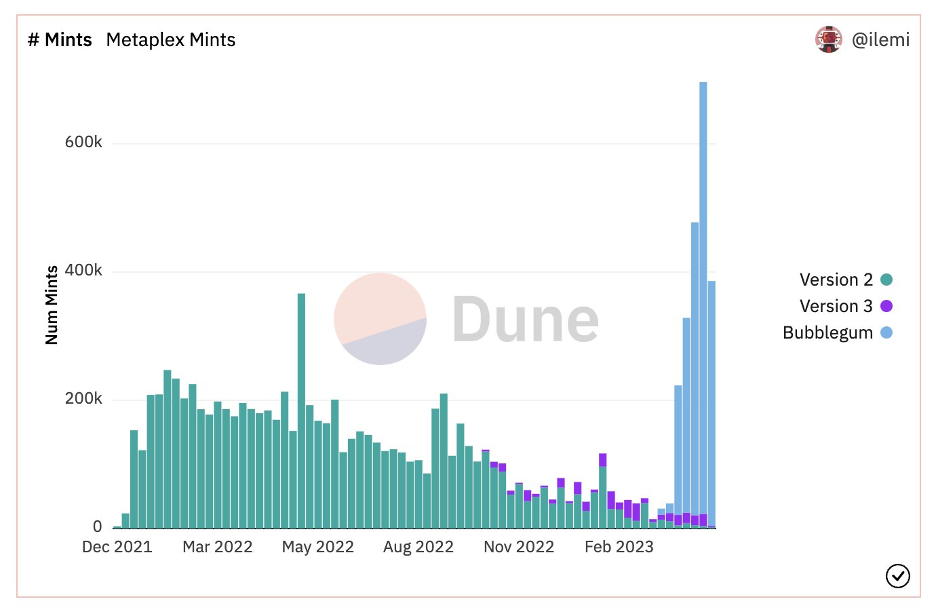

Mad Lads, an NFT collection in connection with the Backpack wallet, launched mid-month with tons of excitement. In the first week of trading, it had the most volume of any NFT collection on any chain. The mint was also extremely popular and proved that the Solana network has resolved issues that had previously led the network to crash during times of congestion. NFT compression launched in April, making NFT minting over 1000x cheaper, an important innovation for making blockchains more palatable for consumers. This table shows how cheap it is to mint compressed NFTs on Solana.

The chart below shows how popular Bubblegum, the smart contract responsible for NFT compression, has been since its launch. We think Solana is well positioned to be the blockchain of choice in the next adoption cycle.

From an investment perspective, the Solana ecosystem is also primed given that only a handful of projects have launched their tokens. As more projects gain adoption and launch tokens, it will increase overall liquidity and interest in Solana.

Music, AI, and Web 3

High-quality, AI-generated songs in the likeness of famous artists like Drake, The Weeknd, and Grimes, among others, are coming to market with greater frequency. Initially, these songs were met with hostility from record labels and taken down from all relevant media platforms. But this game of whack-a-mole is a losing battle, especially with permissionless music enabled by blockchains. Instead of fighting the trend, Grimes decided to lean in, saying she will split 50% of royalties with anyone who uses her voice. People who create AI-generated songs now have an incentive to split the royalties because Grimes is an incredible distribution channel. And what will be the easiest way for AI producers to do this? Through Web 3 protocols.

The traditional model that might take months to approve copyright is incompatible with anonymous producers around the world generating new AI tracks daily. Instead, they can publish the music on Nina, Lens, or Sound, set a distribution fee of 50% on the songs, and share them on the internet. If the music is good, maybe Grimes shares the song earning money for both the producer of the AI song and Grimes. This is a great example of how Web 3 protocols could unleash musical creativity. The free market in action!

Cheers,

Plaintext Capital