Market Commentary #1

Crypto is a $2.5 trillion industry, Bitcoin and Ethereum have yet to reclaim new all-time highs after a summer of consolidation, and the ecosystem is seemingly vacuuming financial and intellectual capital from every other industry. Young tech talent is coming from Silicon Valley powerhouses, top schools, and all over the world – crypto is uniquely global.

Despite the amazing growth of crypto, the $110 trillion investment advisor network has barely had the opportunity to allocate, yet the structural challenges that prevent much of the world from participating are being solved.

The excitement in crypto is palpable — projects are reaching product-market fit, and there’s a collective sense that we’re marching in the right direction. Almost every corner of crypto is winning in its own way.

Memes and narratives play a significant role in traditional markets and likely more so in crypto, where everyone is learning. If you’re aware of the emergent narratives, you can more easily navigate price action. This is especially relevant with the increasing dispersion in crypto and the opportunity for alpha. We want to recap some of what happened over the summer and what is currently happening.

What happened?

NFT boom

NFTs gained popularity in the spring and interest has persisted throughout the summer. The interest in NFTs caused transaction fees to spike. The increased transaction fees led the market to discuss more scalable alternatives — Solana, Polygon, Avalanche, and Fantom were among the market favorites. More on these later.

NFTs without permanent storage are just signatures of the items they represent. To mitigate this, some NFT projects have gone fully on-chain or are using permanent data storage solutions like Arweave. The need for decentralized storage solutions will persist as the NFT market matures.

NFTs created demand for non-financial crypto — people like owning things and now they can own them on the internet. The ability for creators to control their distribution has sparked an explosion of artistic experimentation. NFTs have also become a way of signaling crypto ideals, the most important among them being freedom. Because of this, famous athletes, musicians, and entrepreneurs et al. joined the NFT movement. Crypto is cool and NFTs are an expression of the culture.

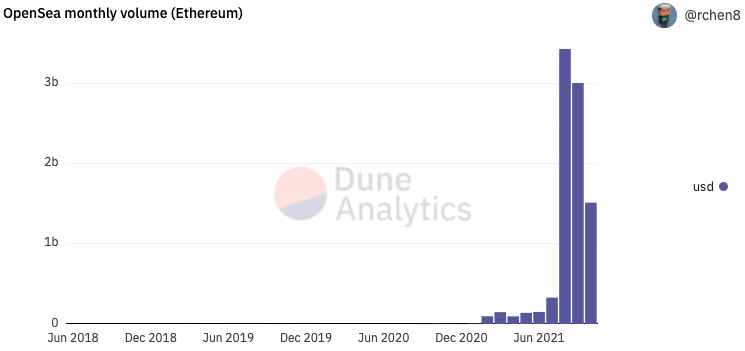

NFT volume is surging on OpenSea, the leading NFT marketplace.

Source: Richard Chen, Dune Analytics

Liquidity wars

Layer 1s and Layer 2s raised huge sums of money, rewarded users with tokens, and gained newfound traction. Solana raised $314 million led by a16z and Polychain. Avalanche raised $230 million led by Polychain and 3AC.

Polygon kicked off the liquidity mining trend in the spring. Avalanche and Fantom upped the stakes later into the summer and fall with their own liquidity mining programs. Retention has been a mixed bag; some users have stayed for the faster confirmation times and lower transaction fees, but many moved elsewhere once the rewards ran out.

With users chasing rewards on other chains, cross-chain bridges became the meme of the hour, with good reason. Will the need for bridges remain even as rewards stall? EVM chains are currently similar in their offerings; chains like Solana are more differentiated.

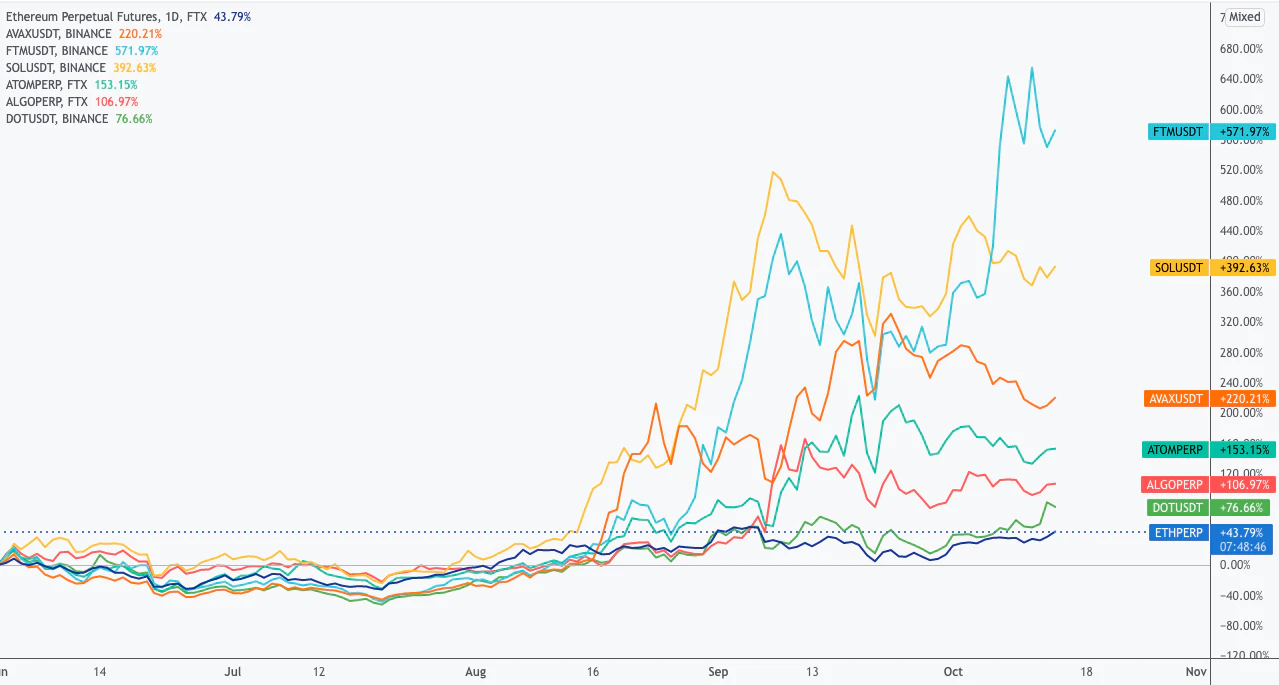

The chart below illustrates the outperformance of Layer 1s and Layer 2s since June 1st.

Bitcoin has been ignored

Bitcoin has been a relatively unpopular investment in crypto as traders chased higher beta on altcoins. But over the past few weeks, Bitcoin began to outperform as the deadline for a Bitcoin ETF approval neared. The CME basis was also expanding rapidly, a sign traders were front running the approval of CME futures-based ETFs. It now appears one or many Bitcoin ETFs will launch this month.

Additionally, Bitcoin will soon be offered to millions of banking customers and is already rolled out to a few clients such as the JP Morgan Private Wealth platform. The structural challenges of buying crypto are being solved.

It’s worth mentioning that altcoins sometimes act as a short on Bitcoin volatility. When Bitcoin surges or falls, altcoins fall. When Bitcoin ranges, altcoins are better situated to outperform. Bitcoin can suck liquidity from the rest of the ecosystem.

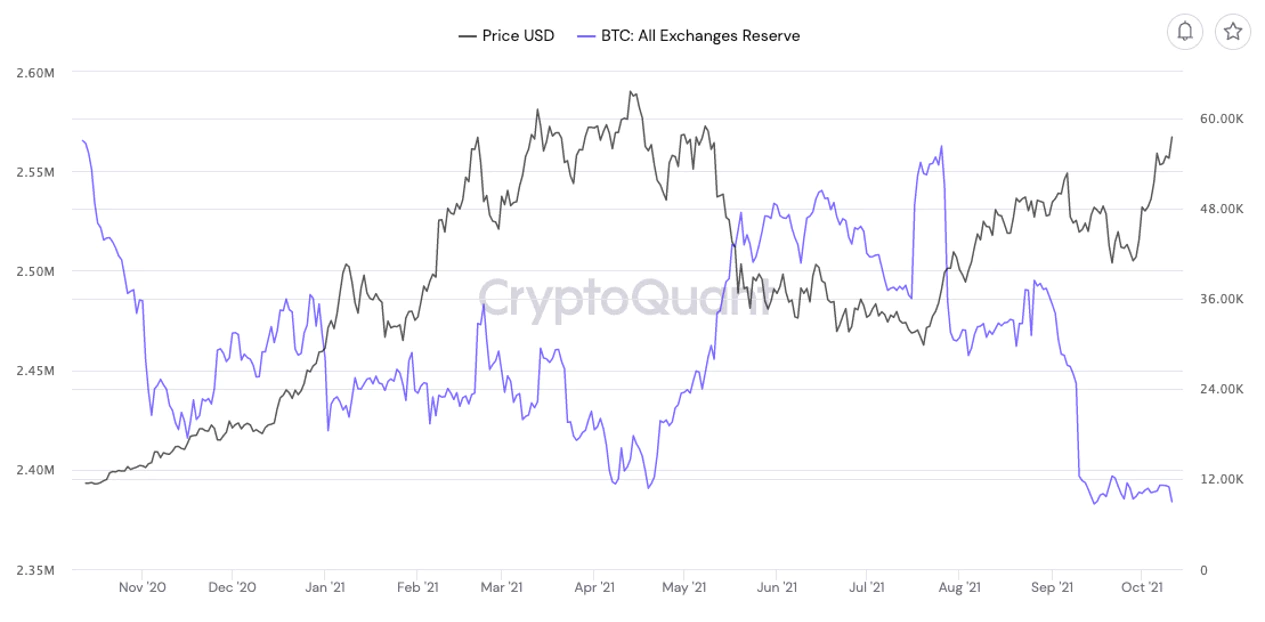

Below shows that the Bitcoin exchange balance (readily liquid Bitcoin) is historically low, typically positive for price action.

Source: CryptoQuant

Source: CryptoQuant

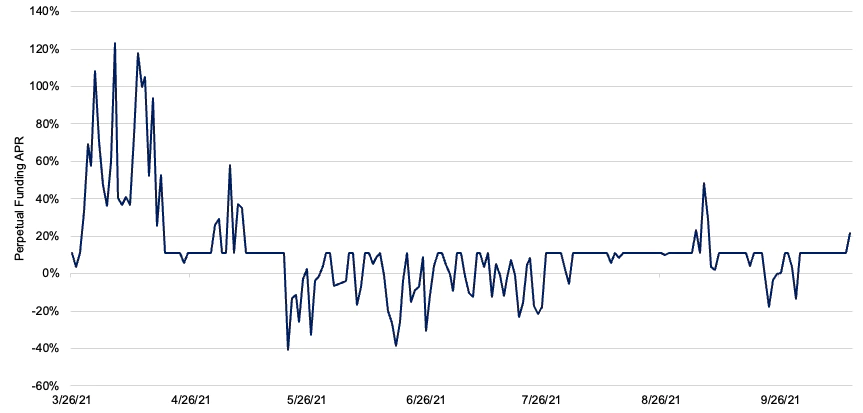

Another important metric to track is the funding rate on the perpetual swaps contracts, the most popular product in crypto. Positive funding indicates outsized demand to purchase the perpetual swap product, often on high leverage — it’s a great counter-signal. As Bitcoin approaches its all-time high prices of May 2021, this muted funding rate is indicative of a healthier market structure.

Source: Plaintext, Laevitas

Derivatives are gaining attention

US customers continue to be restricted from offshore exchanges, namely those that offer derivatives. Perpetual swaps are the most popular product in crypto, producing volumes approximately 4x spot. dYdX has given a glimpse of the potential demand for decentralized perpetual swaps, eclipsing Coinbase’s volume last week. There’s a lot of room for growth in this sector both in central limit order book models and AMMs. With several products soon launching on layer 2s like Arbitrum, it’s not a trend to fade.

Regulation is top of mind

Gensler seems to be taking a hard stance on securities regulation in crypto and we’ve begun to see applications restrict US users. It’s unclear if this will have any effect on the market, but it’s possible Bitcoin and Ethereum could benefit as two clear non-securities in crypto.

What is clear is that the crypto community is emboldened after fighting the overbearing crypto proposals in the infrastructure bill. With a $2.4 trillion market capitalization and support from some of the biggest companies, the crypto industry is now a force to be reckoned with.

Layer 1 battles continue

The Layer 1 battles are just beginning. Most activity is still on Ethereum, but scaling continues to be an issue. Developer traction is increasing on Solana, but EVM compatible networks have a head start in porting applications.

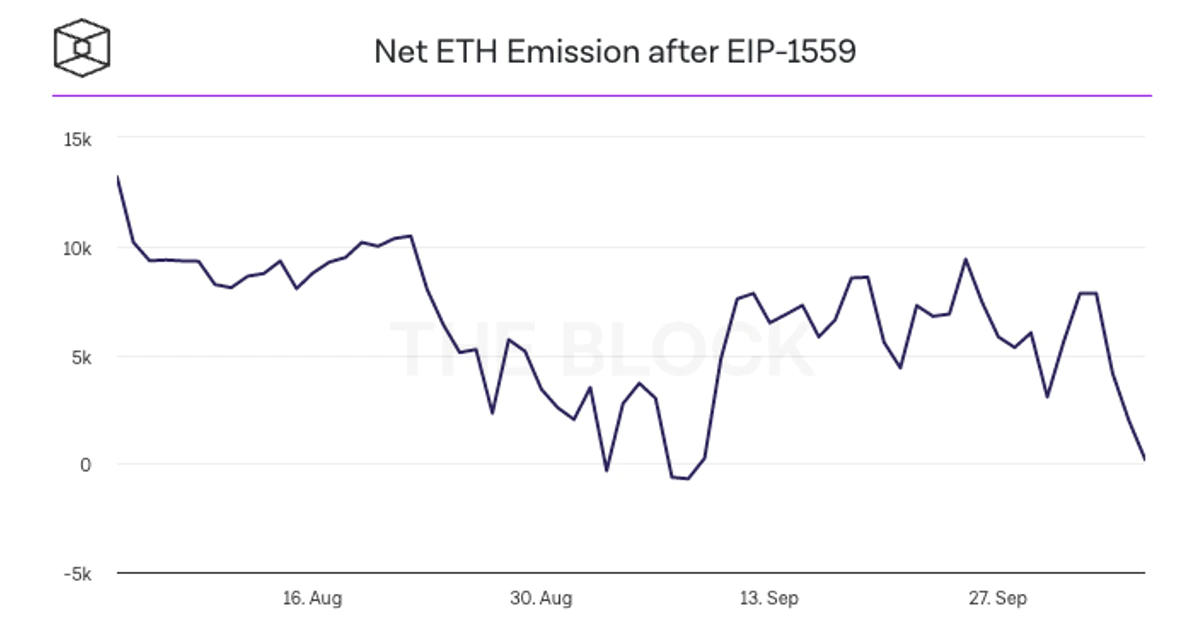

Ethereum has underperformed other Layer 1s significantly, even amid high network volumes and decreasing inflation. After EIP-1559, which implemented a burning mechanism in association with transaction fees, ETH inflation has trended down from the prior rate of 4%. This is a significant reduction that has yet to affect the price. Ethereum is on track to burn 2.6 million ETH by the end of the year.

Source: The Block

So-called DeFi 2.0

DeFi investments skyrocketed in 2020 have stagnated and underperformed ETH. A new crop of products is labeled “DeFi 2.0.” Many of these products are considered the next step in the evolution of decentralized finance: structured products, futures, options, interest rates swaps, insurance, etc. These new products may catalyze a resurgence in the DeFi sector overall.

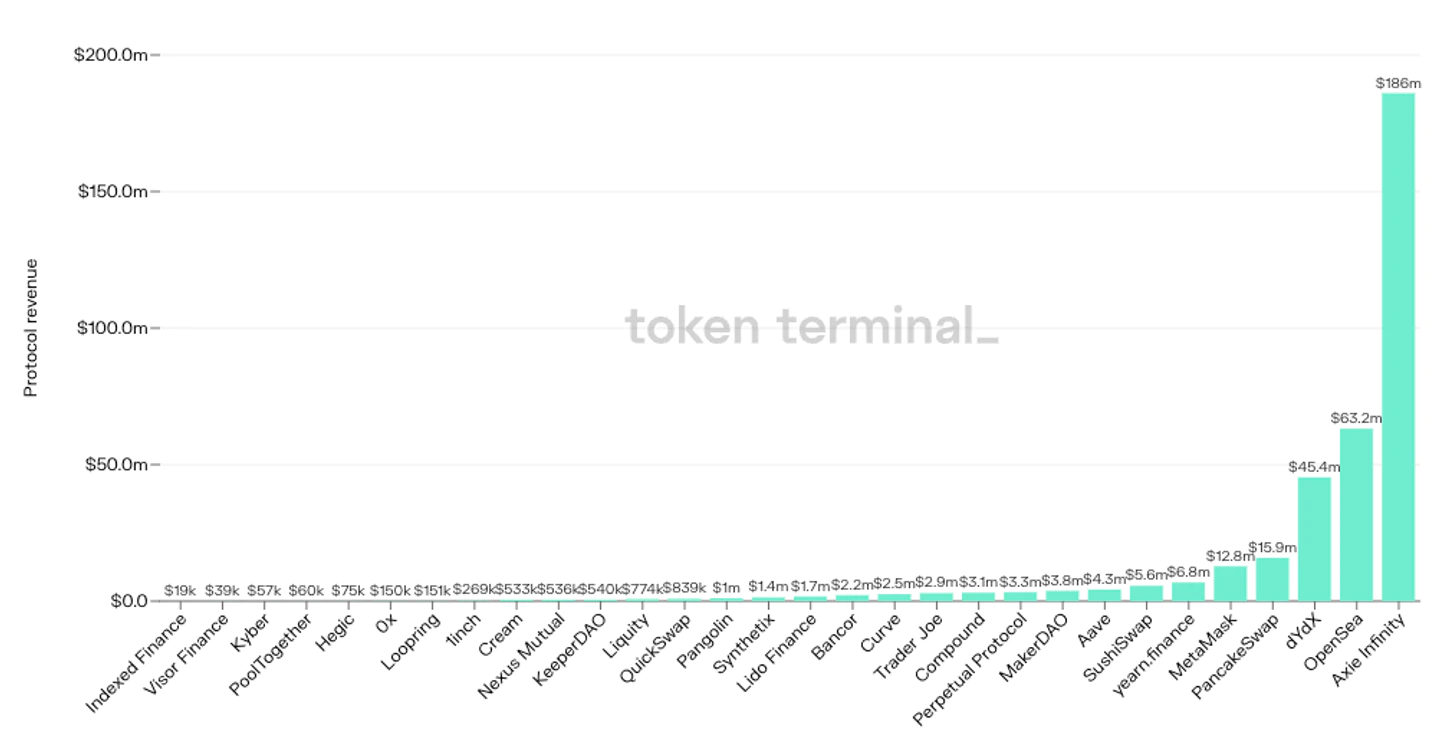

Eyes on gaming

Axie Infinity is leading all protocols by 30D revenue as shown below and recently raised $150 million in a round led by a16z. Axie pioneered the model where video game players can earn money simply by playing (play-to-earn). The model has become especially popular in low-income areas where playing Axie can be more profitable than other types of work. There are nearly three billion gamers globally, and the play-to-earn model could make gaming a popular occupation. The next hundred million crypto users may come from the gaming sector.

With so many moving pieces and uncertainty, crypto presents local opportunities within the mega trend of adoption. This mega trend is clear. Tech cycles are driven by innovations that disrupt industries and unseat incumbent powers and in doing so, change the world. Telephony, radio, broadcast, film, and now the internet all followed this trajectory. The marriage of cryptography and game theory enables public and open-source blockchains where coordination can happen at scale without the need for an intermediary. This coordination allows us to recreate centralized systems under shared ownership and governance models — collectively, “crypto.”

Crypto is at the intersection of technology, finance, art, social media, gaming, and political science. Crypto is unbundling nearly every corner of the internet. Long the mega trend.

Cheers,

Thanks to Cem Ozer, Fran Oliva, and Andres Garcia for reviewing this post.