2021 Year End Market Commentary

Overview

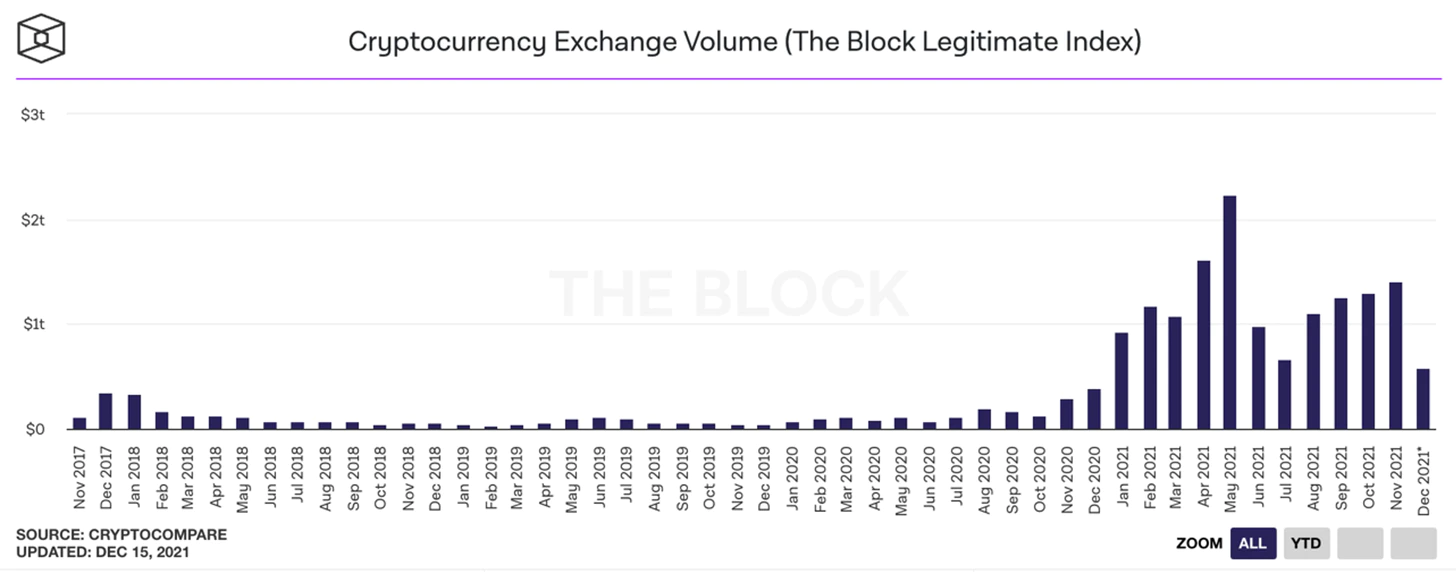

2021 was the biggest year in Web 3.0’s (crypto) lifecycle from the perspective of both mainstream acceptance and absolute dollar growth. The total market cap of the space tripled from approximately $800 billion to $2.4 trillion. Crossing the trillion-dollar market seemed to coincide with interest from sophisticated allocators — volume in the spot and derivatives grew accordingly. Bitcoin and Ethereum futures accounted for $32 trillion of volume in 2021. Spot volume across exchanges was approximately $14 trillion. The options market exploded with nearly $400 billion of notional contracts traded.

Source: The Block

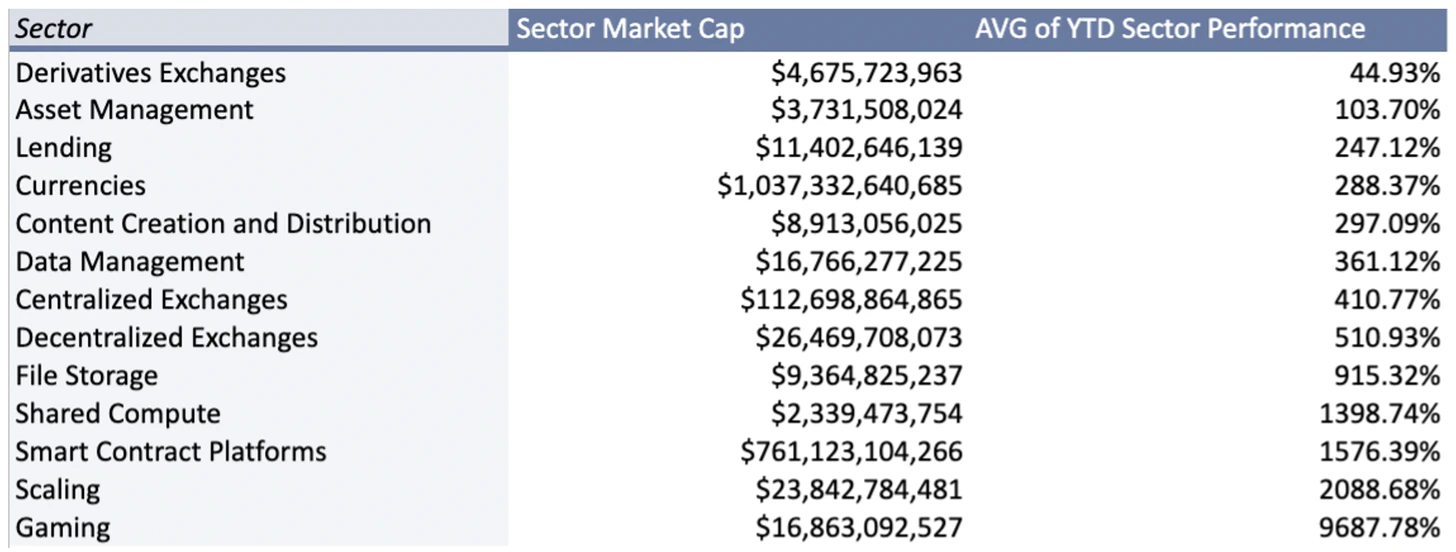

While DeFi was the story in 2020, 2021 saw tremendous growth in non-financial sectors. Gaming was the biggest winner, led by Axie Infinity’s price appreciation of more than 170x. Scaling solutions and alternative smart contracting platforms (“Ethereum killers”) outperformed by attracting users with cheaper, faster transactions and financial incentives.

Source: Plaintext, Messari

Bitcoin broke all-time highs

Bitcoin launched 13 years ago. Since, it has reached $1 trillion+ market capitalization, processed nearly $8 trillion of volume, and this year it reached new highs as institutional adoption has accelerated.

The big financial story this year was inflation reaching nearly 7%, the highest YoY change since the 1980s. There’s little doubt this was driven by favorable monetary and fiscal environments, which may not persist in the short term but are likely to persist long-term. Bitcoin certainly benefitted from this environment, especially given its fixed money supply relative to the ever-growing supply of fiat currency.

Bitcoin outperformed major equities and gold by large margins over the past year. Gold is especially notable because it is frequently referenced as an inflation hedge, and despite the highest inflation in nearly 40 years, gold demonstrated negative absolute returns. Most financial transactions happen digitally and there is little place for a heavy metal that aims to be money.

Source: TradingView

Bitcoin started the year up nearly 100% as Tesla announced that it purchased $1.5 billion on its balance sheet. Other companies like Microstrategy had publicly announced Bitcoin purchases but the announcement from the fastest-growing company in the world was a signal that Bitcoin had entered the institutional conversation. Square followed suit later that month with a $170 million purchase. Right on cue, institutions, famous investors, and nation-states announced involvement in crypto:

-

Morgan Stanley, Goldman Sachs, Wells Fargo, and JP Morgan Private Wealth announced plans to offer BTC funds

-

Goldman restarted its crypto trading desk

-

Howard Marks changed his tune on Bitcoin

-

Ray Dalio announced Bitcoin position

-

Point72 and Millennium entered crypto

-

US Bank launched crypto custody

-

Citibank launched crypto division

-

El Salvador voted to make Bitcoin legal tender

-

Soros Fund entered the crypto markets

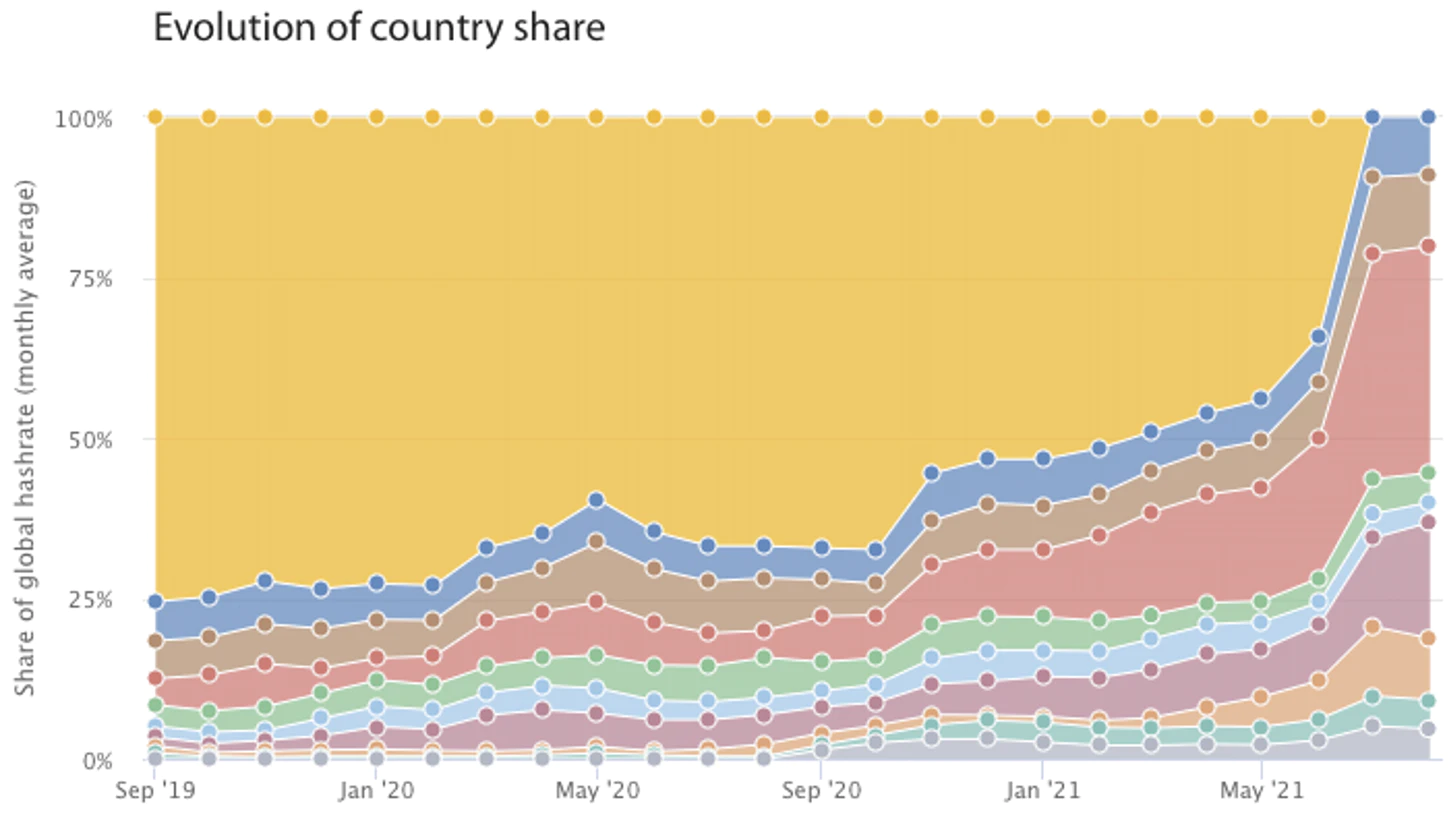

This year we saw a major change in the Bitcoin mining landscape. In the spring of 2021, China controlled an estimated 65% of Bitcoin mining. Then, in what could be described as a nation-state attack, China banned all Bitcoin mining. Hashrate dropped nearly 70% in the following months before migrating to new jurisdictions, namely the United States. It’s now estimated that the United States controls nearly 40% of Bitcoin mining. This event allowed Bitcoin to prove its resiliency against one of the world’s superpowers while transferring significant interests to the United States.

Source: Cambridge Bitcoin Electricity Consumption Index

Further mainstream adoption of Bitcoin could be witnessed through open interest on CME futures climbing to over $5B in October. In parallel, the SEC approved futures-based Bitcoin ETFs, a significant step for adoption — a spot ETF has yet to be approved.

Bitcoin is becoming a household name and it will be at the center of this decade’s zeitgeist.

Gaming: the hottest trend of 2021

The asset prices of crypto games skyrocketed. It was by far the most lucrative sector in 2021. This was led by the idea of play-to-earn, a model pioneered by Axie Infinity, where users can earn income for contributing work to a game. Additionally, with Meta (Facebook) pivoting its focus to the Metaverse, investors began to accumulate projects which are building digital worlds such as Decentraland and The Sandbox.

Most of the development and funding interest for these games occurred on Ethereum but interest has begun to migrate to faster, cheaper networks like Solana, Polygon, or Avalanche.

It’s notoriously difficult to build high-quality games and many of these projects have a long way to go. A few weeks ago, I onboarded my younger cousin to crypto because he was interested in playing crypto games. He was disappointed. A majority of the games required owning an expensive NFT before playing and the ones that didn’t simply weren’t fun. There are 3.2 billion gamers in the world and growing — there’s little doubt that great blockchain games will be a driving force for crypto adoption and will be one of the greatest sectors for value creation. But it might take time.

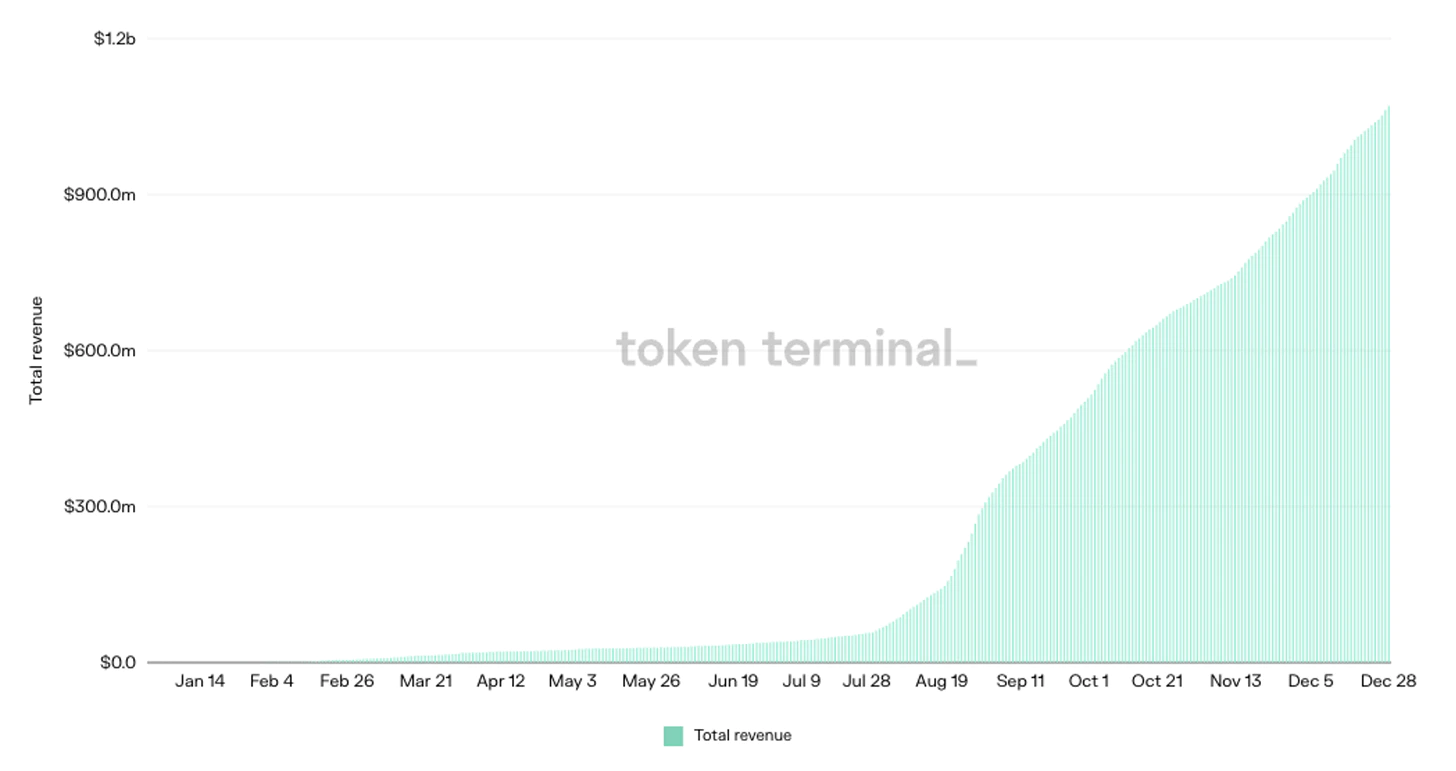

NFTs became mainstream

Demand for digital collectibles like avatars, art, in-game items, and even music saw a huge amount of interest this past year. This is probably best illustrated by the over $1 billion of revenue accrued by OpenSea, the leading NFT exchange platform, in the last 6 months. As a point of reference, eBay’s revenue was just over $10 billion in 2020, one of the highest marks in its 25-year history. The NFT asset class has only existed for 4 years.

Source: Token Terminal

Source: Token Terminal

There continues to be controversy around the value of NFTs. What’s the value of a digital image if it can be copied? If unconvinced, consider that a print of your favorite artwork might not be valuable, but that same print signed by the artist might be significantly more prized. NFTs have a digital signature embedded in their creation and distribution. But if I drew a picture and signed it, nobody would buy it. The digital signature (NFT) is only as valuable as the artist or collection it represents. NFTs also can be encoded with additional functionality and permissions — ownership can grant access to various utilities. There’s no doubt that digital items (NFTs) as a category will grow enormously as we spend more time online.

NFTs are a crucial part of the development of the crypto industry because they change the economic model for all types of digital media, whether it be visual art, music, movies, articles, or video game items. These use cases will allow crypto to transform from a niche industry of speculation to the conduit for a creative renaissance. Non-financial use cases are necessary for Web 3.0 to mature.

Infrastructure projects found product-market fit

On the topic of non-financial use cases, decentralized infrastructure like digital storage, digital content delivery, node infrastructure, and even wireless networking is growing at a rapid pace.

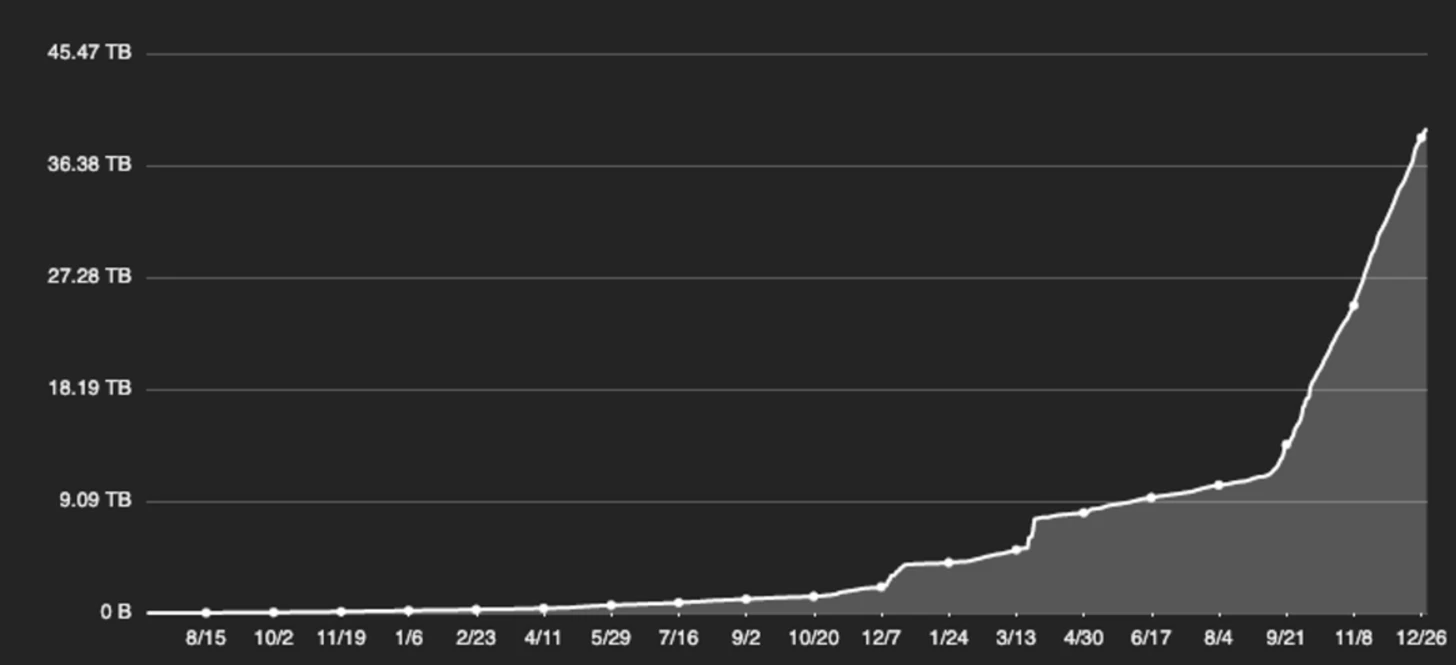

When considering NFTs, the digital signature is permanently stored on a blockchain (usually Ethereum), but often the media is stored on a centralized server — if the payments for the server stop, the media is lost. Projects offering permanent decentralized storage attempt to fix this problem — pay once to store a piece of data for a generation. One example is Arweave which went from virtually unused two years ago to storing 40 terabytes of data today.

Source: Arweave Viewblock

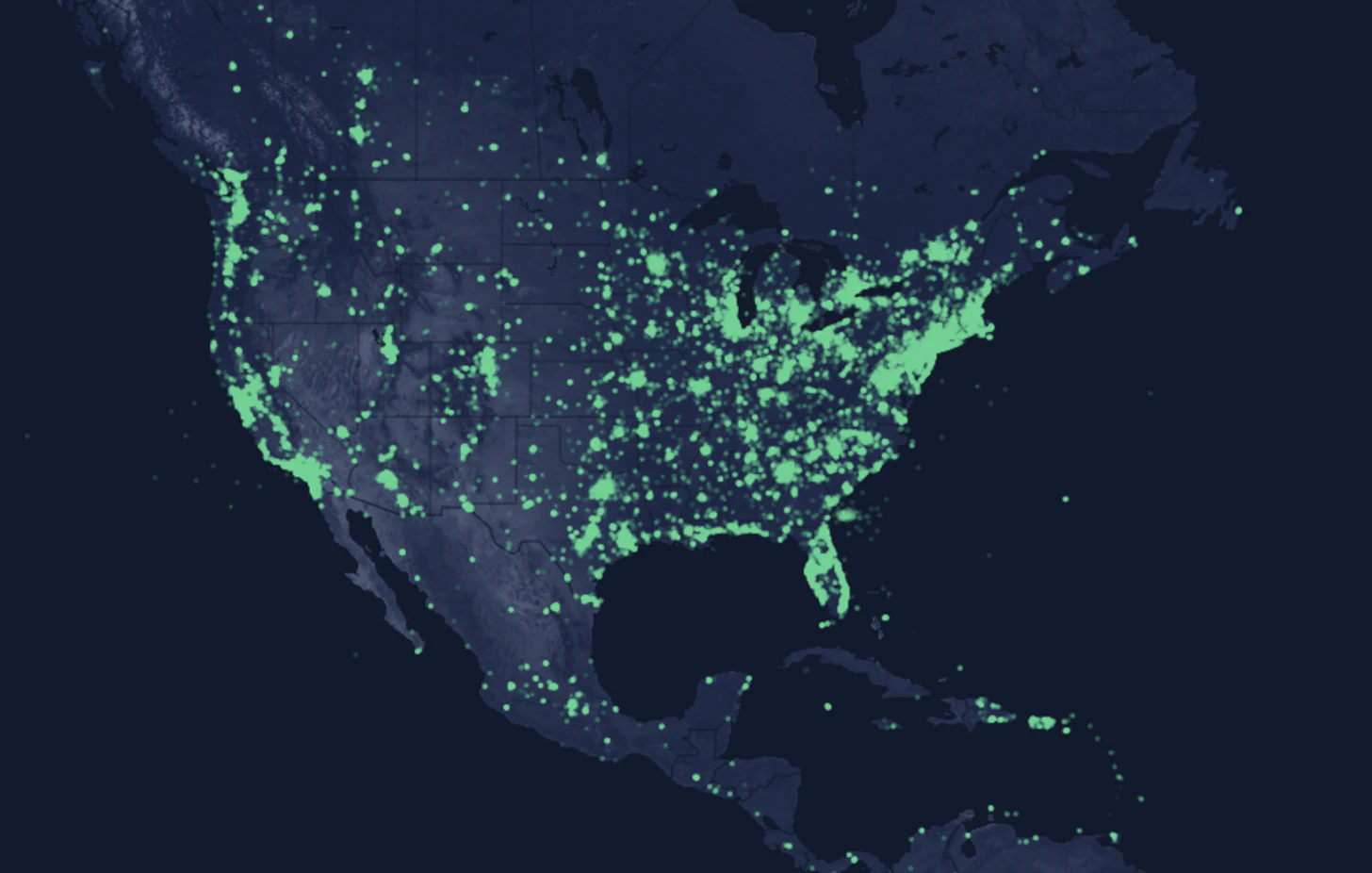

Another example of decentralized infrastructure is Helium which is building a network of IoT (LoRaWAN) and 5G communication. It currently has over 450,000 hotspots around the world. Traditional Telcos struggle to scale new types of networks because the capital expenses are enormous. Using decentralized infrastructure users can set up hotspots to service local networking needs and be rewarded accordingly in crypto. The network can scale organically as demand increases.

Source: Helium Explorer

These types of networks are still in their infancy but the markets they are disrupting are huge. AWS alone is estimated to be worth over $500 billion. The cumulative market capitalization for telecommunication companies is over $2.5 trillion.

Competition from Layer 1s

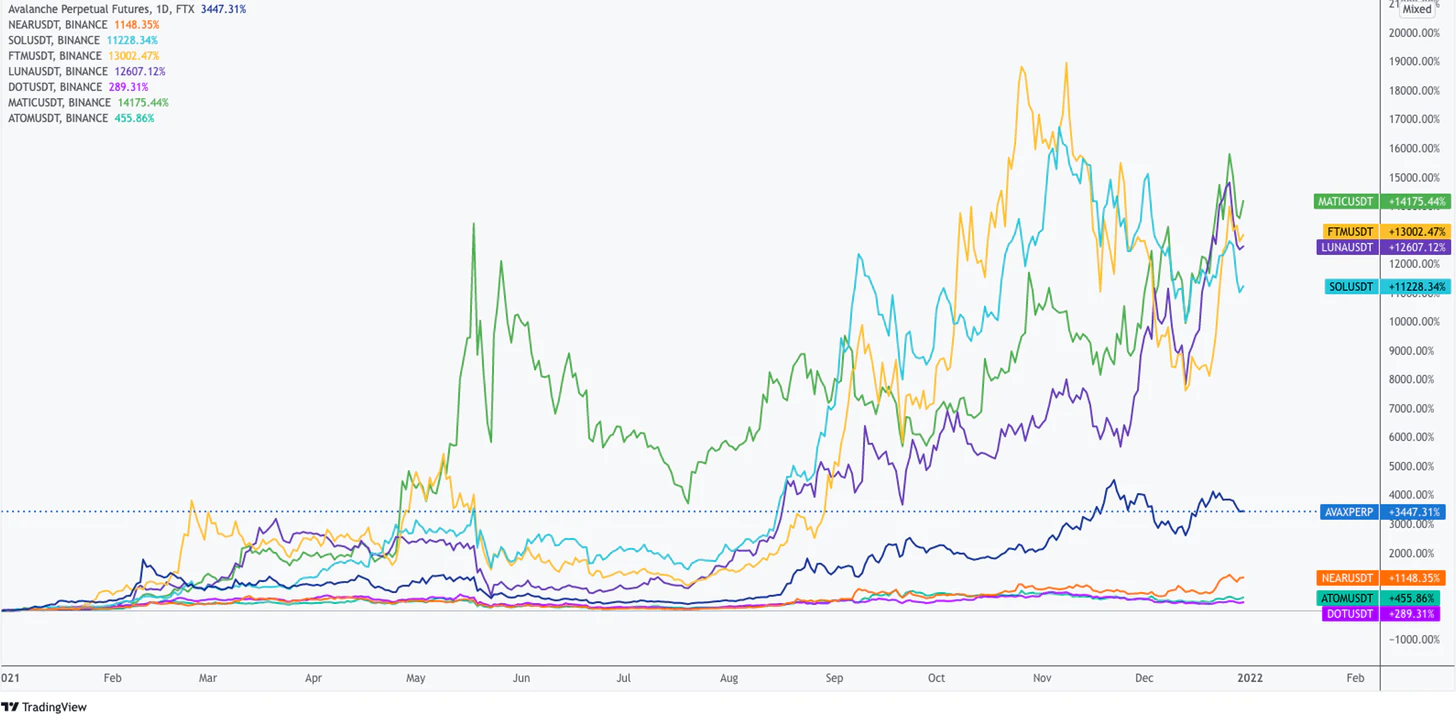

Another big story this year was the competition between smart contracting platforms. Ethereum is relatively slow and expensive to use, yet the network is worth nearly $500 billion. This offered an opportunity for competing networks to provide cheaper, faster solutions to hopefully achieve a fraction of that market capitalization. Nearly all these competing networks offered monetary incentives to use their product with the hope that users would stay. Solana, Avalanche, Fantom, and Polygon proved to be the biggest winners with Solana being the only one to achieve adoption outside the EVM (Ethereum Virtual Machine) network effect.

Source: TradingView

It’s not clear how the smart contracting race with settle. There’s no free lunch in scaling these networks — they often achieve high speed and low cost by trading security and decentralization. EVM does appear to have a very strong moat and reduces stress for application developers because they can more easily migrate between blockchains. Because of this, Neon Labs is also trying to bring EVM functionality to Solana. Layer 2s on Ethereum are promising but have so far lacked the aggressive customer acquisition campaigns and incentive programs that other networks have implemented. With the proliferation of networks, bridges between them became a necessary piece of tooling. The iteration of applications will abstract away this cross-chain interaction.

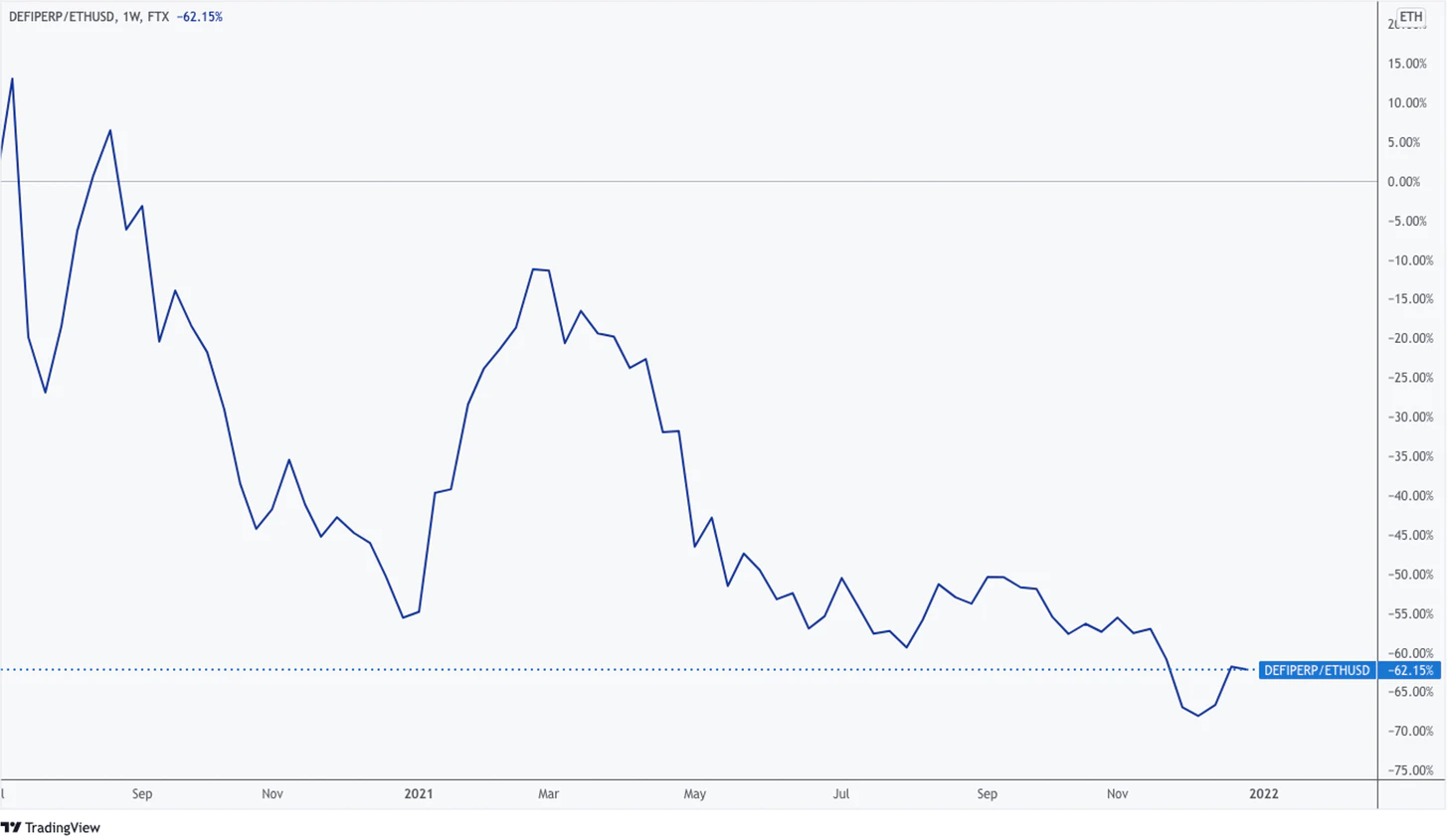

DeFi prices lagged

After Decentralized Finance on Ethereum emerged in 2020, many expected its momentum to continue in both usage and price appreciation. But competing chains emerged, technical limitations hindered growth, and new shiny objects diverted attention from DeFi.

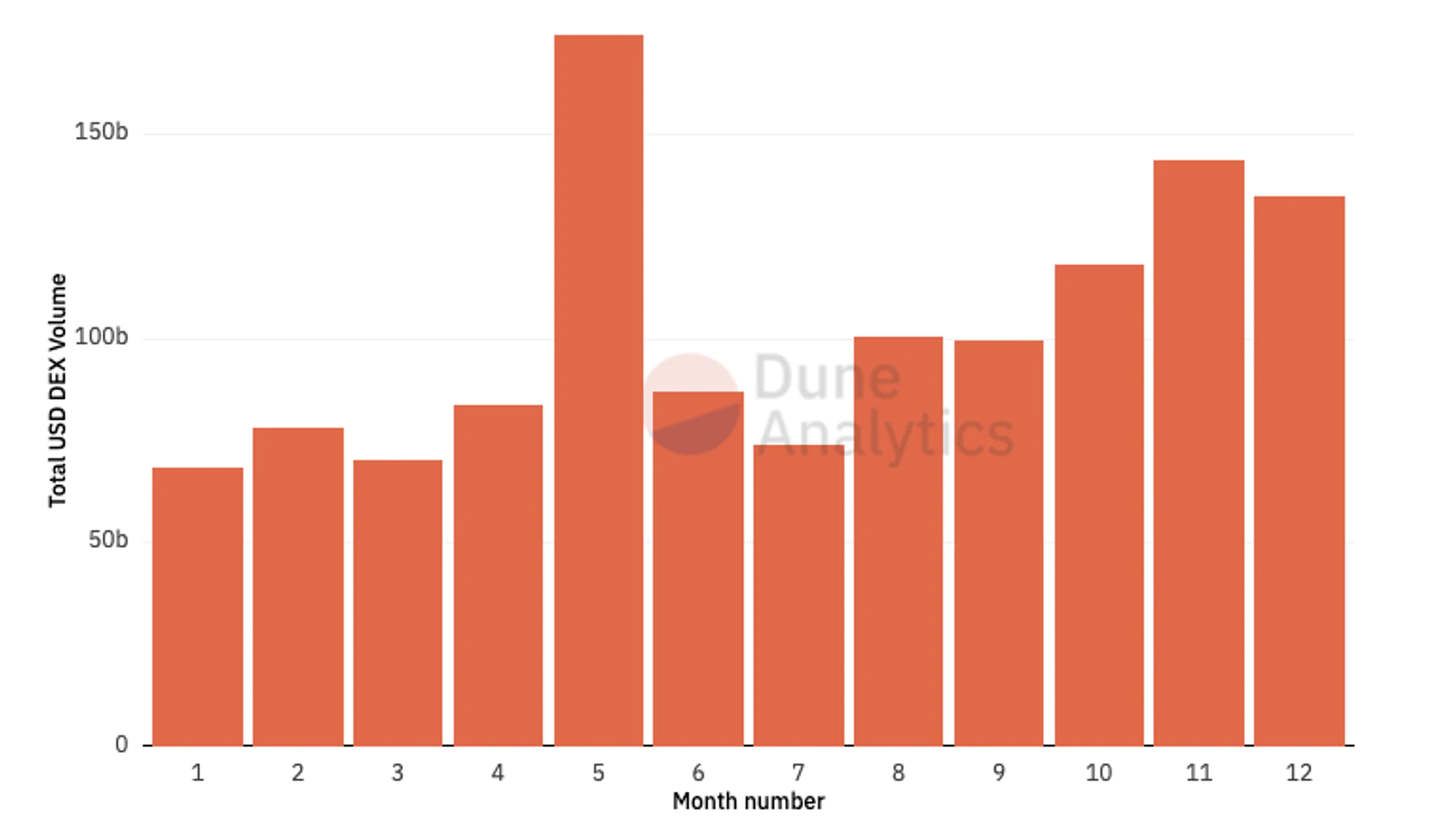

Below is a chart of monthly decentralized exchange volume throughout 2021. While total volume on Ethereum approximately doubled, the growth wasn’t as dramatic as some hoped. High fees and low throughput contributed to the stagnation and competing exchanges on Polygon and Avalanche took advantage.

Source: Dune Analytics

DeFi was the first sector where most applications had cashflows and these cash flows lulled many market participants to hold their DeFi assets while underperforming ETH to the tune of -60%.

Source: TradingView

While DeFi lagged in 2021, new applications and partnerships have emerged which are likely to bring more assets and revenue to the ecosystem. As an example, Switzerland’s SEBA Bank is experimenting with the DeFi lending protocol, Aave. Onboarding banks is a huge step for DeFi.

Looking forward

What performed best in 2021 is unlikely to perform best in 2022. Market participants have limited attention and capital, and that capital continues to rotate into fresh themes. The last two years have allowed active investors to capitalize on this market dispersion. It’s a welcome change from the simple risk-on/risk-off paradigm of years past.

We generally feel that making predictions can cause anchoring bias, especially dangerous in a market that is so uncertain and rapidly changing. With that said, there are some themes we will monitor closely.

Cross-chain tooling. There are now around a dozen networks with legitimate ecosystems and users must rely on (often insecure) bridges between them. We’re interested in applications that securely abstract away the complexity of interchain communication. There will likely be a strong network effect for the winning bridge infrastructure.

Modularity. We’re approaching a shift in focus when building Web 3.0 networks. Monolithic L1s, which perform all parts of infrastructure (execution, data, consensus) that comprise a smart contract platform today, are being unpacked into modular stacks, similar to the Internet Protocol stack. This modular stack hopes to achieve way higher scalability without trading off decentralization as is usually the case today. This new paradigm promises a wildly different infrastructure landscape, with a few examples being specialized data availability layers or specialized settlement rollups. These specialized modular architecture pieces and rollups may represent many new investment opportunities

DeFi. To the surprise of many, DeFi underperformed most crypto sectors in 2021. It’s the most mature sector in crypto and throughout 2021 projects made significant headway. Three areas that we feel are especially important for making DeFi more capital efficient and user-friendly are under-collateralized lending, mature derivatives products, and structured products. Through partnerships with institutions, undercollateralized lending is already in its testing phase and we may see breakthroughs this year. Derivatives were an area of focus in 2021 but underdelivered. Jurisdictions may tighten their grips on derivatives trading which would force users to decentralized alternatives. Structured products package investment strategies to make them more accessible — protocols are competing to use their capital efficiently and structured products may be the main beneficiary of treasury allocations.

Layer 2s. Alternative Layer 1s (AVAX, SOL, FTM, LUNA, etc.) received most of the attention in 2021 and it’s become clear that L2s on Ethereum have a marketing problem. They failed to incentivize growth on their networks and as a result, usage lagged. We expect this will change and all prominent Layer 2 networks will launch tokens creating new opportunities for capital rotation.

Gaming. It’s hard to find value in the current landscape of gaming applications. As euphoria subsides, there will be a new cohort of games that serve as the primary onboarding experience for new entrants to crypto. There will also be significant dispersion in the gaming sector — way more than what we see in other areas of crypto. This will give active investors a lot of opportunities.

Infrastructure. Use cases such as digital storage, node infrastructure, decentralized bot networks, IoT networking, etc. are finding product-market fit. As an additional benefit, these use cases are less financially intertwined with other sectors and often exhibit a lower correlation to the broader ecosystem.

This has been the most exciting year of crypto because it’s the year it became tangible to everyday users. DeFi provided the rails for NFTs and gaming to flourish, which helped onboard millions of users. It is nearly impossible for an educated individual to argue that crypto is going away — each day more attention is focused on the digital world and crypto is the financial expression of that attention.

With that said, people tend to overestimate what happens in the short term and underestimate the impact in the long term. The market’s attention and capital are scarce, and there are some signs of saturation. In an asset class that is likely to create tens or hundreds of trillions of wealth over the next decade, make sure you don’t sacrifice the long term in favor of the short term.

It’s been an incredible year and we’re excited for what the crypto market brings in 2022.