AI and Solana

Mean reversion signals have effectively indicated when to rotate from Bitcoin to altcoins. We mentioned at the end of October that the spike in skew, funding, volatility, and open interest on Bitcoin indicated that we were likely to see subdued price action in Bitcoin giving altcoins room to run. If you rotated to strong altcoins at the beginning November, you significantly outperformed. The signals are now less clear. For now, the trend is your friend.

Bitcoin ETF

The Bitcoin spot ETF will likely be approved by the January 10th deadline. The SEC will probably simultaneously approve all applications at once to not give an unfair advantage to any one issuer. If this is the case, we’re told that the most likely window is January 8-10th. Call options continue to be attractive given the clear timeline. It’s a 40-day countdown to the likely ETF approval. No need to overcomplicate.

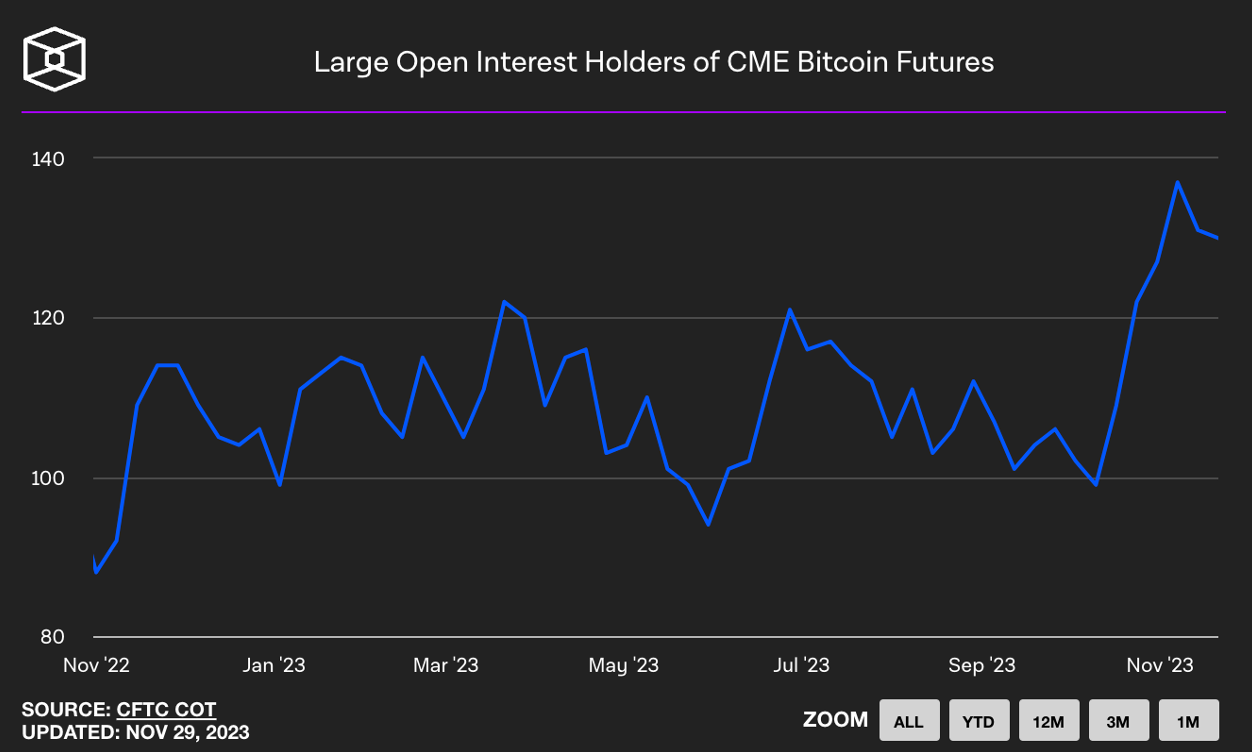

Traditional managers are clearly playing the renewed interest in Bitcoin through CME Bitcoin futures indicated by the spike in open interest starting in early October.

Source: TheBlock

AI Update

Bitcoin’s strength has allowed projects with strong fundamentals to outperform. One such project is Bittensor, a digital marketplace for AI inference, among other things. We published a report on Bittensor in October when the price was $47. Since then, the community has innovated on the network at a blistering pace. The market has taken notice and it’s now trading at $290.

Bittensor recently opened the ability for anyone to create specialized subnetworks with distinct incentive functions and outputs. In the two months since opening, thirty-two subnets have launched, each competing against the others for emissions from the network. You can view all the subnets at taostats.io.

A few subnets include:

-

Subnet 2: Text generation facilitated by LLMs similar to GPT-4.

-

Subnet 3: Translation from one language to another using machine learning algorithms.

-

Subnet 4: Enhances AI systems to process and generate information from multiple types of data such as images, audio, text, video, among others.

-

Subnet 5: Image generation similar to something like Midjourney.

-

Subnet 8: Price predictions. Miners (model creators) compete by submitting their best price predictions. The most accurate predictors are rewarded. This is similar to Numeraire but already has a larger incentive pool.

-

Subnet 16: Text-to-audio output with an initial focus on speech and later music.

I highlight these subnets because Bittensor is generalizable as a protocol. The network is only limited by the creativity of the community. Subnets can create objective functions to incentivize a market for any digital commodity. Subnet creation has only been live for two months and the network is growing rapidly. Bittensor is quickly turning into an application ecosystem where it’ll be nearly impossible to keep up with new projects similar to the explosion of apps on Ethereum in the early days. Try Corcel, which is a ChatGPT clone built on top of Bittensor.

Bittensor provides a permissionless environment for experimentation. Why use DeFi when banking works fine? Why use Bitcoin when the US dollar is the dominant reserve currency? Permissionless networks provide optionality in case things go wrong. Bittensor won’t censor or rate limit you. Bittensor won’t sell your data. If the top model on Bittensor goes down, what happens? The next best model will take its place and fulfill the requests of the validators. It’s a hydra - you can stop a validator or a miner but you can’t stop the network.

Another AI project that we have been following closely is Autonolas, which provides the infrastructure for the creation of AI agents that execute transactions on blockchains. Why is this interesting? An AI bot is quickly limited in meatspace. It cannot easily create a bank account but it can easily use a crypto wallet and execute a crypto transaction. AI agents are a perfect fit for crypto and we could see a future where AI agents outnumber human users on blockchains. We just recorded our first podcast with David Minarsch, the founder of Autonolas where we dive into the details.

Solana

In just about every newsletter over the last year, we’ve discussed our optimistic outlook on Solana. The community and technology are battletested, the user experience is second to none, and the application ecosystem is blooming. The biggest issue with Solana was that there weren’t enough mature applications and enough tokens to trade. That has changed. Pyth, Jito, Jupiter, Tensor and MarginFi are among the high-profile projects with plans to launch tokens to accompany their great products. This will bring liquidity, users, and recognition; once you use Solana it’s difficult to use another chain.

Consumer use cases are also finding a fit. We’re particularly excited about the recent launch of Nina’s music platform, the easiest way for anyone to publish and monetize content. You can sign up in one click using your email, buy music using a Solana wallet or a credit card, and publish your content in four steps. These are the user experiences we need to bring more people to the ecosystem. In fact, you can listen to our podcast on Nina. It was far easier to publish on Nina than it was on Spotify, and it is now permanently stored on Arweave and Solana.

Summary

A more constructive macro environment and strong Bitcoin price performance have allowed the crypto ecosystem to thaw. Projects that continued building during the bear market have seen success in the last six months both in user adoption and in repricing of their underlying assets. Our focus continues to be finding asymmetric opportunities that can outperform over the next two years. Macroeconomic headwinds might still be present, but they will pale in comparison to the positive fundamental tailwinds in the crypto space. Optimism continues to pay.