Peak Panic

Last month we noted that there was light at the end of the tunnel for risk assets. This month we experienced a shift in momentum, especially for BTC and a select group of altcoins. It was also impossible to ignore the effect the global political climate had on crypto, both for short-term price action and for long-term validation of the technology. While altcoins have continued to struggle, value is becoming apparent in certain sectors.

Bitcoin and the geopolitical stage

At the beginning of February, Canada imposed financial sanctions on accounts assisting the trucker protests. As a response, Bitcoin and Ethereum came into the spotlight as censorship resistant avenues for fundraising.

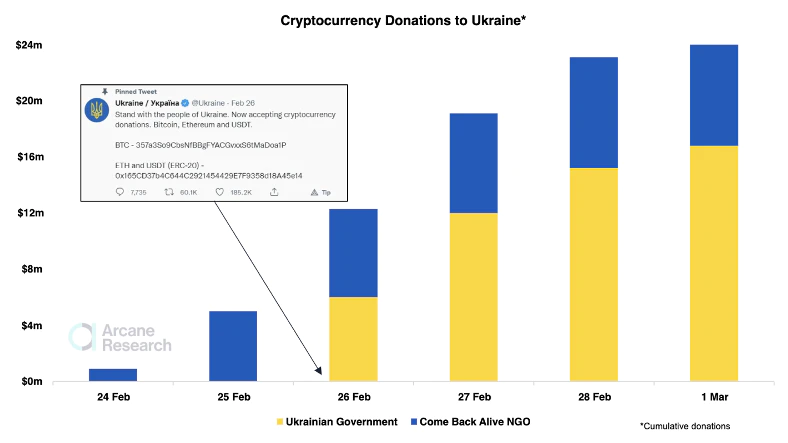

As the Russian invasion in Ukraine has escalated, crypto has again come into the spotlight as a way to fundraise globally and without censorship. According to the chart below, approximately $24 million has been donated to the Ukrainian government and the Come Back Alive NGO, alone.

Source: Arcane Research

There is likely additional demand from Ukrainian and Russian citizens trying to preserve their wealth. For Ukrainian citizens leaving the country, storing savings on a hardware wallet might be one of their few options. For better or worse, crypto is now center stage in the geopolitical scene.

https://twitter.com/ercwl/status/1498380832058265607?s=20&t=bIkqH9evme5RrW0zGAPbcQ

It’s unlikely that the recent Bitcoin move was a direct result of buying in Eastern Europe but it does highlight the long-term value of a global, digital, censorship-resistant, fixed supply asset. Bitcoin cannot be unilaterally controlled which gives its users economic assurances that have never before been possible.

Short term price action

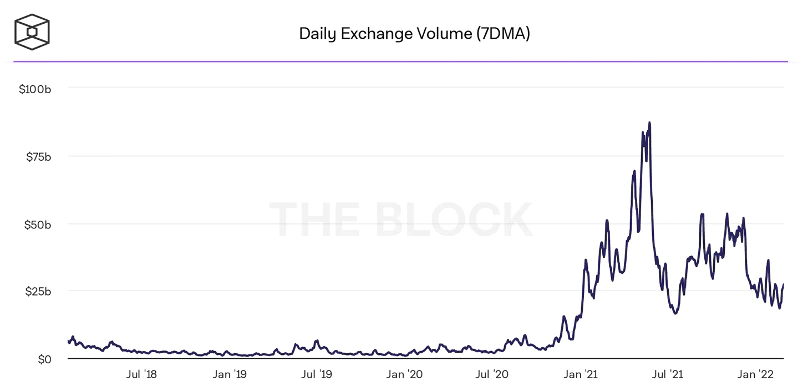

Exchange volume is about 25% off the highs of last spring indicating the beginning of apathy in the crypto market, generally a decent sign of retail capitulation. This decline in volume also partially contributed to the 15% Bitcoin move on the last day of February

Source: The Block

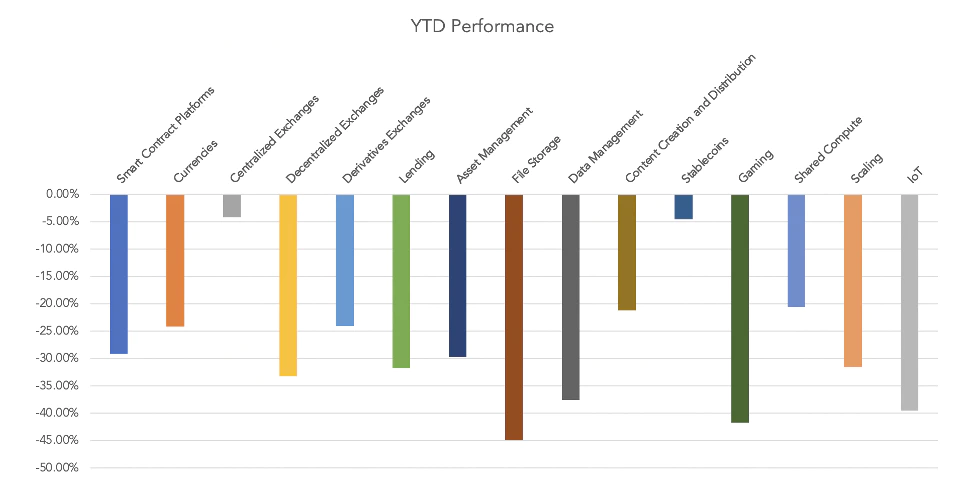

It wouldn’t be surprising to see further corrections in sectors of the crypto economy but many are trading at significant discounts since their highs and since the start of the year. In some cases, prices are down 80% but adoption continues to increase creating the opportunity to buy value.

Source: Messari

Signs of value

In January, Bitcoin neared the bottom of its year-long trading range and again revisited that area in February. Bitcoin is starting to look cheap given its increasing role in the global economy, holding patterns of Bitcoiners, and the amount of stablecoins on exchange. The below chart shows that 76% of circulating Bitcoins have not moved in the last 6-months. The 6-month time period is significant because that is approximately when Bitcoin bottomed in July. In other words, a large amount of supply was purchased in July and has not moved despite the high volatility. I’m often skeptical of the predictive power of Bitcoin’s on-chain metrics but this pattern of long-term holders is very compelling and adds credibility to the thesis that Bitcoin has been in a year-long accumulation pattern.

% Bitcoin Held for Longer than 6 Months

****

Source: Glassnode

Stablecoins on exchanges have continued to increase, indicating there is a lot of dry power on the sidelines. The recent sharp increase started on January 23rd, just as the market bottomed. If crypto regains positive momentum, we could see a rush from this sidelined capital.

On-Exchange Stablecoin Supply

****

Source: Glassnode

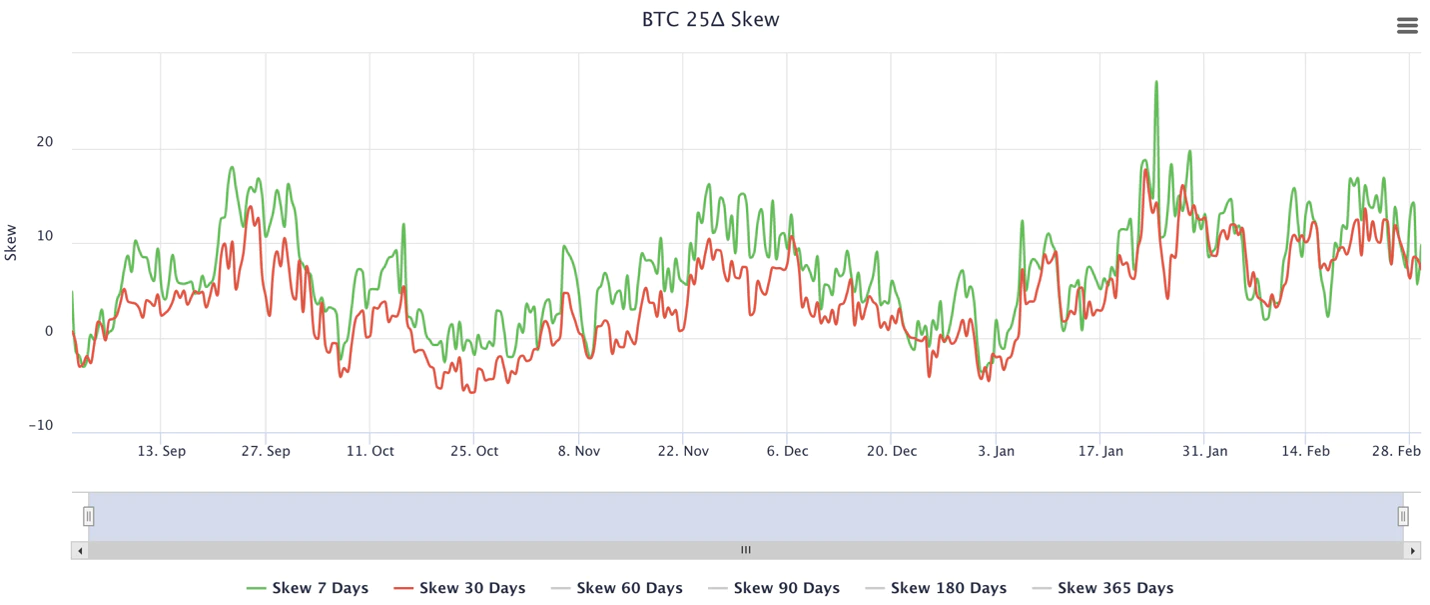

Given the uncertainty in the market, near term skew was particularly elevated at the lows in January and again at the lows in February. This is a good counter-indicator that can show which side of a trade is crowded. It’s another sign that panic over rate hikes and war may have peaked.

Source: Laevitas

Summary

With good reason, there’s uncertainty and worry in the market, but Bitcoin is showing early signs of climbing this “wall of worry” and the on-chain holding patterns add confluence to this view. Crypto is front and center in global politics which may cause short-term volatility and long-term adoption as investors realize the power and scope of crypto’s use cases.

Cheers,

Phil Bonello