Cautious Optimism

Investing in what works vs predicting what’s next

Despite the schadenfreude towards crypto of late, this is the first crypto bear market where we can invest in what’s working instead of focusing on what’s next. There’s a tendency to look for the next great thing, which is a valuable mindset, but we have product market fit across multiple sectors and we can track growth metrics as they change.

DeFi

A clear example of this is DeFi which has strong product market fit and importantly, attractive supply schedules relative to the rest of the market.

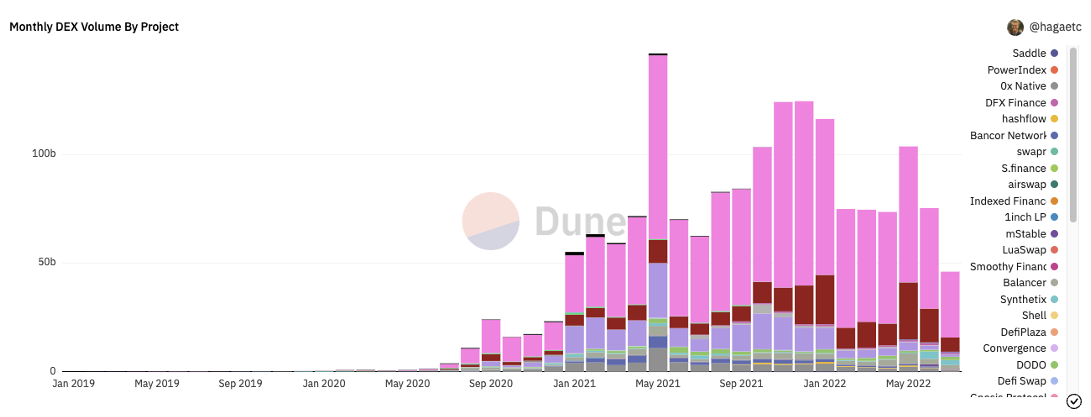

Lending protocols have issued tens of billions of dollars of loans. DEXs have facilitated trillions of dollars of exchange. And this has all happened within a two-year timeframe. Most of these projects are now trading 90% down.

Source: Dune Analytics

Proven but battered Layer 1 Protocols

Layer 1 protocols are great index plays that can represent the applications built atop and they are the entry point for many new investors.

Ethereum and Solana are the leaders of distinct ecosystems. Ethereum seems like a boring bet but it’s one of the best performers of July and one of the best investments of the last 5 years. Solana has been ridiculed for being too centralized, for having outages and for being owned by VCs – the criticisms are similar to those received by Etheruem in 2018. Solana has a distinct and growing ecosystem, the team does a great job with business development, and the data shows that activity has increased in many aspects despite the bear market. The Saga phone is an interesting avenue to test mobile applications and further bolster interest.

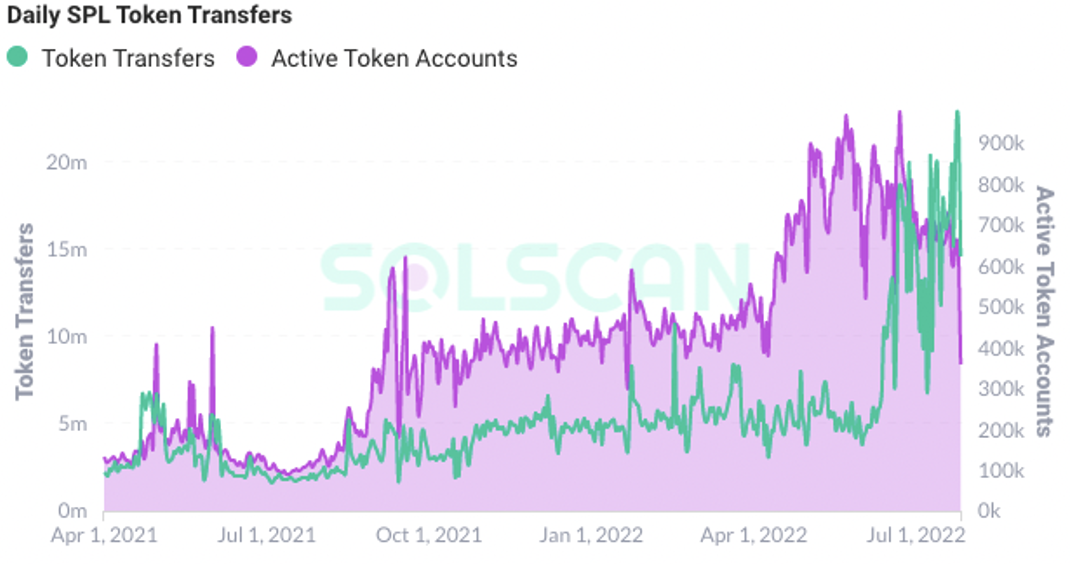

Looking at token transfers and active accounts below, both metrics have been resilient throughout the last six months.

Source: Solscan

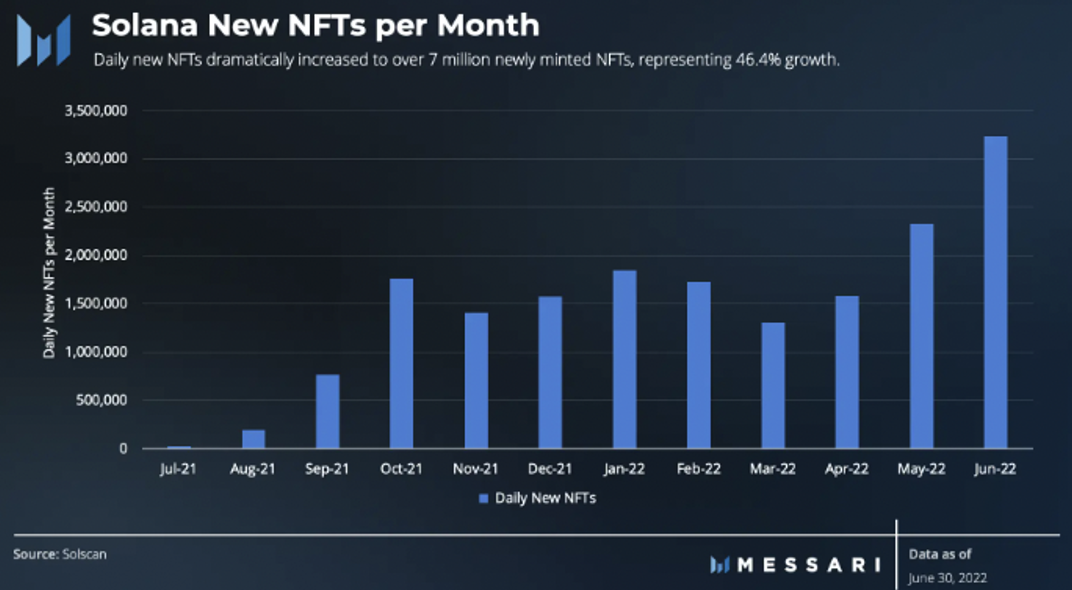

NFT launches are increasing dramatically on Solana.

Source: Messari, Solscan

Web3 Infrastructure

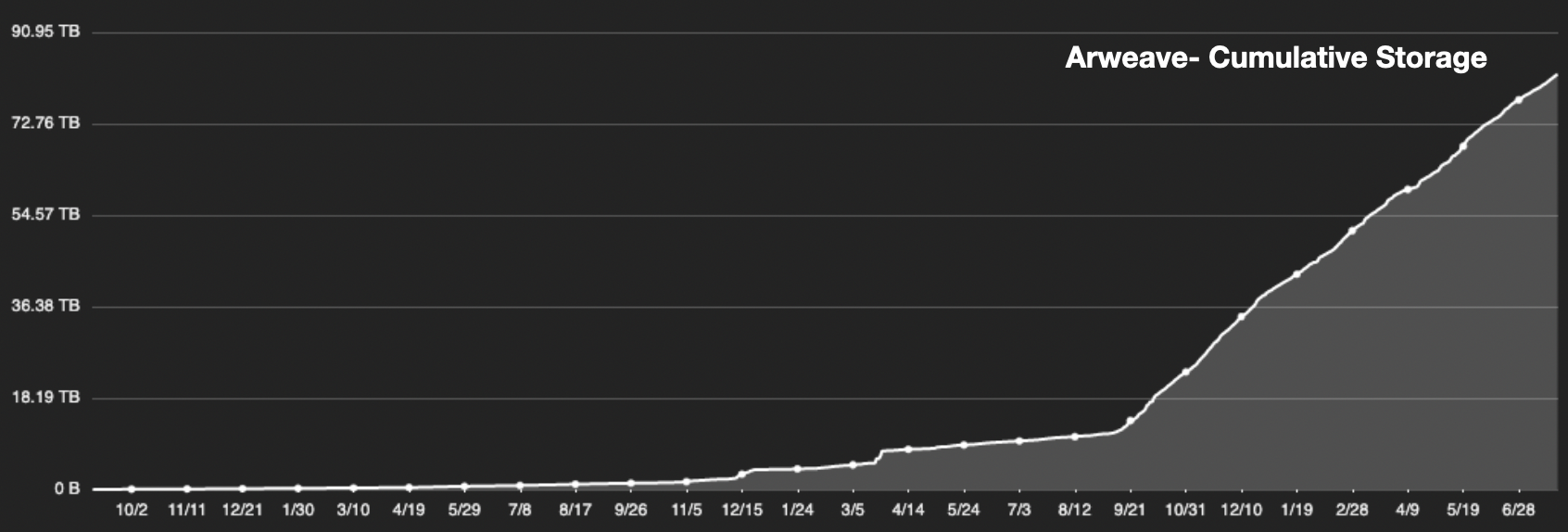

Infrastructure is an interesting corner of the market because so many back-end networks we use today can be made more resilient with incentive-driven, crypto networks. Data storage, which is usually done through a centralized aggregation of machines, can be made more efficient and secure by coordinating storage in a distributed network. Solutions like Arweave have had great success throughout the bear market, partially because the success of the protocol isn’t solely dependent on the wealth of the ecosystem, much like DeFi is. Since the beginning of the year, storage on Arweave has doubled.

Source: ViewBlock

Another interesting example is the decentralized wireless movement with projects like Helium which have been able to rapidly grow the supply side of their network due to token incentives. Helium went from 14k hotspots to over 900,000 in under two years, the fastest rollout of a wireless network ever. It remains to be seen if Helium can grow the demand side.

Keep a long-term outlook

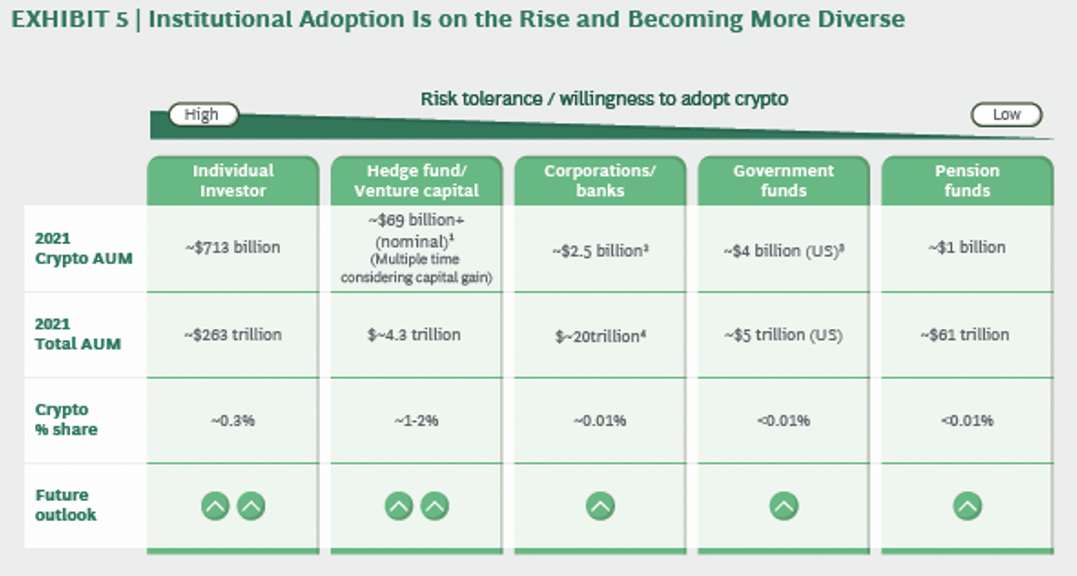

It’s easy to get caught in the short-term and ignore the long-term trend. Crypto is part of a generational wealth transfer that is just beginning.

The digital economy is a growing force and crypto is the expression of that idea but remains only a small fraction of most investment portfolios. Not many people would argue with the idea that the digital economy is growing, but not everyone realizes yet that crypto is the way to express that view.

Source: BCG Consulting

Crypto has exhibited massive adoption in a short period of time. Bitcoin is joining the geopolitical conversation as an unstoppable money. DeFi has facilitated trillions of dollars of financial contracts. NFTs, in their first real year of adoption, permeated all corners of society.

Macro Cracks

And finally, a word on the inescapable macro environment. The recent press conference had a more dovish tone as cracks in the economy have started to form and we have now had two consecutive quarters of GDP decline (recession).

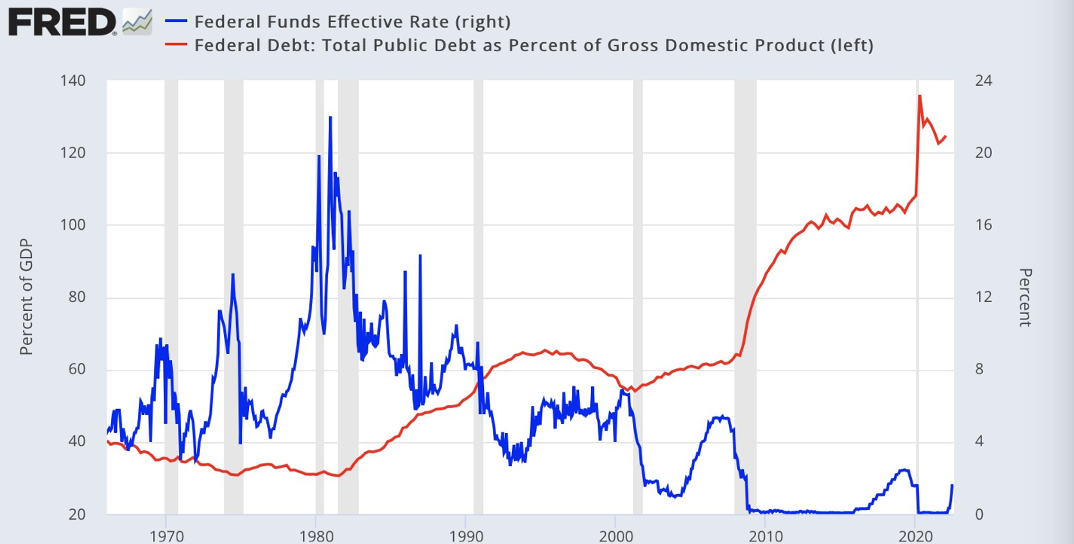

The US dollar is driving markets right now. We are in a denominator-driven market. The denominator (US dollar), has become too strong amid a hawkish Fed. As the dollar becomes too strong, it becomes harder for USD-denominated debt to be serviced resulting in a deflationary spiral. A year ago, the market didn’t believe the Fed could or would tighten. Now the market believes the Fed is willing to crash the economy to fight inflation. That may be true, but the chart below also illustrates how difficult it will be for the Fed to continue this crash course.

Source: St. Louis Fed

Cheers,

Phil Bonello