Head Fake

Market action

For the second month in a row, Bitcoin breached highs but couldn’t sustain the momentum. This is likely due, in part, to inflation worries and what that could mean for the economy — rising yields and tapering from the Fed. This is a headwind for risk assets and Bitcoin and crypto fall into the risk bucket. The market fear was further exasperated by worries of the new COVID variant, Omicron. However, Omicron may serve as a scapegoat for the Fed — the reality is markets need their perpetual support and the possibility of lockdowns gives reason for the Fed to continue this support.

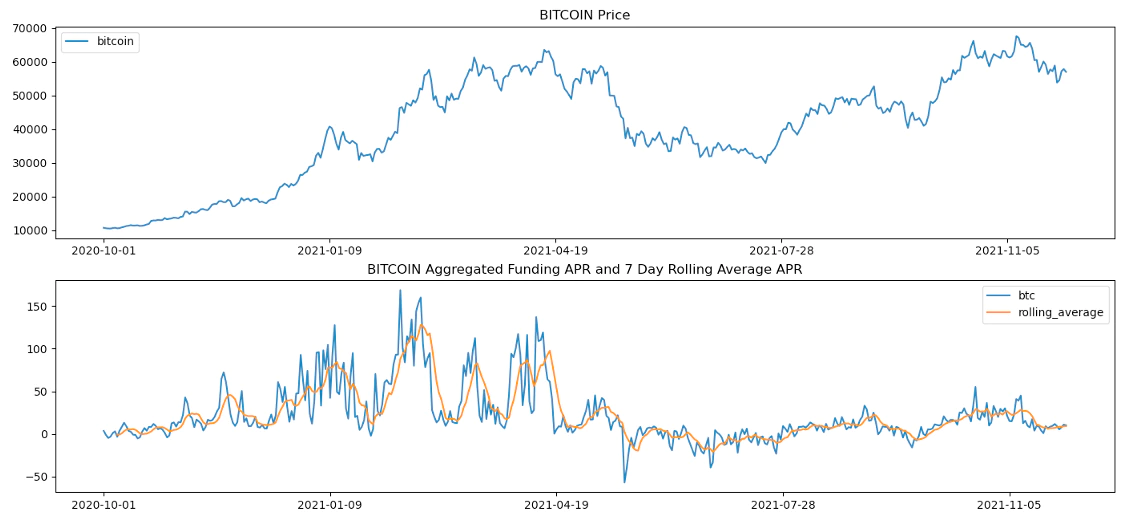

If weakness in the macroeconomy persists, crypto likely will be negatively affected. However, when taking a more isolated look at the crypto markets it’s reasonable to remain optimistic. Financing for perpetual swaps (known as funding) has been relatively muted in recent weeks, a sign that the market is healthy with ample cash on the sidelines. In contrast, when financing is high, spot buying is lagging demand for derivatives, a sign there might not be enough new money to support the market. We can see below that funding is sitting at about 8% APR relative to the 130% APR seen last spring.

Source: Plaintext Capital, CryptoQuant

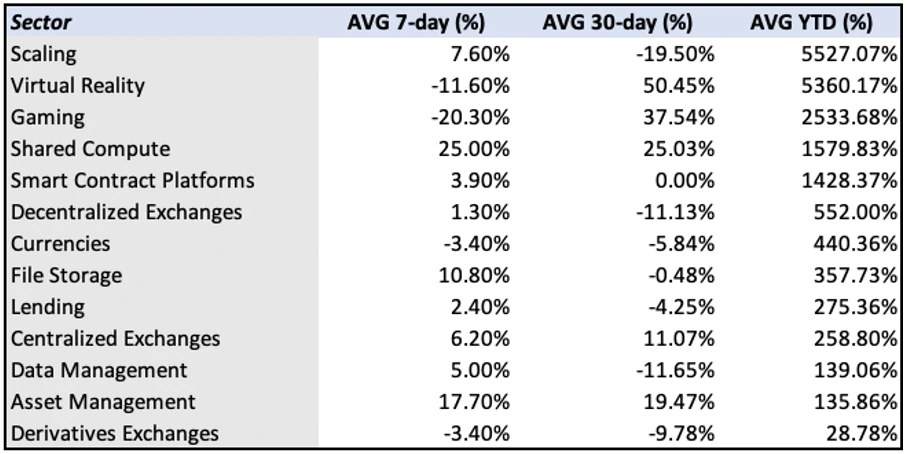

Even so, it’s worth taking stock of the performance of crypto since the beginning of the year. Almost all major sectors have shown tremendous performance. It would not be a surprise to see tax-related selling in the new year.

Source: Plaintext Capital, Messari

Miscellaneous

The Ethereum Name Service is a domain registry protocol that links a readable name with an Ethereum address. While it can be used to point to a typical web domain, it’s more popular as a Web3 identity. Nearly 500,000 names have been created using ENS as users claim their identities in the metaverse. Earlier this month to decentralize the protocol, ENS rewarded users and contributors with a token that will be used to govern the protocol moving forward. A total of 137,000 wallets were eligible for the token drop and so far, the median claim value of about $13,000 at current prices. The reward process isn’t yet perfect but the ability for users to be rewarded as owners is a powerful force.

The ConsitutionDAO, a decentralized autonomous organization, was created to raise $20 million to purchase a rare copy of the U.S. Constitution at a Sotheby’s auction in mid-November. Instead, the crowdfunding effort raised over $40 million and seemingly won the auction before it was announced that Ken Griffin, CEO of Citadel, outbid the ConstitutionDAO. Even though the DAO failed to win the auction, it was a very public display of distributed coordination. A group of internet friends nearly purchased the U.S. Constitution.

Jack Dorsey resigned from Twitter. Dorsey is a well-known Bitcoin supporter but famously uninterested in other crypto projects. There’s speculation that Twitter will begin to integrate Ethereum more tightly into its infrastructure for both payments and NFTs. For reference, Twitter has 220 million daily active users.

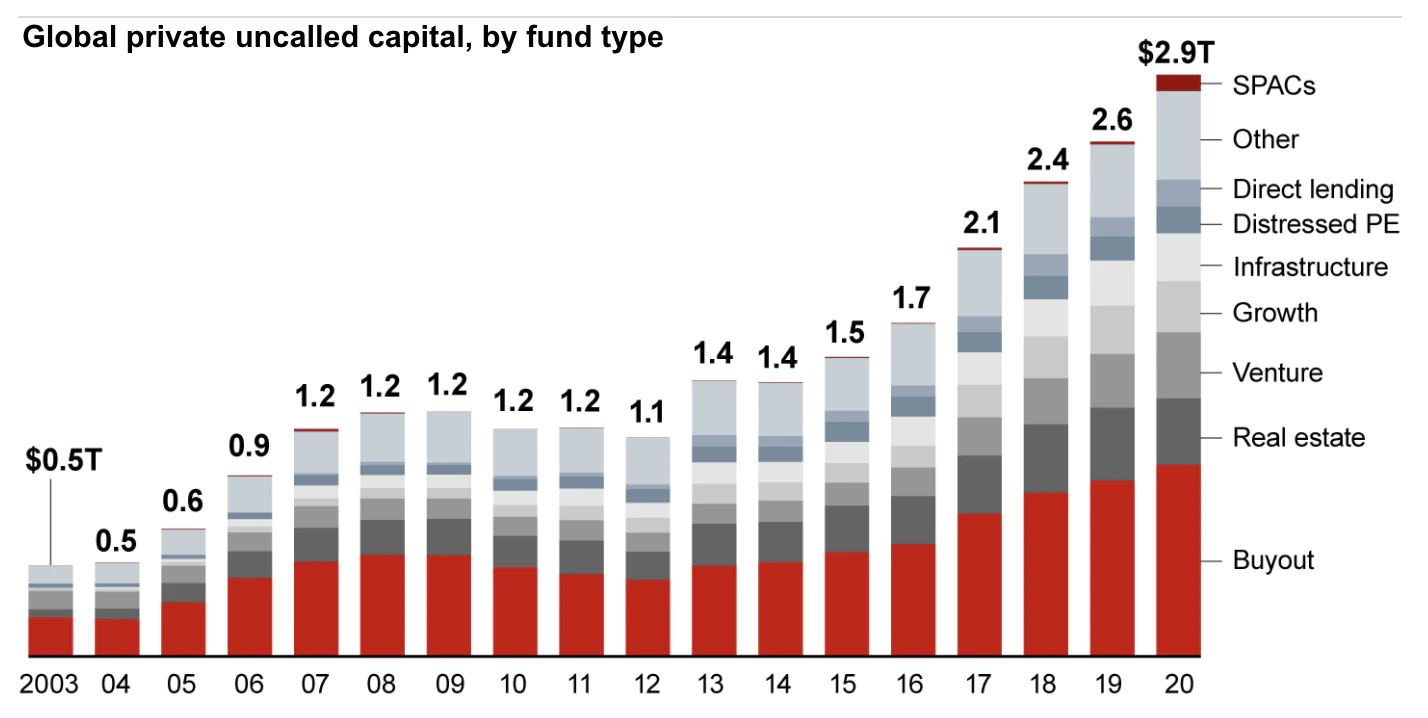

Funding continues to flood into crypto from the likes of traditional firms like Tiger Global and Softbank but also crypto-specific mega-funds. Paradigm recently raised a $2.5 billion fund and Hivemind raised a $1.5 billion fund. With $3 trillion of dry powder, it seems private capital is making its way into crypto.

Source: Bain

What we’re watching

EVM wars, which we mentioned in past newsletters, have slowed with the risk-off market of the last few weeks. While Avalanche garnered the most attention and price appreciation, it likely will run into similar scaling challenges as Ethereum if demand for the network increases. This realization might bring some attention back to Ethereum and Ethereum scaling solutions.

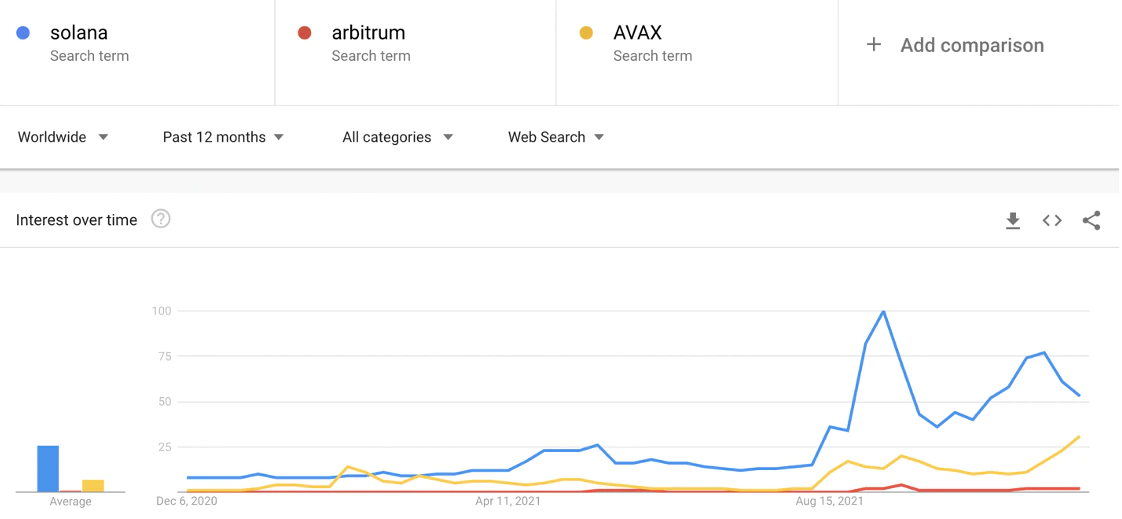

One of the key reasons Layer 2 Ethereum solutions haven’t yet gained traction is that few of them have a token to incentivize early participants. Attracting speculators might seem like a strange goal, but when these applications are inherently financial it’s not a bad user acquisition strategy. Looking at the Google Trends chart below, many users are searching for Solana and AVAX but very few for Arbitrum. When Arbitrum, Optimism, and other Layer2 networks launch tokens, we might expect a rush to those networks.

Source: Google Trends

Closing thoughts

The weakness in Bitcoin and the relative strength in altcoins is reminiscent of last spring before we witnessed a down market through the summer. A key difference is that market participants are already positioned defensively, meaning there will be ample cash to weather a drawdown or they will be forced to purchase back higher. Further, a flurry of recent fundraising is an indication that investors with trillions of dry powder are keeping an eye on the market.

Cheers,

Plaintext Capital