Blackrock & Bitcoin

Q2

After Bitcoin reached $30k in early April, the crypto market trickled downwards for most of the quarter. Altcoins particularly struggled which was at least partially a result of the aggressive action of the SEC. There are many open cases including the SEC v. Bittrex, SEC v. Ripple, SEC v. Genesis & Gemini, SEC v. Coinbase, and SEC v. Binance, among others. Coinbase and Grayscale have also brought cases against the SEC given their ambiguous approach to rulemaking and enforcement.

The SEC’s aggressive stance worried the market but it’s becoming clear that Gary Gensler may have overreached. The courts have asked tough questions of the SEC and there is an effort by Congressman Warren Davidson to fire Gensler. Even the former SEC Chairman, Jay Clayton, calls the approach the SEC is taking, “un-American.” If that wasn’t enough, two weeks ago Blackrock announced it would file for a Bitcoin spot ETF, a product the SEC has famously rejected repeatedly. The timing is important. In the coming months, Grayscale is due for a decision on its SEC battle to convert its GBTC product to an ETF. Given that Blackrock has an outstanding ETF approval record of 575-1, they likely have a strong indication a spot ETF will be approved.

Blackrock’s interest in a Bitcoin ETF is a major turning point. It is the biggest asset manager in the world with about $9 trillion under management. Blackrock’s foray into Bitcoin is a signal to the world that it’s kosher. It is an important signal that crypto is here to stay and sets us up for the coming cycle.

Trading outlook

Given the ETF is specific to Bitcoin, Bitcoin is likely to continue its outperformance in the next few months. Bitcoin strength relative to the market is expected at the end of a bear market and the pattern closely resembles 2019. Bitcoin is the value play, creating wealth that eventually flows downstream into higher-growth crypto. Because of this, we have slowly started allocating to small-cap assets that present exceptional value. A barbell approach is sensible right now - overweight Bitcoin and majors with tail allocations to small, long-term plays that can return multiples on invested capital.

Bitcoin is a safe bet heading into a likely ETF approval later this summer. But Bitcoin dominance had its highest RSI reading ever earlier this week, so altcoins are due for some relative outperformance in the immediate short term.

In the first half of the year, traders were clearly positioned defensively. That led to a great start to the year for crypto and equities as traders were forced to cover their shorts. That positioning has now flipped bullish indicating the long side might be slightly crowded.

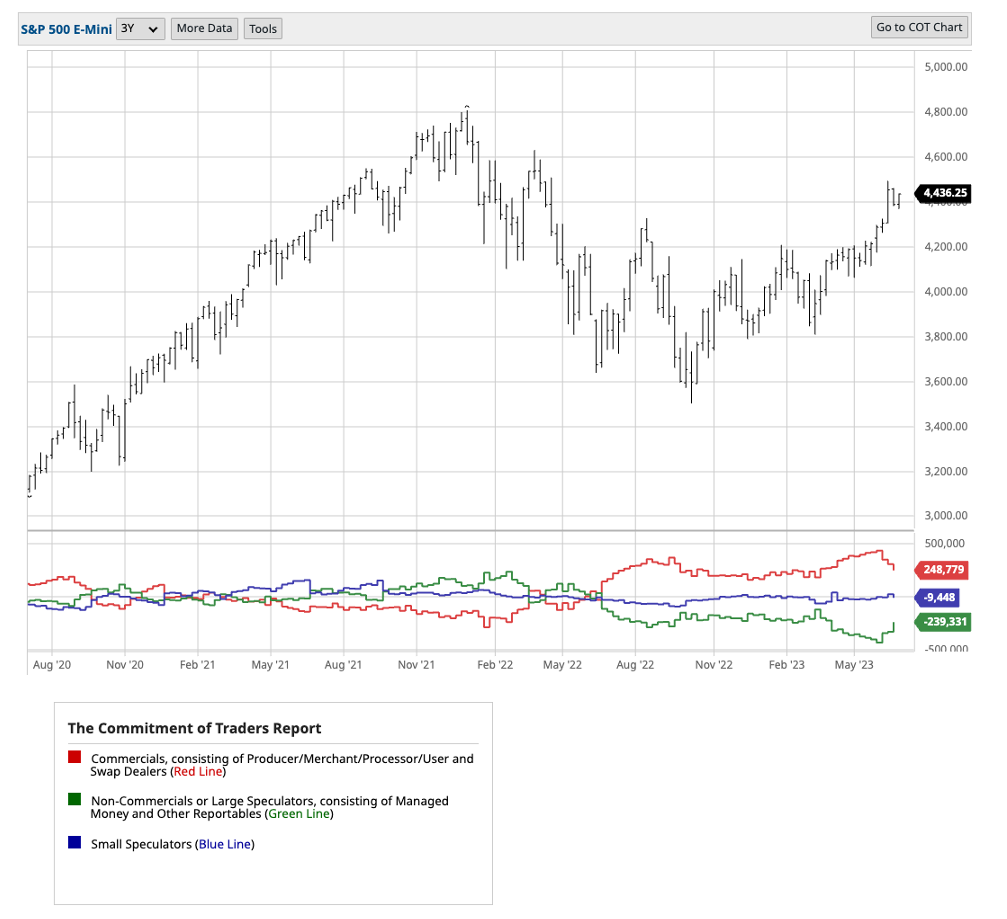

Commitment of Traders

The Commitment of Traders report is one of the sentiment readings that showed Large Speculators (green line) had an overly bearish stance until the last few weeks when shorts were forced to cover their shorts. Traders are still defensively positioned according to this reading but have retreated to a more neutral position.

BTC CME Future Open Interest

Traders of the CME Bitcoin futures are the ultimate trend followers. They presumably aren’t crypto natives and tend to be a little late to the party. The spike in open interest following Blackrock’s ETF news makes sense but increased leverage can sometimes act as fuel for a flush. It’s worth keeping an eye on.

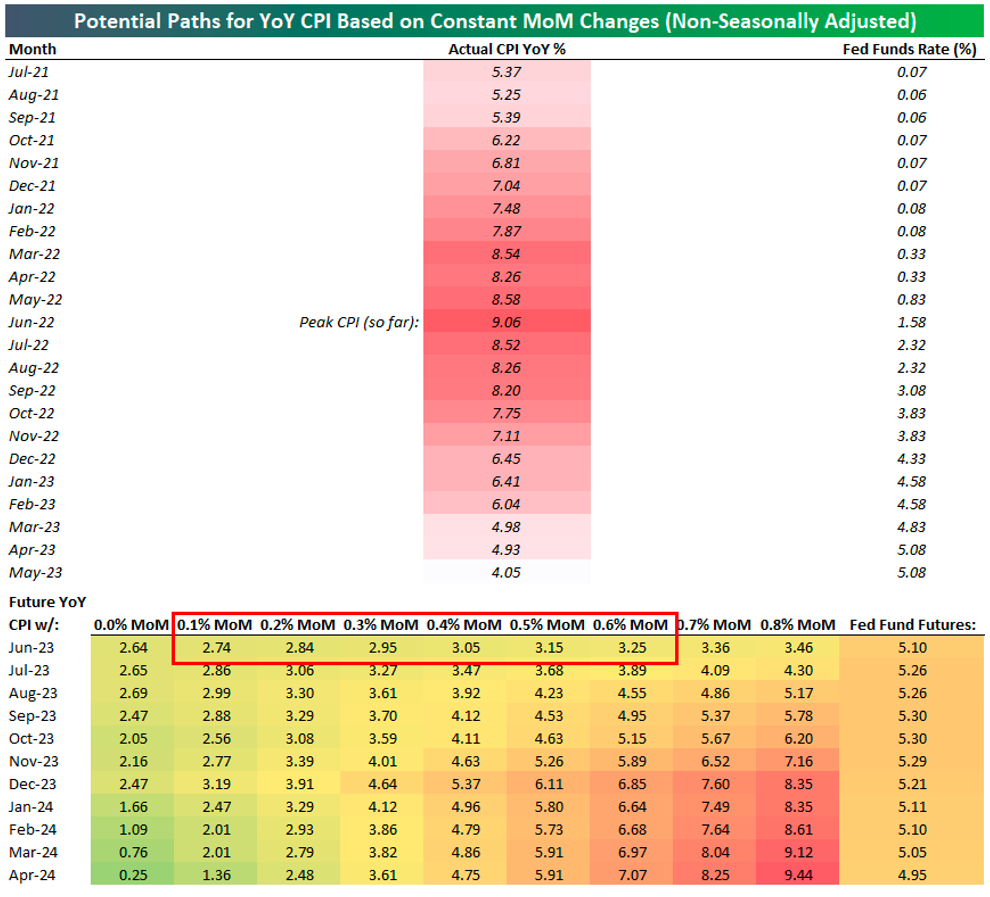

CPI fireworks

The CPI is expected to read in the high twos or low threes for June. Either way, it’s an impressive reduction from 9% last year. After June however, the base effect that has contributed to very low year-over-year readings in the last few months begins to work against us. After what will be twelve consecutive months of lower CPI readings, expect the trend to change. This might have a cooling effect on what have been red-hot markets.

Crypto Themes to Watch

The worst of this cycle is over and we’re now in what may be a stretch of sideways price action before a new market cycle. As a result, we’re beginning to position ourselves in long-term, asymmetric opportunities trading at seed-stage valuations.

Vampire attacks on successful protocols

Vampire attacks are growth strategies used by newer protocols to attract liquidity by providing incentives, which we think will be an effective strategy in the coming cycle. EIP-4844 introduces a concept called data blobs which bundles rollup transactions and decreases rollup costs up to 20x and substantially increases throughput. This should both drive usage on rollups and increase profitability due to reduced costs of posting transactions to Ethereum. There are several early-stage projects on Arbitrum and Optimism that stand to benefit. Some use cases that are infeasible on Ethereum will be possible on rollups. But even simple protocols that replicate the stalwarts like Uniswap and AAVE have an opportunity to draw new users by incentivizing them with token rewards. In a bear market, token inflation is a burden for a token’s value but in a bull market that inflation can be used as a speculative carrot. The risk-reward profile of these projects is extremely attractive.

AI and crypto crossover

AI and crypto is a buzzword headline made in heaven, but the overlap is natural. AI is built on models and compute. Crypto can create efficient markets for both. Crypto is how AI will scale. There are crypto projects focused on every layer of the stack whether it’s training, inference, or simply compute. An open-source, incentive-driven AI is likely to outcompete any closed-source competitor, and seeing as OpenAI raised at a $30 billion valuation and is the fastest-growing product ever, the ceiling is quite high. We might have reached a local maximum for hype in the short term, but the AI bubble is only getting started.

Crypto games

We continue to be interested in games because they will attract users to the crypto economy and the ability to own your character and your assets is an incredibly powerful psychological draw. There’s one investment we’re extremely excited about that brings an avant-garde culture to online casino play.

Solana TVL growth

Solana has been chewed up and spit out. Its close ties to FTX left a hole in development and in its reputation. It’s down over 90% from its 2021 highs and the TVL of the protocol has collapsed. But the protocol has a strong ecosystem of projects that leverage the throughput and low transaction costs of Solana. They’ve fixed issues with downtime and network spam, they will soon have multi-client support, and they’ve grown a strong NFT ecosystem. State compression on NFTs makes the cost of minting negligible, opening new use cases. A new crop of projects has now launched, and they are beginning to release tokens which will draw interest and capital to the ecosystem. We’ve talked a lot about Solana throughout the bear market and continue to think the investment opportunity resembles Ethereum in 2019.

An Optimistic Outlook

Regulation has been a major headwind over the past six months, but the current is shifting. With seemingly every major asset manager filing for a Bitcoin ETF and significant pushback to Gensler’s draconian enforcement tactics, the market has been derisked. We continue to believe that right now the most important thing is to remain optimistic and find asymmetric opportunities while most of the market is apathetic or pessimistic.

Cheers,

Plaintext Capital