Crypto: contrarian once again

Much of the crypto market is up over 50% YTD despite a constant stream of regulatory headlines. Fred Wilson of Union Square Ventures published a short and powerful blog post where he responded to questions about crypto regulation with “when they want to shut it down, I say double down.” It’s an important message from a VC who invested in the rise of the internet and witnessed what differentiated us from China: the freedom to innovate.

Despite outstanding performance in the crypto markets this year, the sentiment is poor. We’ve reached the apathy phase of the crypto cycle where people lose faith, question the future of the industry, and leave. In the public crypto markets, sellers have been exhausted but buyers have not yet been convinced to return. This leads to low volume and a rangebound market. Investors have now turned to the newest shiny thing, AI.

The best time to invest in a market is when it’s least popular; when sentiment is negative, we can more easily identify undervalued assets for the long term. During a bear market, lots of reasons appear for why an asset class might never recover, but the reasons why crypto adoption will continue to grow have not changed. In an increasingly digital world blockchains are the best avenue for capital formation, distribution of data, and digital governance.

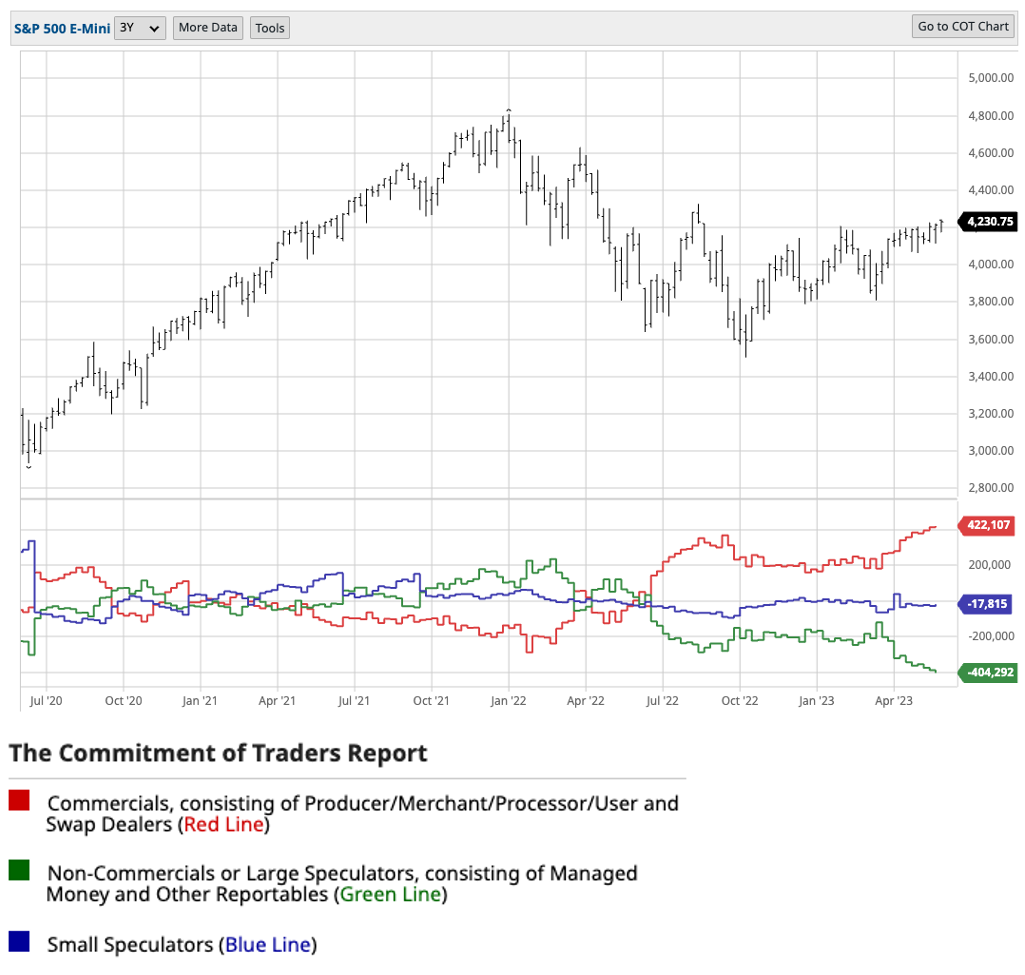

This feeling of apathy is similar in traditional markets right now. The S&P 500 and NASDAQ are up about 10% and 25%, respectively. But the prevailing sentiment is that this is not the time to invest. This perspective may be right; liquidity has been sucked out of a market that is addicted to it, so a severe withdrawal seems inevitable. But in the short-term, movements are largely dictated by positioning among traders. If everyone is short, who is left to drive the market lower? The below chart illustrates this concept with the sum of futures contracts owned by certain groups. The green and blue lines represent the large and small speculators. When their patterns are extreme on either end of the spectrum, it serves as a good countersignal; sell when everyone is buying and buy when everyone is selling. The “large speculator” segment is more short the S&P 500 than at any time in the last three years.

Source: Barchart.com

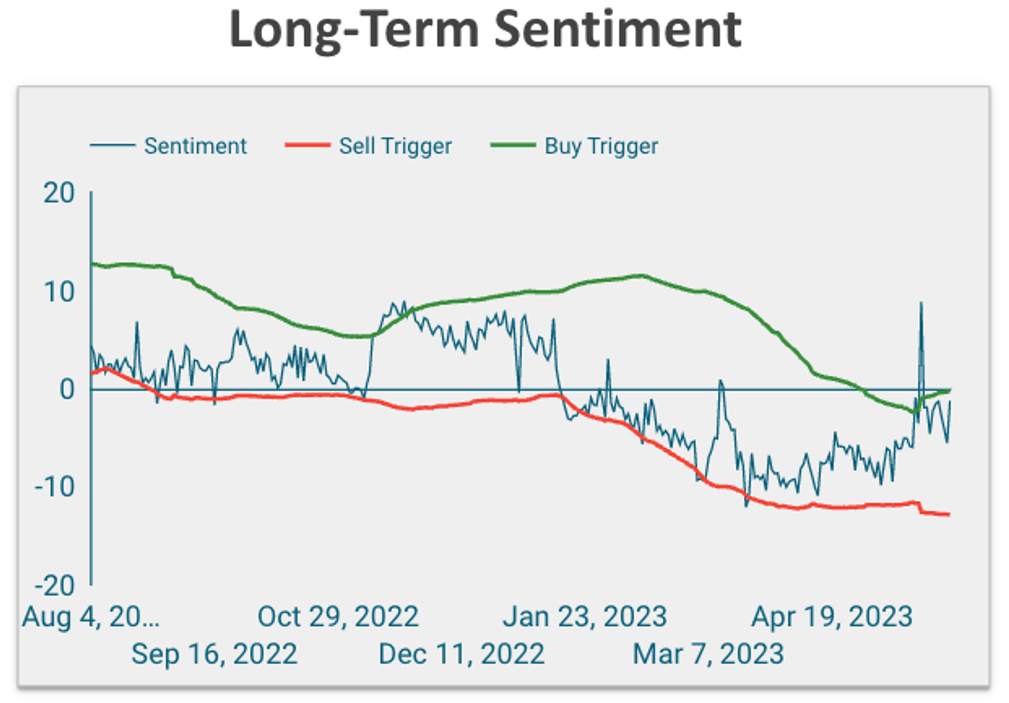

Our long-term sentiment indicator shows a similar story to the above graph; traders are positioned bearishly tends to be a good buy signal.

Source: Plaintext Capital

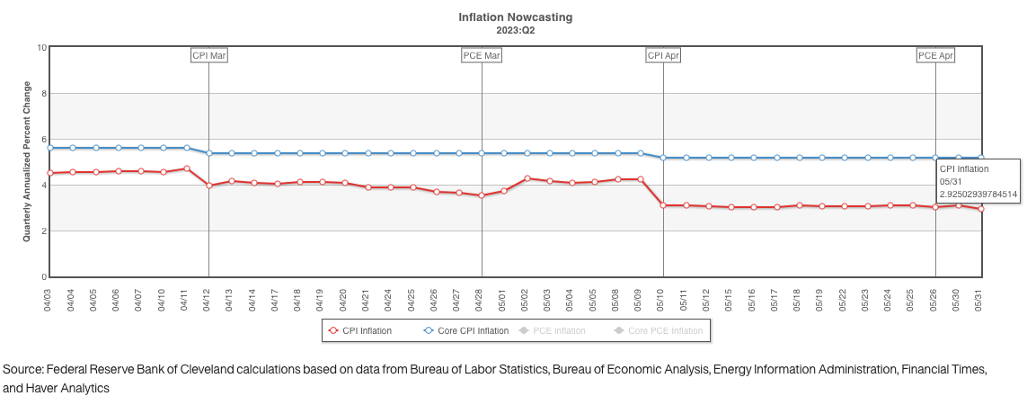

This could provide an interesting setup in the next month as CPI comes out on June 13th and the FOMC is on June 14th. I don’t expect a pivot from the Fed, but a favorable CPI reading might be the fuel the market needs to move higher. According to the Cleveland Fed’s Nowcast, inflation is forecast to come in at 4.13%, which would be the first time since before COVID that inflation is below the effective Federal Funds rate, which currently sits at 5.1%. This would be a good sign for the market that the Fed has been effective in bringing down inflation. Further, as of today, inflation is projected to be 2.9%.

Source: Cleveland Fed

I expect that soon we’ll be hearing a narrative pushing the Fed’s successful “soft landing”, and I expect that narrative to be wrong. The bottom often falls out of the market after the Fed Funds rate has topped, as credit conditions remain tight amidst a deteriorating economy and traders are crowded on the long side. This is when we may see the best opportunity, as this will trigger the Fed to aggressively step in.

All in all, participants are right to be wary of the current market. “Don’t fight the Fed” is still in play and liquidity isn’t there to support a sustained rally. It remains a trader’s market. Our focus is long-term research and short-term risk management.

Cheers,

Plaintext Capital