Inflation has Topped

I’ll keep this brief and chart-focused because inboxes are bombarded with 2023 predictions, and we also plan to publish a longer form piece next week.

Crypto on-chain indicators point to a bottoming process. And on the macro front, inflation seems to have topped which may lead to a Fed pause and a subsequent market reversal. But while inflation might not be a worry, recessionary risk will be. In other words, can the Fed achieve its soft landing?

Crypto Indicators

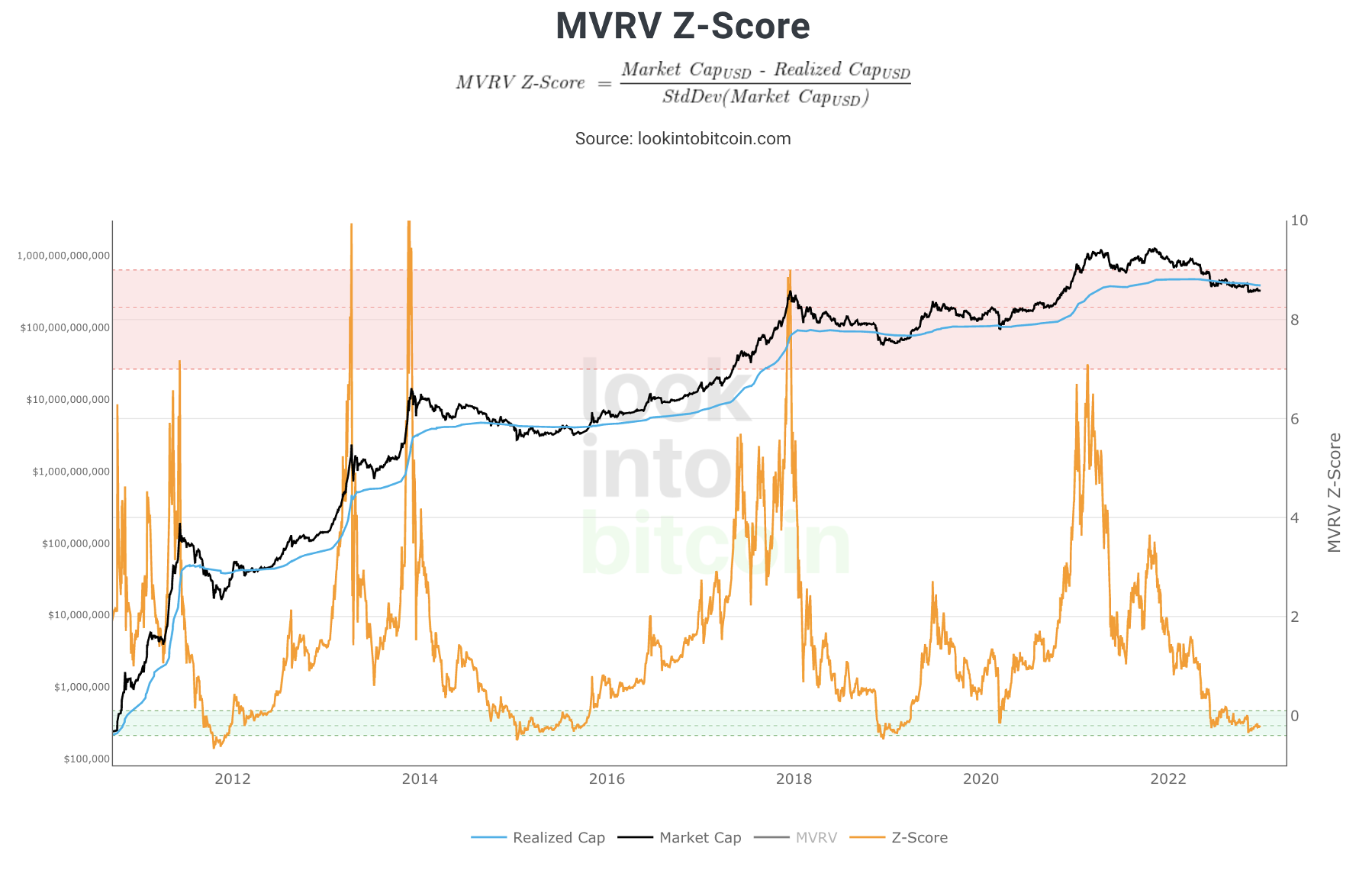

There are only a handful of on-chain indicators that I believe are reliable. The MVRV Z-score is one of those indicators. It measures the ratio between the market capitalization of Bitcoin and the realized market capitalization, which is calculated by averaging the most recent cost basis of each respective coin. For example, if I bought a coin at $5000, that price would be added to the average realized price. In some ways, realized price gives a more intuitive read on price if all liquidity was readily available. The MVRV Z-Score has consistently served as a support zone as shown below.

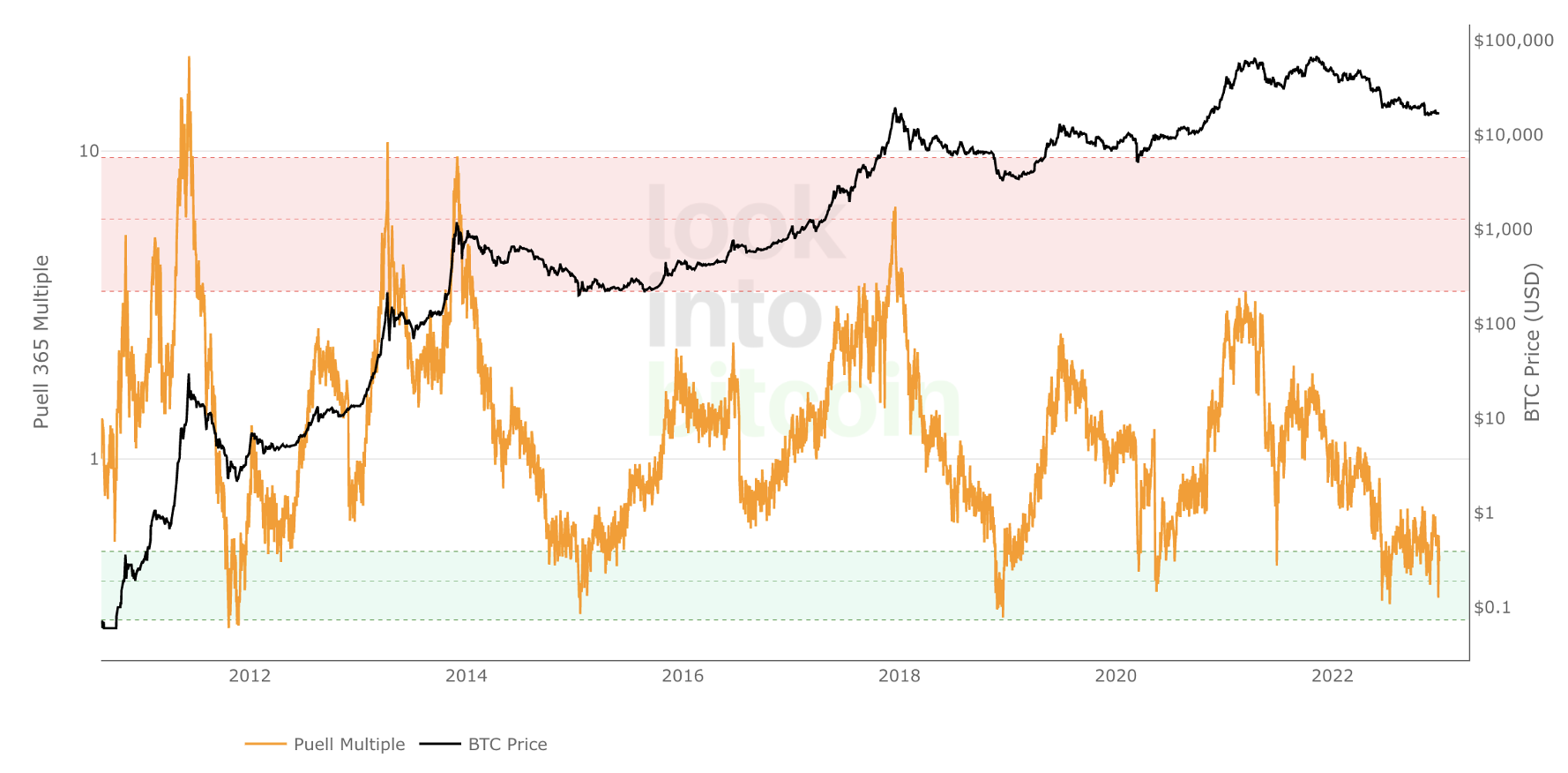

The Puell multiple is also intuitive. It measures the amount of supply in USD terms generated by Bitcoin mining each day, relative to the 365-day trailing average. This reading shows how much marginal demand must exist relative to the daily supply over the last year; at the top of the market, there needs to be a large increase in demand and at the bottom, far less demand is required to support price.

Inflation Outlook

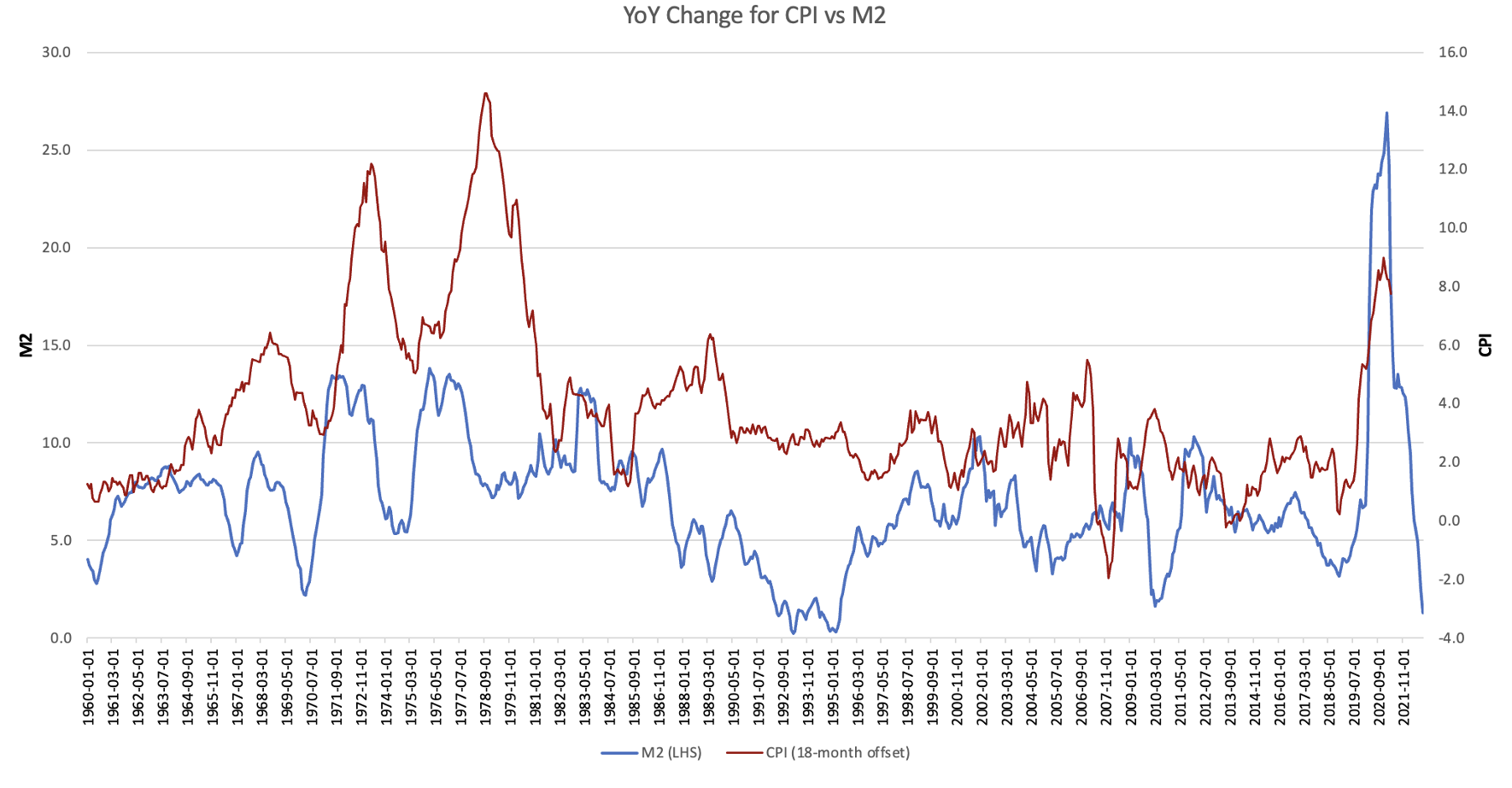

Milton Friedman said that “inflation is always and everywhere a monetary phenomenon” and it sure looks that way. The largest increase in M2 money supply in history was followed eighteen months later by the largest spike in CPI since the 1970s. And now with nearly negative YoY M2 growth, it appears CPI is poised to aggressively reverse.

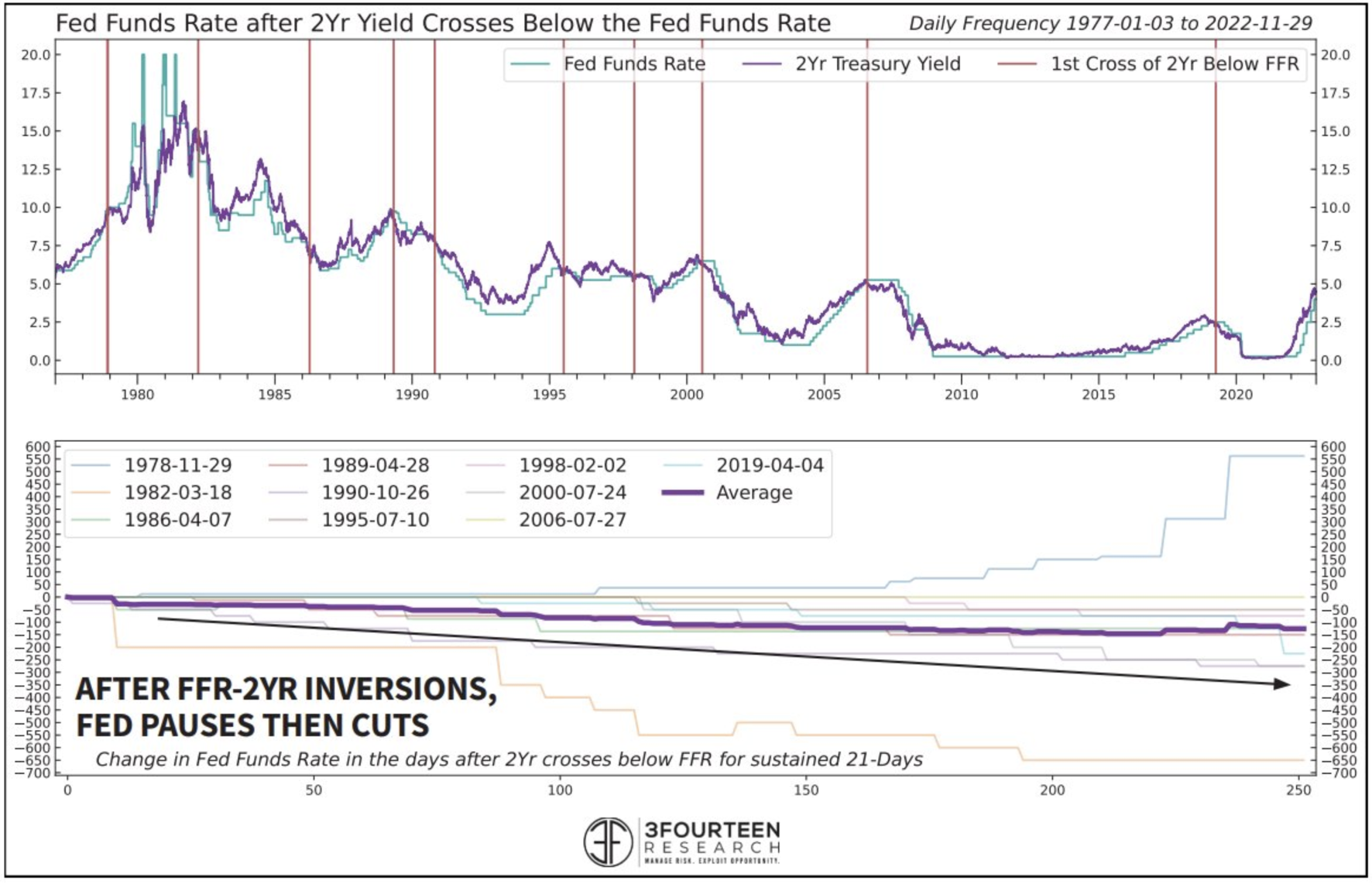

A drastic reversal in the CPI might lead to a more dovish Fed and give risk assets some room to breathe. The 2-year yield just crossed below the Fed Funds rate, indicating that the market believes there will be a pause in rate hikes.

Recession Worries

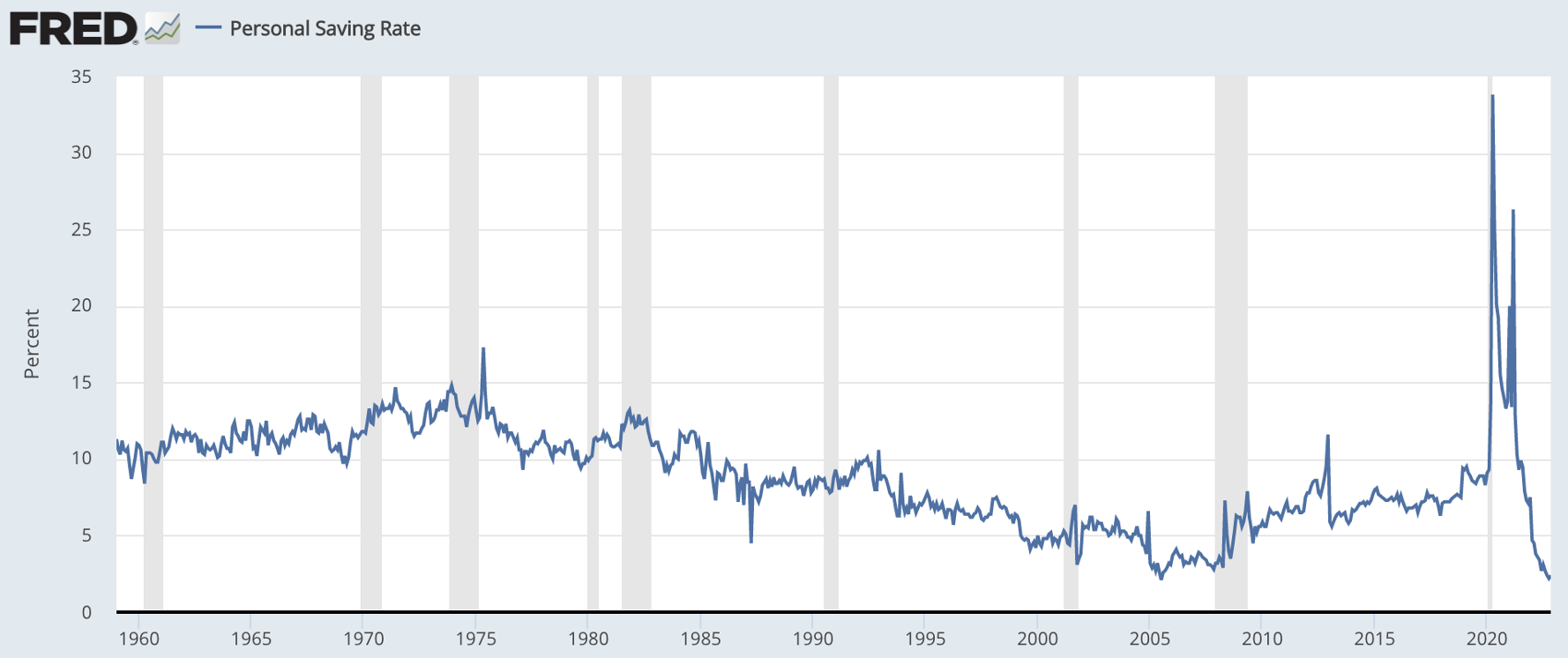

A deflationary spiral is now a bigger concern than inflation. With the savings rate near all-time lows, global debt at all-time highs, and interest rates steeply higher, the question is whether Powell can succeed in his “soft landing” promise.

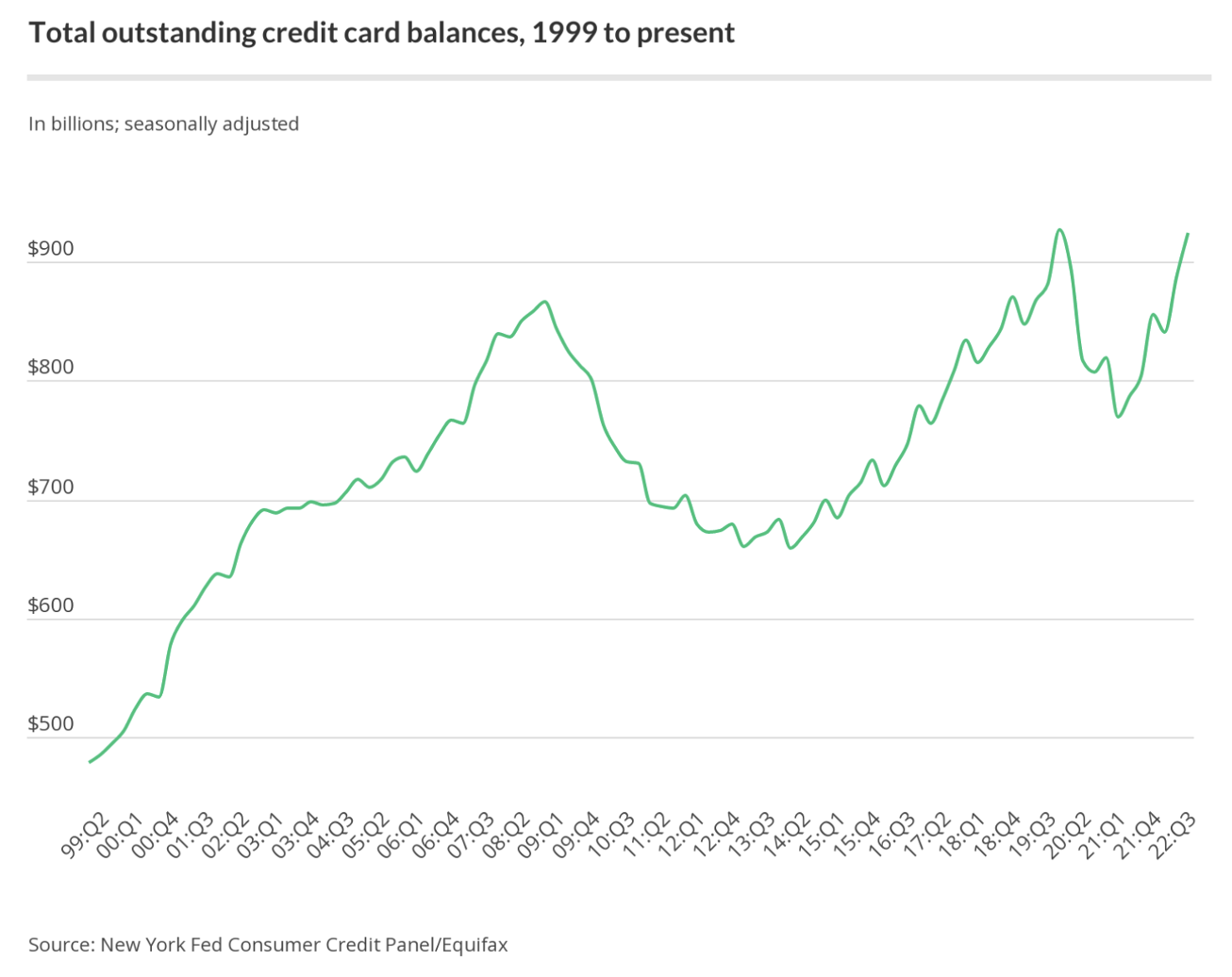

As CPI quickly corrects and possibly goes negative over the next six months, there will be less appetite to tighten. The total outstanding credit card balances shown below illustrate a broad problem in the market: people and organizations are struggling to pay back their debts in a high-rate environment.

Summary

Crypto is showing signs of bottoming and a fast-correcting CPI may be a tailwind for risk assets in the short term. But recessionary worries are likely to take over inflationary worries in the coming year, and we will need to navigate that. While the market is attractive from a value perspective, the coming year will likely require active management as the tides shift.