The Storm Before the Storm

After Bitcoin’s 28% month, derivatives are positioned for more upside and as a result, the below metrics signal some caution. Skew is approaching a sell signal for the second time in two weeks. Open interest and implied volatility are hugging the upper bounds. And futures basis for both BTC and ETH are near sell territory. But trend takes precedent and right now the trend is clearly up. Given the strong upwards move in BTC, these signals indicate we are likely to see a lower volatility environment for BTC in the coming weeks which might give room for altcoins to catch up.

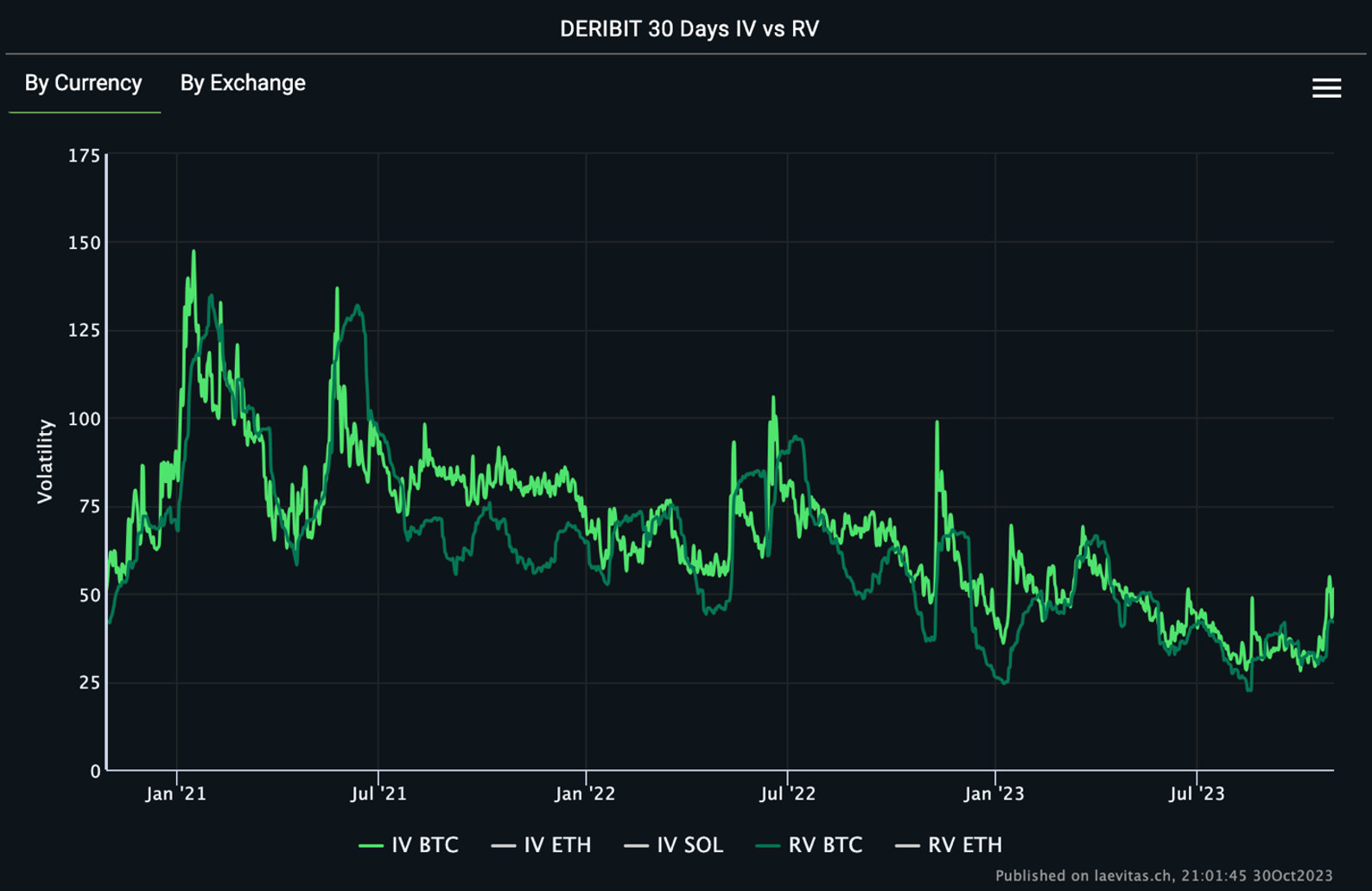

Return of Volatility

Volatility has been steadily declining for nearly two years since the market peaked in 2021. It became a great environment for sellers of volatility, a strategy that earns a nice premium if price doesn’t move too much, too fast. But the ETF narrative is picking up steam, sellers have been exhausted by a two-year bear market, and long-term holders continue to accumulate. As a result, Bitcoin broke to new highs in October. The price action reaffirmed that at this point in the crypto market cycle, it is difficult to not be invested in Bitcoin. Expect volatility to pick up in the next six months.

Bitcoin has continued be the dominant asset in the market; when it rises, it sucks liquidity from most everything else. This pattern is nearly identical to Bitcoin’s dominance in 2019. As the bull market begins to form, a strong move in Bitcoin forms the foundation on which the rest of the market can stand. As the asset that represents over 50% of the market capitalization of the space, when Bitcoin does well, it instills confidence in the market and creates an enormous wealth effect.

The renewed strength in Bitcoin even in the face of a struggling equity market, foreshadows what’s coming in the next year with the Bitcoin halving and a Bitcoin ETF. This is the storm before the storm. And while Bitcoin is leading most of the pack right now, rest assured that the alpha is found elsewhere.

The AI Narrative

The AI boom is only getting started and crypto has a big part to play in AI reaching its full potential. Crypto is the connective tissue for digital commodities, providing the incentives for market participants to act in a certain way. With respect to AI, there are three main verticals we’re watching: compute, model training and inference, and applications.

Distributed compute networks are a straightforward idea. Match GPU demand with idle GPU supply. An open marketplace for compute should theoretically be far more efficient. On a long timeframe, these networks are obvious. In the short term, the immense demand for GPUs gives suppliers pricing power and may make these relatively unattractive. Why would a supplier want to risk their business on a nascent network when they are making money hand over fist? But as new supply continues to rush to market, we will see a supply/demand imbalance and suppliers will look to fill idle compute resources using distributed compute marketplaces. Once critical mass is reached, distributed compute marketplaces will be the standard. Projects to watch include, Akash, Render, and io.net, among others.

Data and data storage are another crucial element in the growth of AI networks. Accessing disparate data sources is important for broadening the training of a model. This data needs to be stored cheaply and reliably and accessed quickly. Decentralized data storage protocols have been around for a while, and they have successfully the supply side but have lacked demand. The increasing need for cheap storage will drive users to networks like Filecoin.

If compute, data, and training are the inputs; intelligence is the output. Ensuring that the highest quality machine intelligence is available to everyone and is provided on an open network is crucial for humanity and represents an enormous investment opportunity. ChatGPT was the fastest growing application ever and OpenAI is likely valued somewhere between $40-$80 billion. But OpenAI’s closed source approach is unlikely to win against a coordinated open-source community. We recently wrote about Bittensor’s approach to solving this problem and remain extremely excited about the future of the project.

Finally, infrastructure is only useful if it supports great applications. Digital intelligence and a digital economy are a match made in heaven. Give your digital autonomous agent the parameters for how to control your crypto finances, and watch as it does just that. In the past, the crypto x AI crossover has mostly been meaningless hype but LLMs and crypto are coming of age at the same time.

Solana’s Ecosystem Boom

Solana is the best performing major cryptoasset YTD, rising from the ashes of FTX’s collapse. Its arc continues to resemble that of Ethereum in 2019, and it stands to outperform the market going forward.

It’s not difficult to reason about Solana’s success. The user base in crypto is still nascent so market share is for the taking. And when users do eventually return in force, they will encounter high fees that are experienced on EVM chains whether that be Ethereum or rollups like Arbitrum and Optimism. The bottleneck is in the EVM. On the other hand, Solana has localized fee markets and parallelized execution, mitigating the possibility of surging fees and slow confirmation times.

The biggest issue with Solana right now is that there is simply not enough to do. There aren’t enough quality tokens to trade or applications to use. But that’s changing rapidly. Many of the highest quality projects on Solana are in the process of launching their tokens which will bring more excitement and liquidity to the ecosystem. And consumer apps like Nina, Drip, and Dialect bringing in non-financially motivated users to the ecosystem. In six months, the Solana ecosystem will look much different, and the Solana trade will look even more obvious.

The best marketing for a protocol is an increase in its token’s price. It brings more eyes and more liquidity. As a result of SOL’s performance, there will be an influx of developers and users.

As we’ve said over the last six months, we remain incredibly optimistic on the crypto market. The tides are turning.